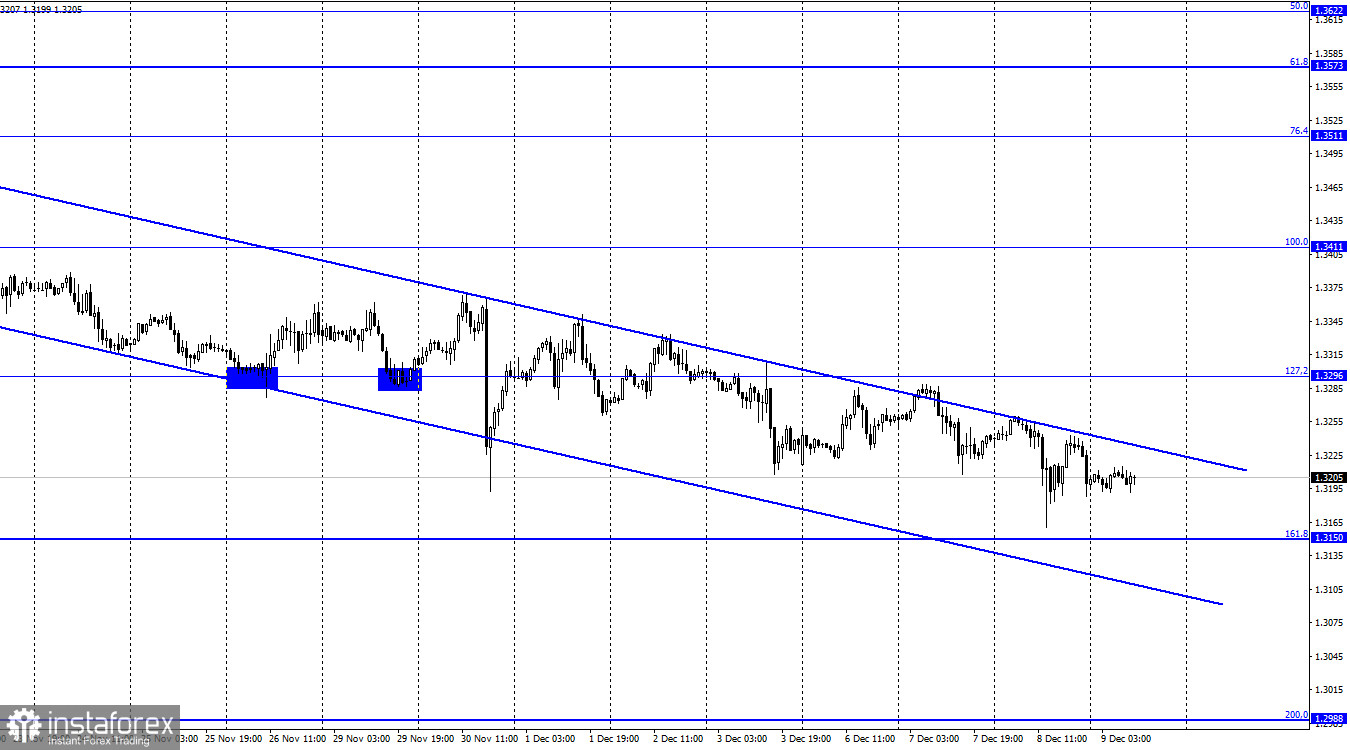

GBP/USD – 1H.

Hi, dear traders!

On Wednesday, according to the 1H chart, GBP/USD again tested the upper level of the descending channel and bounced down. Currently, the quote is still moving within the channel, indicating a bearish trend. If GBP/USD settles above the price channel, it could lead to a strong upside movement towards 1.3296 and 1.3411, though the pair's chances for an uptrend are dwindling. Yesterday, UK prime minister Boris Johnson announced further toughening of COVID-19 restrictions due to Omicron strain's faster transmission compared to Delta. Johnson stated that the spread of Omicron could lead to a rise in hospitalizations and deaths. The so-called Plan B was enacted to buy the UK government more time for rolling out booster shots.

Starting next week, nightclubs and other venues where large crowds gather would require visitors to have COVID passes. Guidance to work from home will be reintroduced, and wearing masks will be mandatory in all public spaces. The NHS reports no increase in hospitalizations at the moment. The situation could change in the next 2-3 weeks. Earlier statements by the WHO, as well as the Fed's Jerome Powell and US president's chief medical advisor Anthony Fauci all underlined that it is too early to come to conclusions regarding Omicron, and that it could carry high risks for the population and the economy. The new strain could displace Delta and paralyze the world's economy right before the New Year. The only support the pound sterling could find in December would come from the last Bank of England meeting of 2021.

GBP/USD – 4H.

According to the 4H chart, the pair closed above the 61.8% retracement level (1.3274), which indicates further downside movement is likely. The bullish divergence near the MACD line has disappeared, and the pair is continuing to slide down along the upper line of the downward channel, similar to the channel at the 1H chart. If GBP/USD settles above the upper channel line, it could allow the pair to rise towards the 560% retracement level (1.3457). Today, the indicators show no signs of emerging divergences.

US and UK economic calendar:

US - Unemployment claims data (13-30 UTC).

The jobless claims data is unlikely to influence traders today.

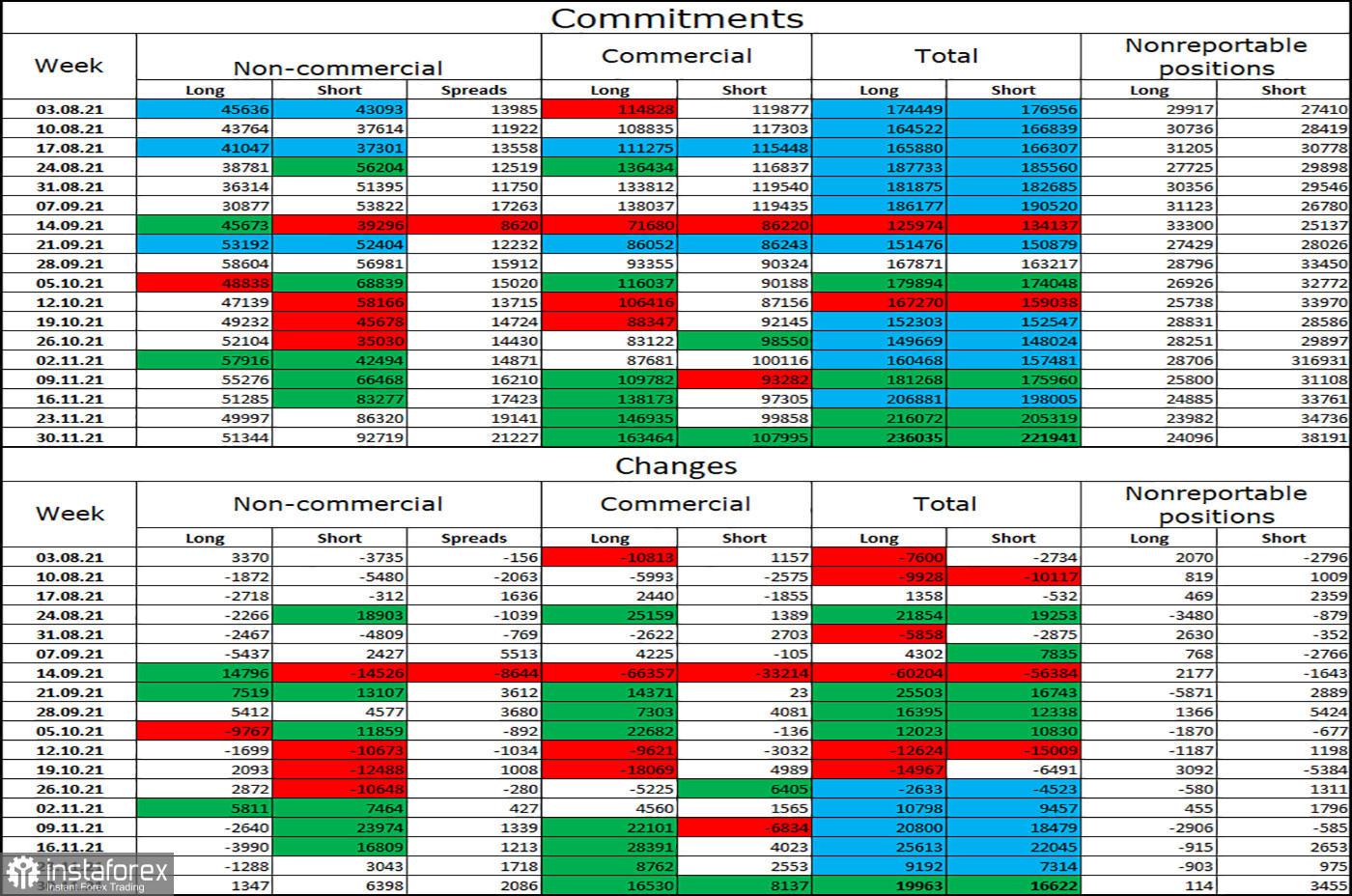

COT (Commitments of traders) report:

The latest COT report as of November 30 indicates an increasingly bearish sentiment among market players for the fifth straight week. Traders opened 1,347 Long positions and 6,398 Short positions. About 56,000 Short position were opened in total in December, exceeding the amount of opened Long positions. Given the bearish trend of the past few weeks and the pair's limited upside, GBP/USD could continue to decline. The total number of opened Long and Short positions is almost the same among all categories of traders.

Outlook for GBP/USD:

Long positions could be opened if the pair closes above the upper channel line on the 4H chart, targeting 1.3296 and 1.3411. Earlier, traders were recommended to open short positions if GBP/USD closes above 1,3274 targeting 1.3150, however the bearish divergence has cancelled the sell signal. Currently, traders are advised against opening new short positions.

Terms:

Non-commercial traders are major market players: banks, hedge funds, investment funds, and large private investors.

Commercial traders are commercial enterprises, firms, banks, corporations, companies that buy currency not to obtain profit, but to maintain current activities or import-export operations.

The category of non-reportable positions includes small traders who do not have a significant impact on the price.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română