The November consumer price index in the US will be published today. This is the last significant report before the FOMC meeting next week. A month ago, the inflation report forced bears to close short positions, yields and the dollar index rose, and the FOMC comments traders additional reasons to count on an earlier closing of QE from the Fed and on 3 rate hikes in 2022 instead of two.

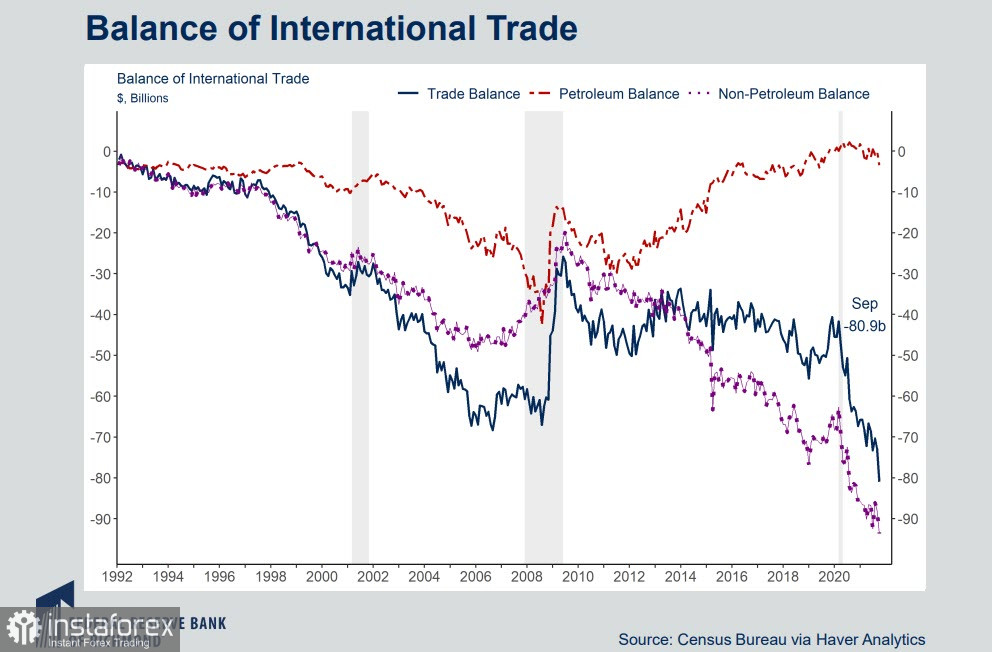

The pace of the US economic recovery currently supports the hawkish bias of the Fed. Inflation remains high, and a sharp drop in the unemployment rate in November indicates growing tension in the labor market. Household consumption increased by 0.7% mom, while exports of goods increased by more than 9% despite the fact that imports decreased. Thus, we can finally expect a suspension of the sharp decline in the trade balance.

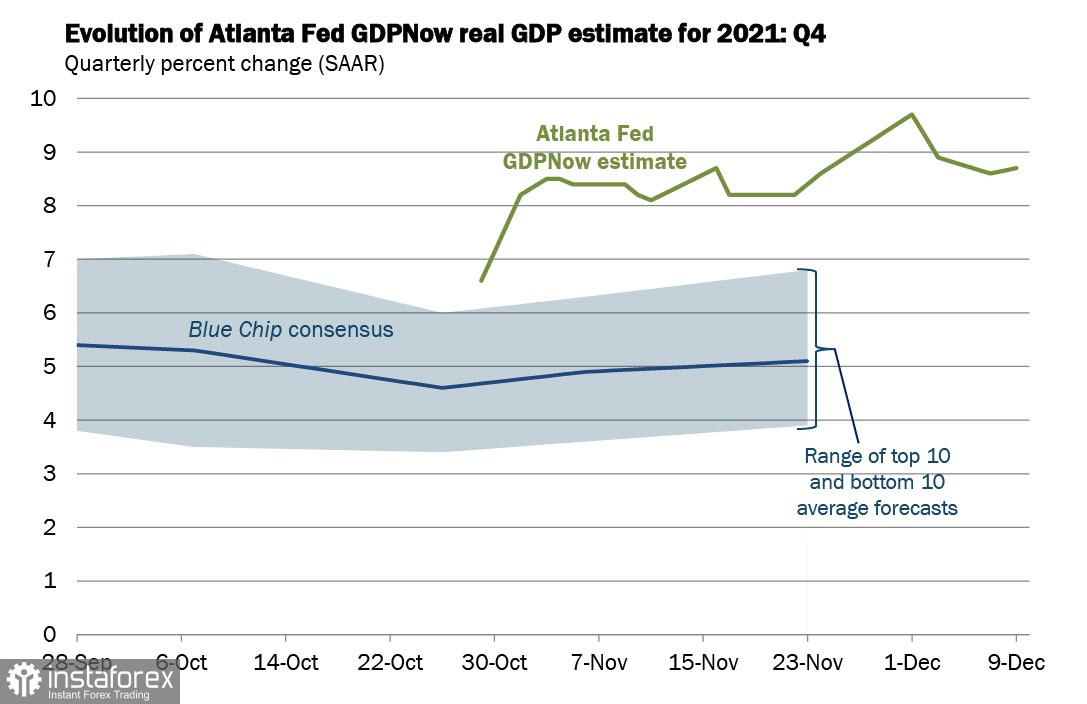

Surveys of enterprises indicate the continuation of positive dynamics in November. In general, GDP growth rates are high enough to talk about a strong recovery. The GDPNow model from the Atlanta Fed as of December 9 assumes GDP growth in the 4th quarter by 8.7% yoy.

Accordingly, the increase in inflation until recently was the main, if not the only barrier to the need to start a cycle of return to normal monetary policy. And while the Fed was promoting the rhetoric of inflation's temporary nature, it was possible to balance on speculation about the timing of the exit from QE, but if the high rates of price growth are confirmed today, then the markets will draw very definite conclusions and demand for the dollar will increase sharply.

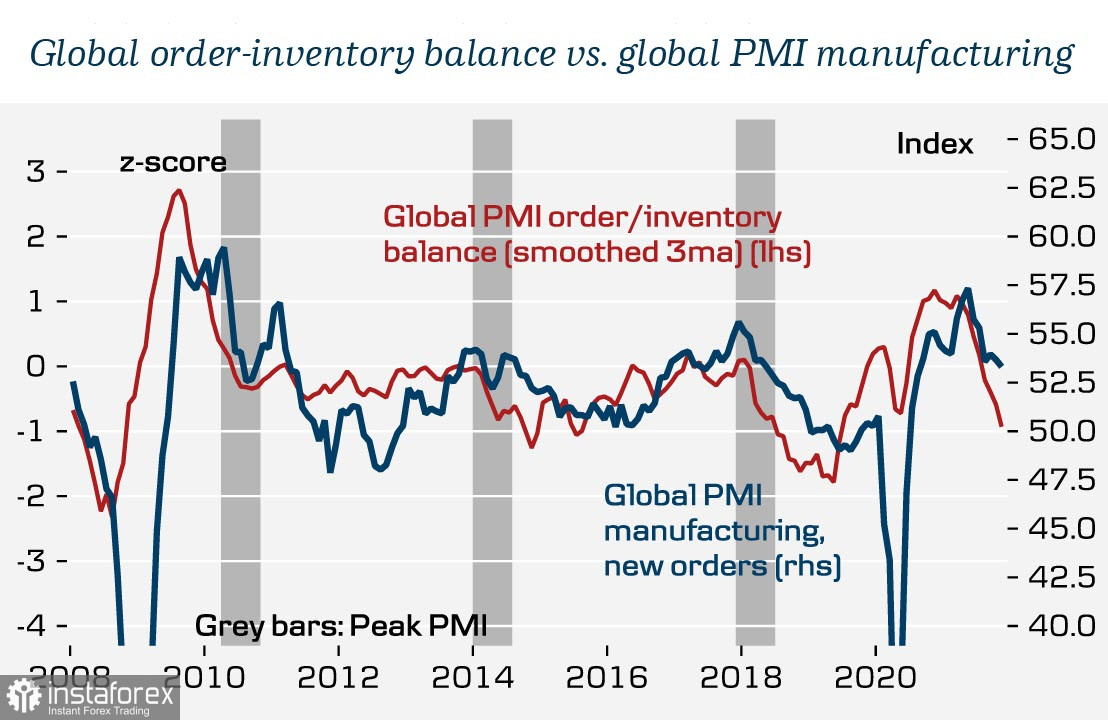

The situation is quite understandable, but only up to a certain limit. A number of indicators of the state of the global economy indicate that current expectations may be greatly overstated. Danske Bank points out that the key uncertainty regarding the prospects for the global economy is due to the fact that growth is being held back not by weak demand, but by supply-side problems.

The key driver of the current situation is the unusually high demand for goods in the United States, which remains high even though restrictions on the service sector have been relaxed and covid restrictions are disappearing. Danske Bank does not expect a reduction in the shortage of raw materials and components, the ratio of global orders to inventory is rapidly declining, which simultaneously with the slowdown in the global PMI indices indicates a global slowdown in general.

Can the situation improve in the near future? It's possible but unlikely. The situation with energy carriers in Europe is not stabilizing, the gas storage facilities are filled less than a year ago, and gas extraction is going faster. Europe will most unlikely see an increase in shale gas supplies from the United States, respectively, it is not necessary to expect a reduction in prices. The cost of production is accelerating, which will not significantly increase the volume of orders.

The People's Bank of China has been actively taking steps in recent days aimed at preventing the growth of the yuan exchange rate and correcting the volume of the money supply. both DanskeBank and NAB independently concluded that in the next 6-9 months, we should expect a slowdown in the production cycle until it reaches the bottom. At the same time, Scotiabank notes that the Bank of Canada predicts a rate hike no earlier than April next year, which it regards as a dovish turn. ANZ Bank sees risks for commodity currencies that will not allow them to strengthen in the near future. Mizuho Bank notes that only a strong decline in the inflation index today can somewhat cool the Fed's hawkish attitude, which is unlikely (forecasts suggest an increase in inflation to a maximum since 1982), which means that there is a threat to risky assets.

In general, the mood of large financial institutions is as follows:

The Fed will remain inside the hawkish rhetoric and the US dollar will receive additional grounds for strengthening. Commodity currencies are at risk of being under the greatest pressure. Accordingly, they are waiting for the US dollar to strengthen by the end of the week. Oil growth will slow down, which will lead to a decrease in AUD and CAD. The euro has no driver for growth, and gold may also decline slightly by Friday's close amid rising demand for the dollar.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română