Hello, dear traders! I present to you the trading idea for oil.

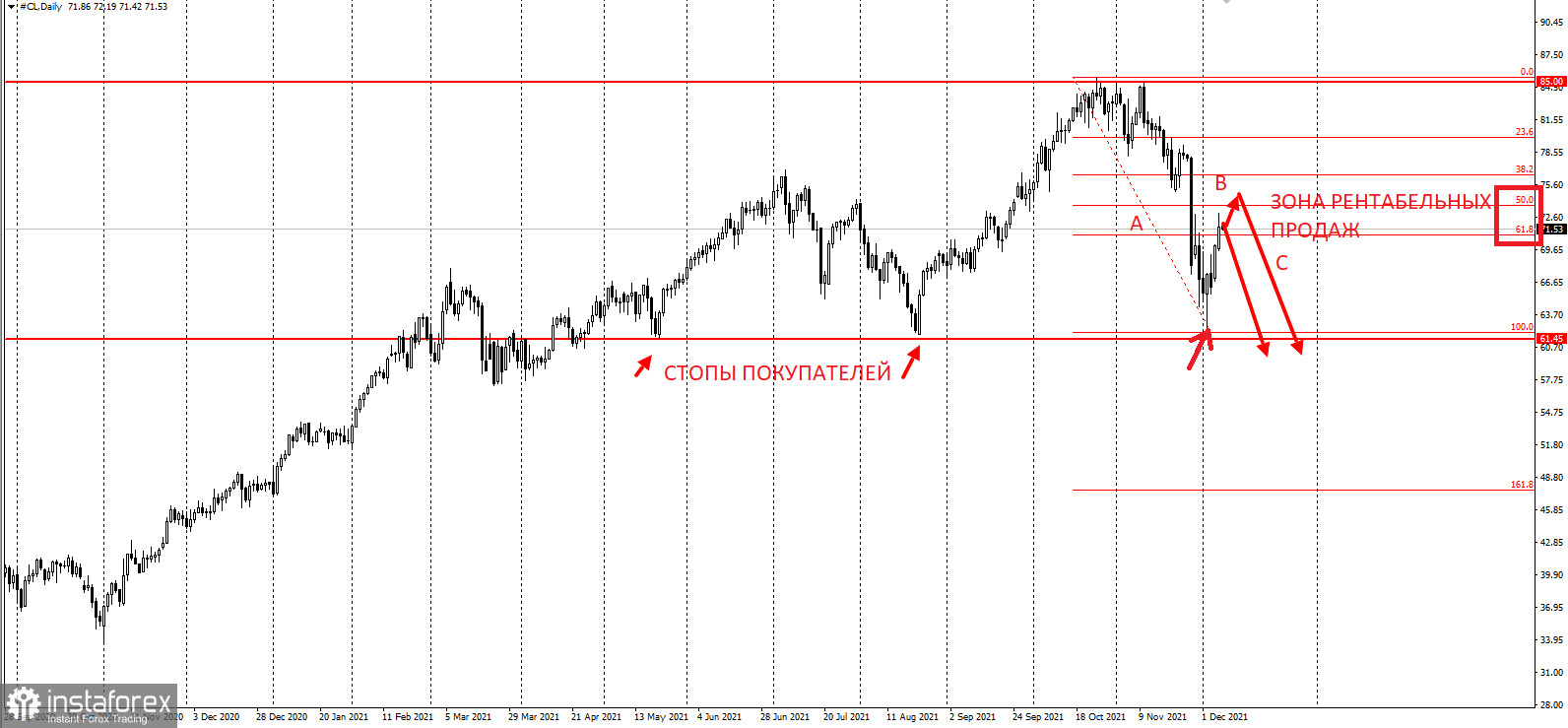

Thus, after oil prices collapsed from $85 to $61 a barrel in November, the WTI instrument is correcting into the 50% fall range. This fact creates the prerequisites to search for possible entry points to the downside within the stop hunting strategy according to the chart shown in the screenshot below:

Overall, it is a three-wave ABC structure, where the A wave is the short initiative of November.

It is recommended to consider short positions from a pullback of 50-61.8% on the Fibo level from the current prices and up to 73.34 for WTI according to the chart presented in the screenshot above.

It is advisable to limit risks to $80-82 and fix profits on a breakout of $61-60.

The trading idea is presented within the price action and stop hunting strategy.

Good luck and control your risks!

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română