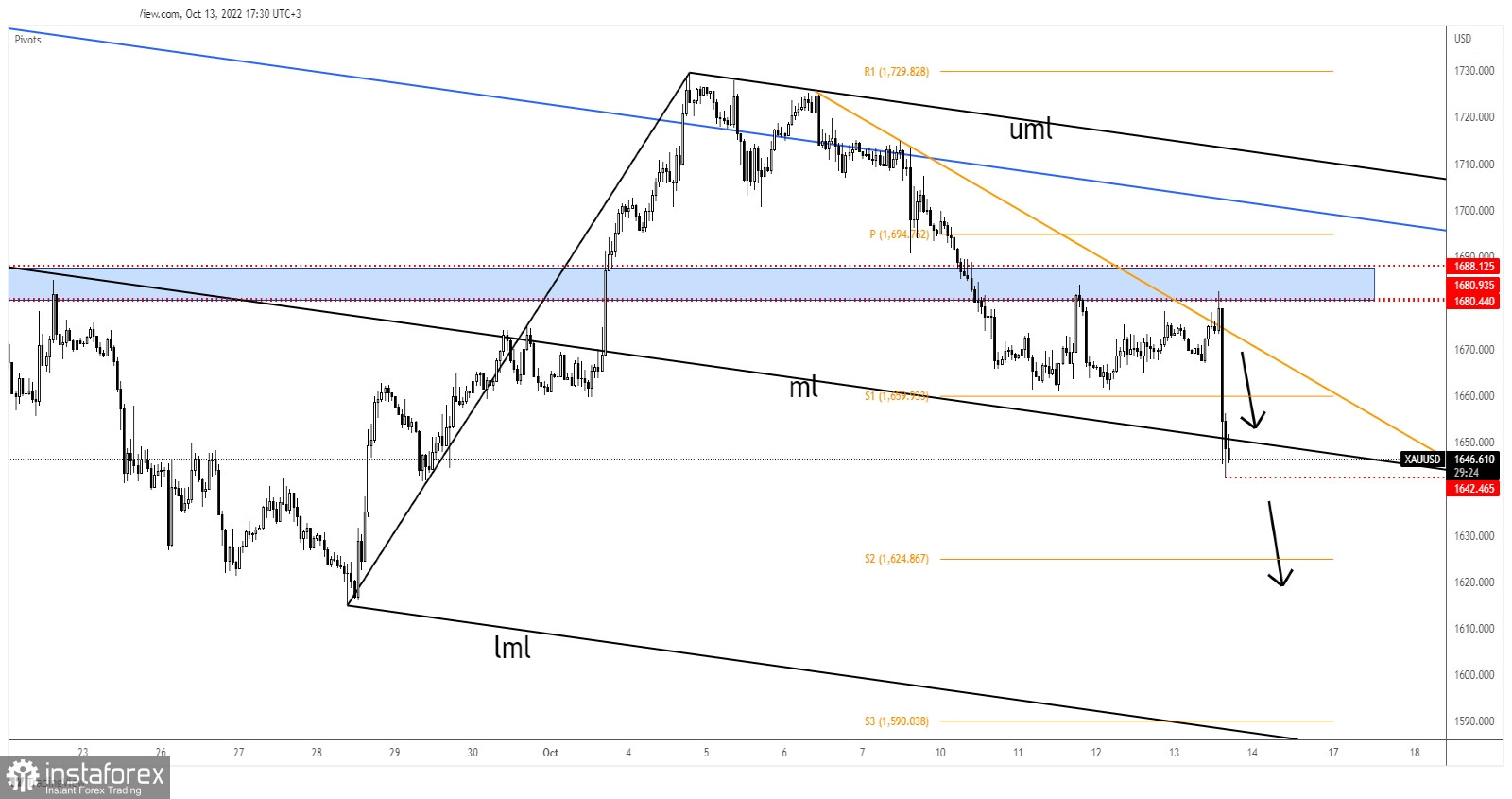

The price of gold crashed after reaching 1,682 today. You knew from my previous analysis that XAU/USD maintains a bearish bias and could drop if the Dollar Index resumes its growth if the USD dominates the currency market. Also, I've said that the US inflation could really shake the markets and bring sharp movements.

The yellow metal dropped by 2.38% from today's high of 1,682 to 1,642 daily low. XAU/USD crashed as the US reported higher inflation. The CPI m/m reported a 0.4% growth in September versus the 0.2% expected and compared to 0.1% growth in August, the CPI y/y came in at 8.2% above the 8.1% expected, while Core CPI m/m rose by 0.6% exceeding the 0.4% growth forecasted. The economic data boosted the USD, that's why the price of gold dropped. Higher inflation forces the FED to continue hiking rates in the next monetary meetings.

XAU/USD Massive Drop!

You knew from my previous analysis that the bias remains bearish as long as it stays under the 1,680 - 1,688 area and below the downtrend line. The rate retested the resistance zone and it registered a false breakout through the downtrend line.

Now, it has ignored the S1 (1,659) and the median line (ml) which represented downside obstacles. The 1,642 low represents a downside obstacle.

XAU/USD Forecast!

The median line (ml) represents dynamic support. Validating its breakdown below it, stabilizing under this downside obstacle, and making a new lower low, dropping and closing below 1,642 activates more declines and brings new short opportunities. The S2 (1,624) stands as the next downside obstacle.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română