Analyzing trades on Wednesday

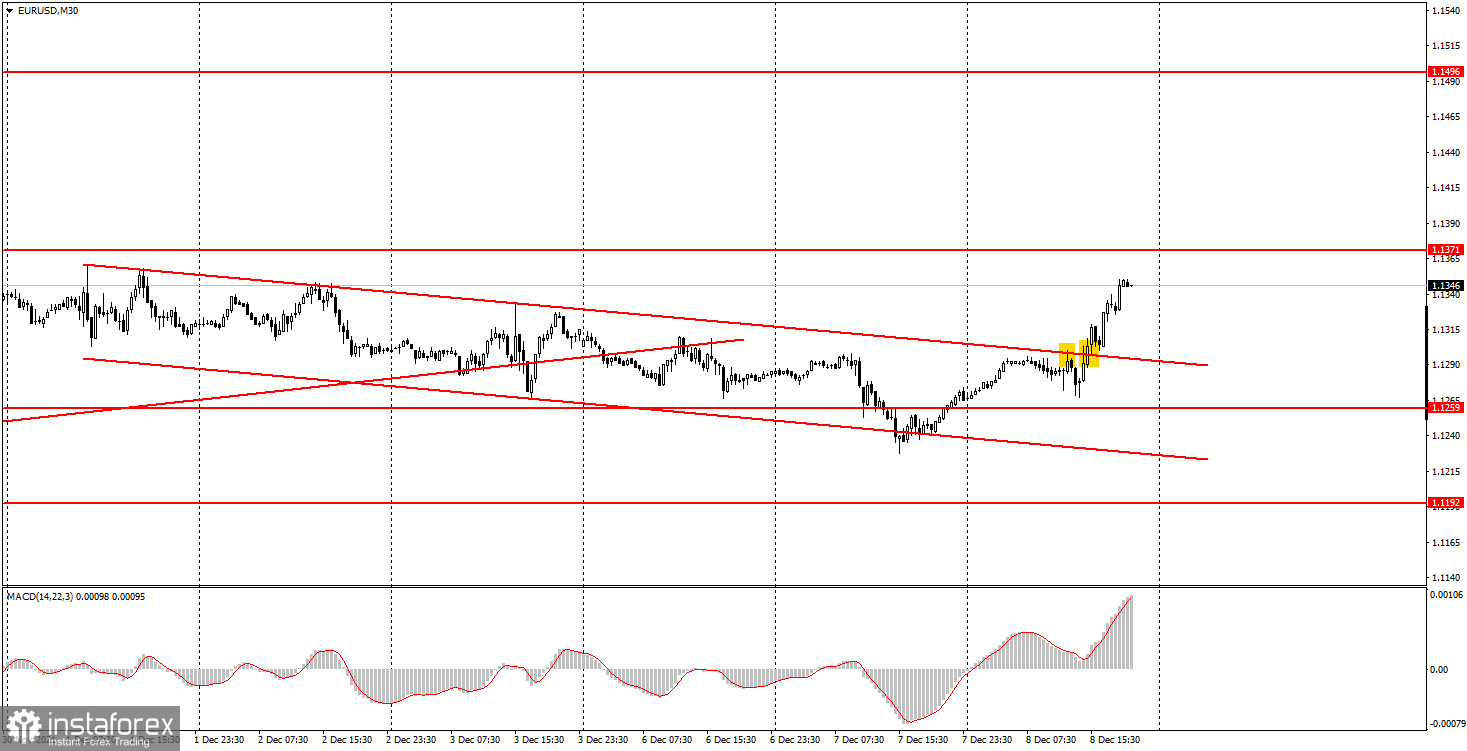

EUR/USD on M30 chart

On Wednesday, the EUR/USD pair made a desperate attempt to stay within the downtrend channel, but under strong bullish pressure, the price consolidated above it. Thus, there was a trend reversal. On the 30-minute time frame, two signals were formed, a sell and a buy one. Initially, the pair bounced off the upper boundary of the channel. So traders should have sold the pair at that moment. However, at the same time, a buy signal was already generated on the 5-minute time frame, and there was no signal to cancel it! Therefore, on the 30-minute time frame, the sell signal should have been ignored. The same applies to a buy signal to overcome the downward channel. By that time, a long position had already been opened on the 5-minute time frame and there was no need to repeat it. This means that in the current time period, no trades should have been opened. Notably, the movement of the EUR/USD pair was quite strong on Wednesday, with total volatility of more than 80 pips. There was no fundamental reason for a strong rise of the euro. However, the euro has been depreciating against the US dollar for a rather long time. Therefore, a technical correction was quite logical.

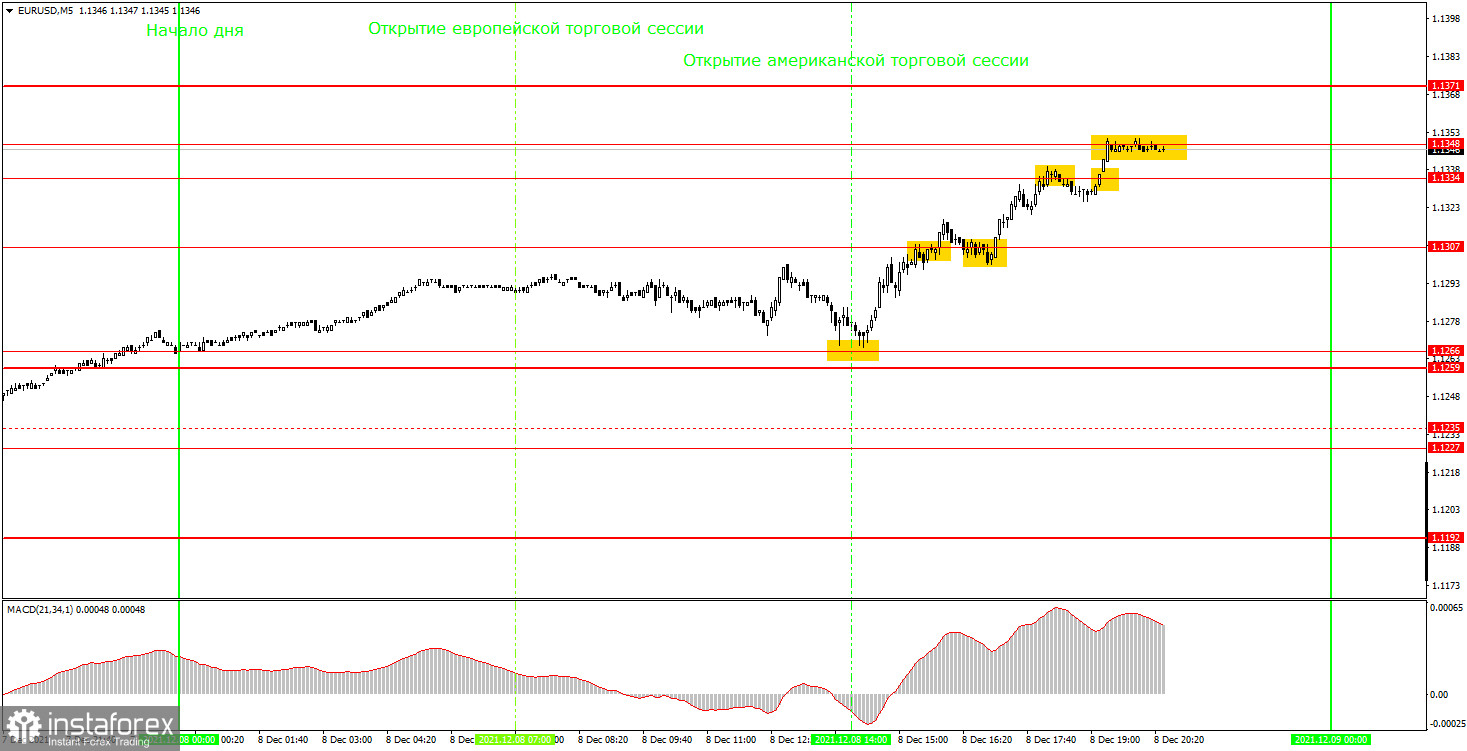

EUR/USD on M5 chart

On a 5-minute time frame, the technical picture on Wednesday was almost perfect for novice traders. All levels that the pair crossed during the day had been successfully tested and good signals formed around them. The first buy signal was formed at the beginning of the American trading session when the price bounced from the level of 1.1266 twice. In both cases, the quotes missed 1 pip to reach the level, but this was not a big deal. Thus, at this point, beginners should have opened long positions. Then the pair tested and overcame the level of 1.1307 and reached 1.1334, from where it initially bounced off. This was a signal to close long positions. The profit on this trade was 50 pips. Also, the trade could be closed at any Take Profit from 30 to 40 pips. The next buy signal was formed when the pair broke through the level of 1.1334. However, like with the previous sell signal, it should not have been followed since it was formed quite late. The same applies to the last signal which gave unclear direction: the price simply reached the level of 1.1348 but did not pull back or break through it.

Trading tips on Thursday

On the 30-minute time frame, the downtrend was canceled and replaced by an uptrend. Therefore, the euro may keep rising against the dollar for some time ahead. On the 5-minute time frame, the key levels for December 9 are 1.1266, 1.1307, 1.1344, 1.1348, 1.1371, and 1.1422. A Take Profit should be set at a distance of 30-40 pips. A Stop Loss should be placed to a breakeven point as soon as the price passes 15 pips in the right direction. On the M5 chart, the nearest level could serve as a target unless it is located too close or too far away. If it is, then you should act according to the situation or trade with a Take Profit. No major publications or other events are scheduled for Thursday either in the EU or in the US. Thus, novice traders will have nothing to pay attention to during the day. At the same time, the pair showed strong upside momentum. So tomorrow, the upward movement may continue, and the volatility will also be quite good.

Basic rules of the trading system

1) The strength of the signal is determined by the time the signal took to form (a bounce or a breakout of the level). The quicker it is formed, the stronger the signal is.

2) If two or more positions were opened near a certain level based on false signals (which did not trigger a Take Profit or test the nearest target level), then all subsequent signals at this level should be ignored.

3) When trading flat, a pair can form multiple false signals or not form them at all. In any case, it is better to stop trading at the first sign of a flat movement.

4) Trades should be opened in the period between the start of the European session and the middle of the US trading hours when all positions must be closed manually.

5) You can trade using signals from the MACD indicator on the 30-minute time frame only given that volatility is strong and there is a clear trend that should be confirmed by a trend line or a trend channel.

6) If two levels are located too close to each other (from 5 to 15 pips), they should be considered support and resistance levels.

On the chart

Support and Resistance Levels are the levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels.

Red lines are channels or trend lines that display the current trend and show in which direction it is better to trade now.

The MACD indicator (14, 22, and 3) consists of a histogram and a signal line. When they cross, this is a signal to enter the market. It is recommended to use this indicator in combination with trend patterns (channels and trend lines).

Important announcements and economic reports that you can always find on the economic calendar can seriously influence the trajectory of a currency pair. Therefore, at the time of their release, we recommend trading as carefully as possible or exiting the market in order to avoid sharp price fluctuations.

Beginners on Forex should remember that not every single trade has to be profitable. The development of a clear strategy and money management is the key to success in trading over a long period of time.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română