Yesterday's trading on the GBP/USD currency pair was very ambiguous. Before proceeding to a more detailed technical analysis, let's briefly talk about the main reasons that affect the exchange rate of the British pound. In my opinion, the three most important factors restrain the potential growth of the British currency. First, the number of people infected with the new COVID-19 Omicron strain continues to grow in the UK. While this is not a disaster at all, the fact of an increase in cases of Omicron, which has several dozen types of mutations, alarms market participants. Also, investors are still concerned about the problems of Brexit. First of all, these problems are fishing, the transportation of goods across the Northern Irish border, as well as the problem of illegally arriving migrants from France across the English Channel. The third factor that prevents sterling from strengthening can be considered the head of the Bank of England, Andrew Bailey, whose statements and comments are more of a "dovish" tone. Of course, not the least role in the price movement of GBP/USD is played by the technical picture, which we immediately proceed to consider.

Daily

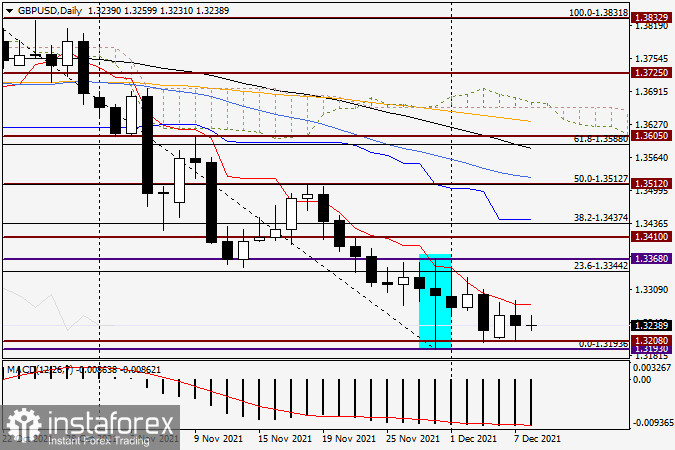

The ambiguity of yesterday's trading, which was noted at the very beginning of this article, is due to a candle with approximately equidistant shadows. And yet the lower one is a little longer. The lows of yesterday's trading were marked at 1.3208, and this mark on December 3 already provided the pair with quite strong support. As for the movement in the north direction, in the current situation, it is held back by the red line of the Tenkan Ichimoku indicator, and this has been happening since November 30. It was the lows and highs of this trading day that created the 1.3368-1.3193 range, in which the pound/dollar is still trading. In this regard, it is quite logical and technically reasonable to assume that the true exit from the designated range will indicate the further direction of the course. Only when exactly it will take place remains a mystery. The pound likes to get stuck in such corridors for a long time, followed by a sharp exit to one side and a good directional movement of the quote.

Moving on to trading recommendations, I'll start with potential sales. To open short positions, we are waiting for a true breakdown of the support levels of 1.3208 and 1.3193, after which, on a rollback to them, we are looking for options for selling the GBP/USD pair. At the same time, bearish candlestick signals at this or smaller time intervals will confirm the decision to open sales. I recommend considering purchases of the GBP/USD pair only after a true breakdown of the Tenkan red line, and preferably a strong technical level of 1.3300. We act by the same method - after fixing above 1.3300, on a rollback to the price zone 1.3300-1.3285, we are waiting for the appearance of bullish candlestick analysis models, after which we try options for opening long positions.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română