The EUR/USD pair is moving sideways in the short term as the Dollar Index moves somehow sideways as well. The bias remains bearish, so the currency pair could approach and reach new lows. It was trading at 0.9694 at the time of writing and it seems under pressure.

Fundamentally, the US PPI reported a 0.4% growth in September versus the 0.2% expected and compared to the 0.1% drop in the previous reporting period, while Core PPI registered a 0.3% growth matching expectations.

Later, the FOMC Meeting Minutes represent a high-impact event and could bring sharp movements on all markets and not only on the EUR/USD pair. As you already know, the FED is expected to increase the Federal Funds Rate in the next meeting again. A more hawkish-than-expected report could boost the greenback.

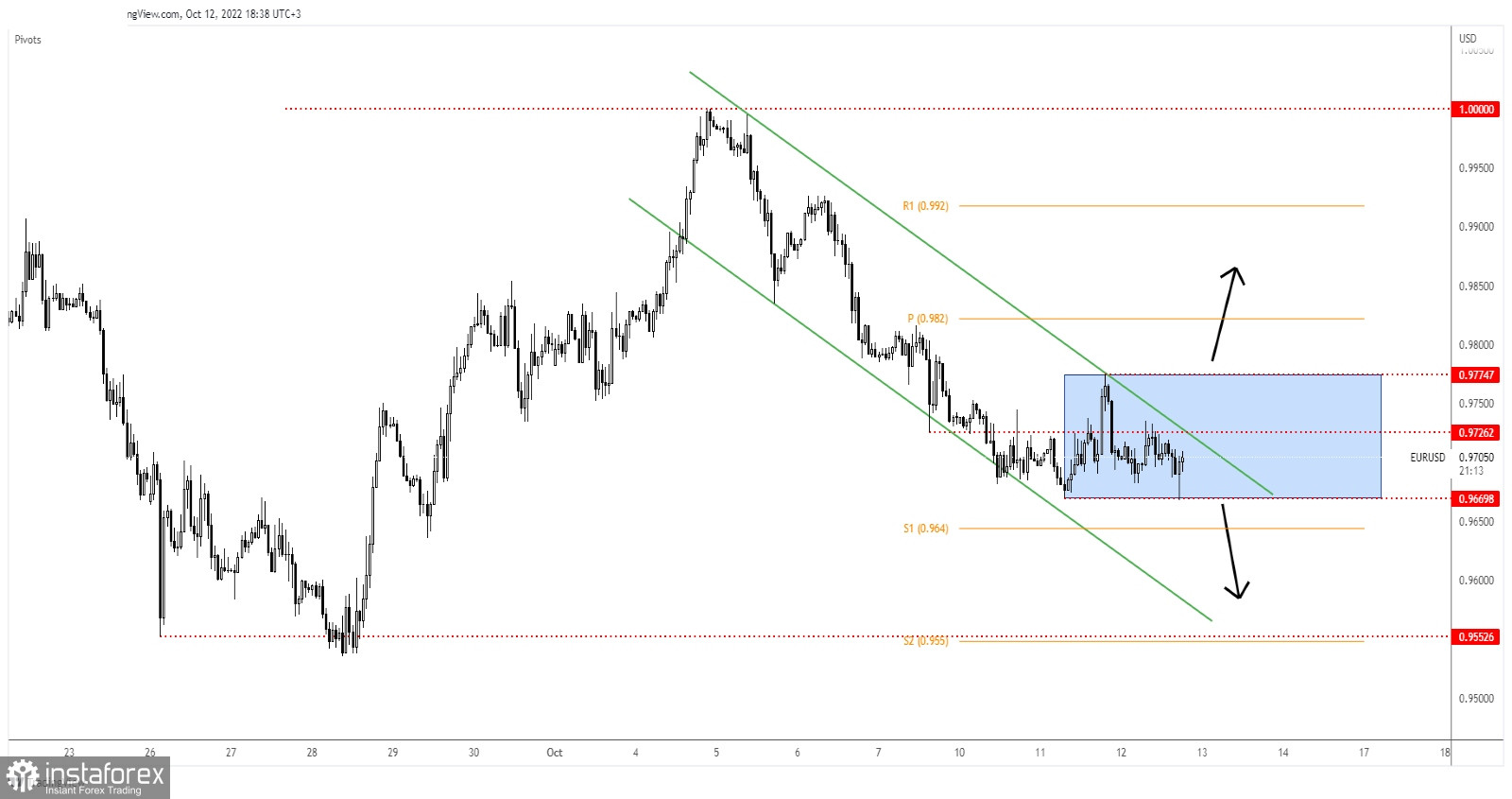

EUR/USD Range Pattern!

Technically, the EUR/USD pair is trapped between 0.9669 and 0.9774 levels. 0.9726 represents a static resistance while the downtrend line represents a dynamic resistance. As long as it stays under these levels, the price could extend its downside movement.

0.9669 stands as critical support. Taking out this downside obstacle may signal more declines within this down channel. Still, you have to be careful as the rate could register sharp movement in both directions later around the FOMC Minutes.

EUR/USD Forecast!

A valid breakdown below 0.9669 and staying below the downtrend line may signal more declines. False breakouts through the downtrend line and making a new lower low brings new short opportunities. 0.9552 stands as a major target.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română