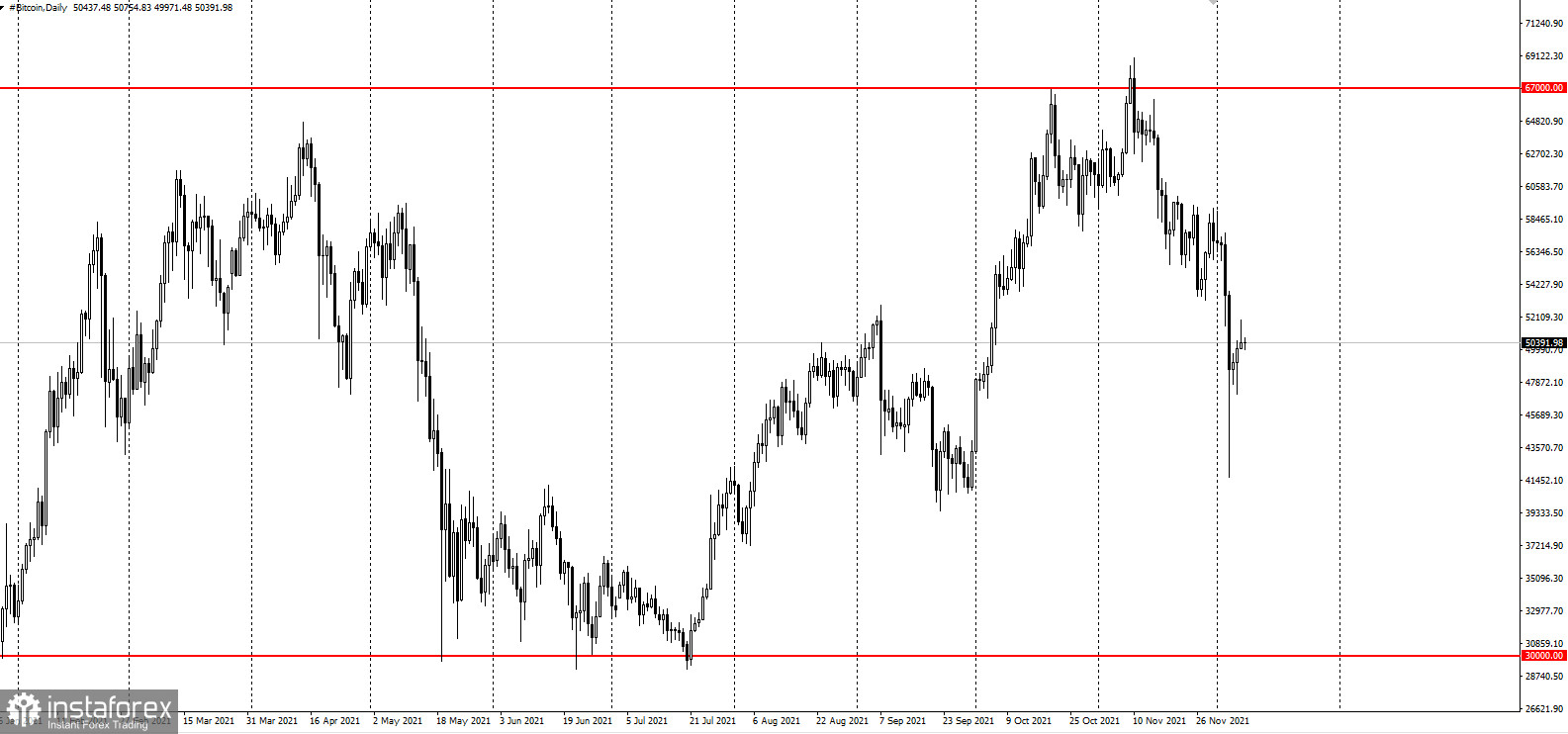

Bitcoin, which is the largest crypto coin, has demonstrated a steady recovery and is growing for three days in a row after its value collapsed on Saturday by more than 35%. Chart observers predict that such a rally will be able to push this digital token back to the area of 55700 dollars per coin.

On Tuesday, this coin showed a 3.6% increase to $51,897, while other smaller tokens also showed growth.

According to Bloomberg Intelligence analyst Mike McGlone, the cryptocurrency market has resumed a more stable bullish trend. The market has seen speculative traders exit stop orders, and they attract more sustainable buy-and-hold types.

Bitcoin and other cryptocurrencies strongly fell in price this weekend amid a stronger anti-risk sentiment, which also included sell-offs in many areas of the US stock market. This happened as a sharp rise in inflation forces central banks to tighten monetary policy, threatening to reduce the tailwind of liquidity that has lifted a wide range of assets.

Mati Greenspan, Quantum Economics founder, and CEO said that it is important to remember that such pullbacks are an integral part of a market that is increasingly hungry for excessive risks. From time to time, the riskiest parts of the market, in this case mainly mime coins and metaverse tokens, really need to be dumped.

"Let's hope we've already seen the worst of it," Greenspan added.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română