The EUR/USD edged higher at the time of writing as the Dollar Index plunged. The price dropped as much as 0.9631 after the US inflation data publication. The CPI and Core CPI reported higher inflation which forces the FED to take strong action at the next monetary policy meeting, that's why the USD rallied as a first reaction.

Higher inflation is not good for the US economy, and that's why the USD started to lose ground in the last hours. Still, the EUR/USD pair maintains a bearish despite temporary rebounds. After its last downside movement, a rebound could be natural.

Tomorrow, the US is to release high-impact data again. The retail sales figures and the Prelim UoM Consumer Sentiment could bring sharp movements as well. The fundamentals will drive the price.

EUR/USD Range Breakout!

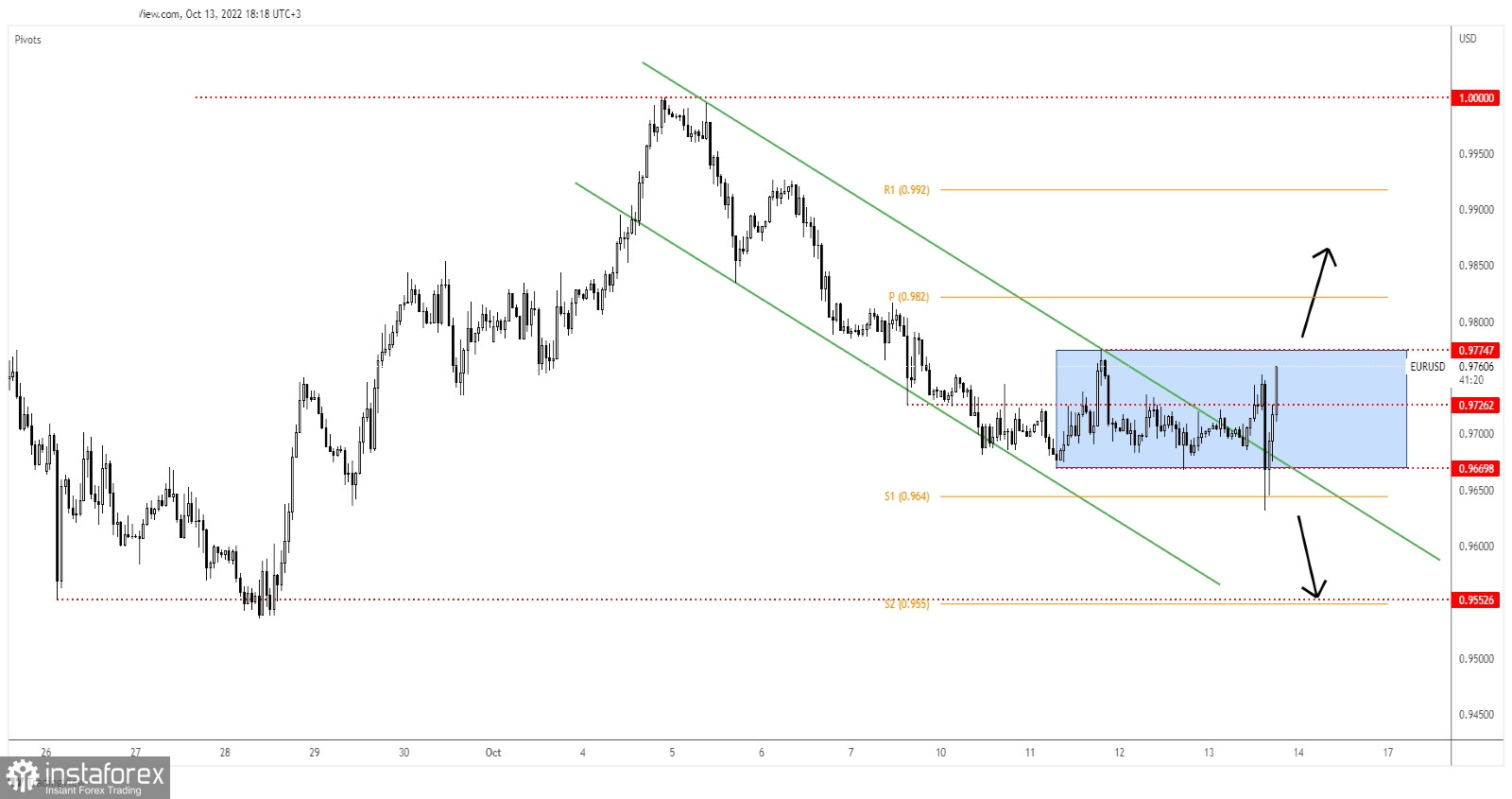

You knew from my previous analysis that EUR/USD is trapped between 0.9669 and 0.9774 levels. I've told you that we'll have a new trading opportunity after the rate escapes from this pattern.

As you can see on the H1 chart, the rate registered a false breakdown below 0.9669, below the broken downtrend line, and under the weekly S1 (0.9640) signaling that the sellers are exhausted.

EUR/USD Forecast!

The price escaped from the down-channel pattern, it has retested the support levels and now it challenges the 0.9774 resistance. The false breakdown from the range pattern signal an upside breakout.

A new higher high, a valid breakout above 0.9774 may signal a strong rebound and could bring long opportunities. The near-term major target and obstacle are represented by the parity level (1.0000).

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română