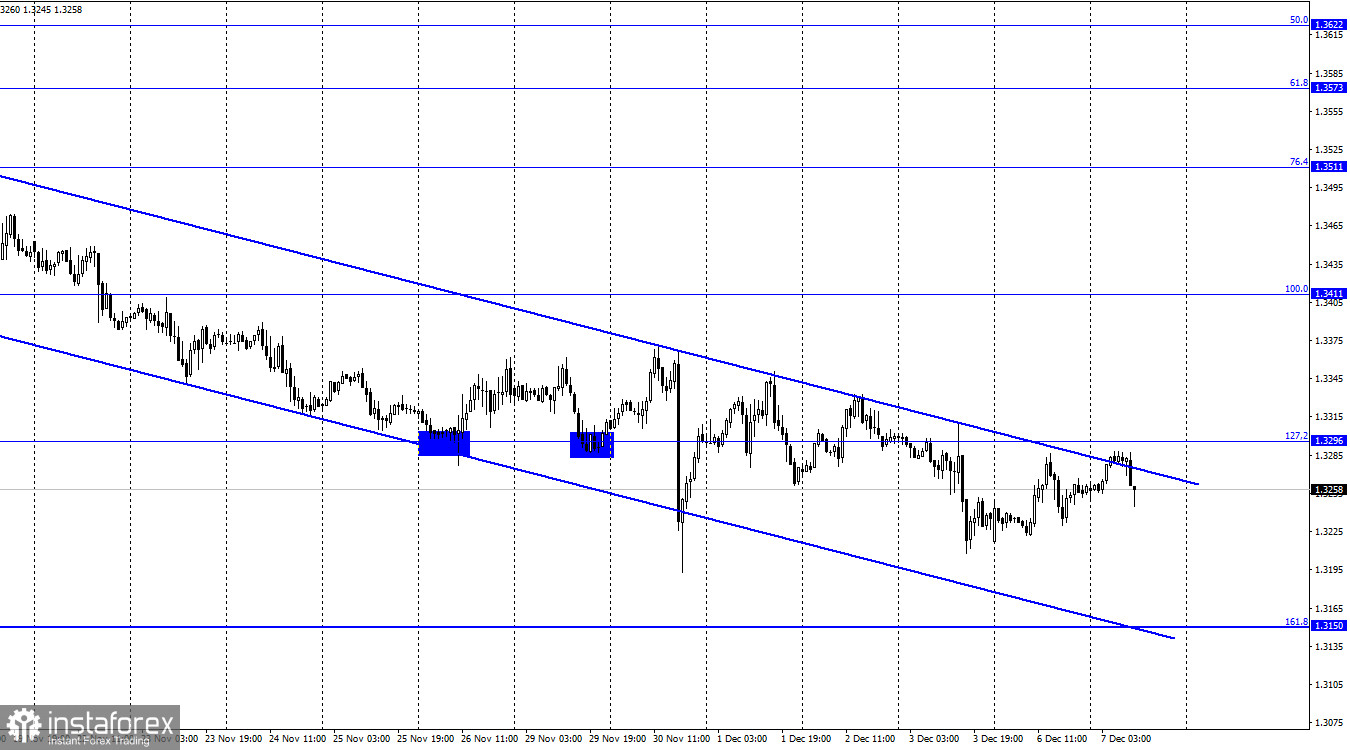

GBP/USD – 1H.

Hello, dear traders! On the hourly chart, on Monday, the pair GBP/USD rose to the upper boundary of the descending trend corridor, then it rebounded and reversed in favor of the US currency. Consequently, the bull traders' fifth attempt to consolidate above the corridor failed. The quotes may continue to fall towards the 161.8% correctional level at 1.3150. However, if bulls manage to close above the corridor, traders' sentiment will change into a bullish one. Besides, the rise of the British pound may continue towards the 100.0% correctional level at 1.3411. It is noteworthy that in the coming days the British pound may close above the 127.2% level at 1.3296 and above the corridor. In the past 6 days, the pair has tried to break the upper line of the corridor 5 times. Therefore, according to probability theory, it will manage to break it next time. At the same time, currently, bear traders also do not have enough strength for the pair to continue falling. Traders are most likely to expect new data. Overall, the British pound is fairly low, near this year's lows. Thus, GBP needs a strong information background from the UK. However, UK positive news is unlikely this week. Only the GDP report will be released on Friday. Moreover, London and Brussels are unlikely to conclude Northern Ireland protocol talks this week. Paris and Brussels will not probably have sorted out the fish issues by the end of the week. Besides, the latest COVID-19 pandemic wave in the UK will unlikely dramatically and unexpectedly decline. There are not too many events in the US this week that could be considered negative. There are hardly any reports. Friday's inflation is likely to be higher than a month earlier, triggering the dollar to rise.The issue of raising the US debt ceiling should also be resolved this month. However, earlier traders have been vaguely interested in this matter. Unless the deadline is missed by US senators and congressmen and a technical default is announced, traders will unlikely apply the news on this issue to the GBP/USD chart.

GBP/USD – 4H.

On the 4-hour chart, the pair closed under the 61.8% correction level at 1.3274. This aspect accounts for a possible slight drop in the quotes. However, bullish divergence of the MACD indicator allows expecting some rise. The pair has been moving below the upper boundary of the downtrend corridor for the second week in a row and it is unable to close above it. The same picture is observed on the hourly chart, i.e. the probability of closing above the two corridors is higher. Therefore, it is possible to expect some rise of the British currency towards the 50.0% Fibo level at 1.3457.

US and UK economic news calendar:

On Tuesday, the US and UK economic calendars include no relevant entries. Thus, news background does not influence traders' sentiment today.

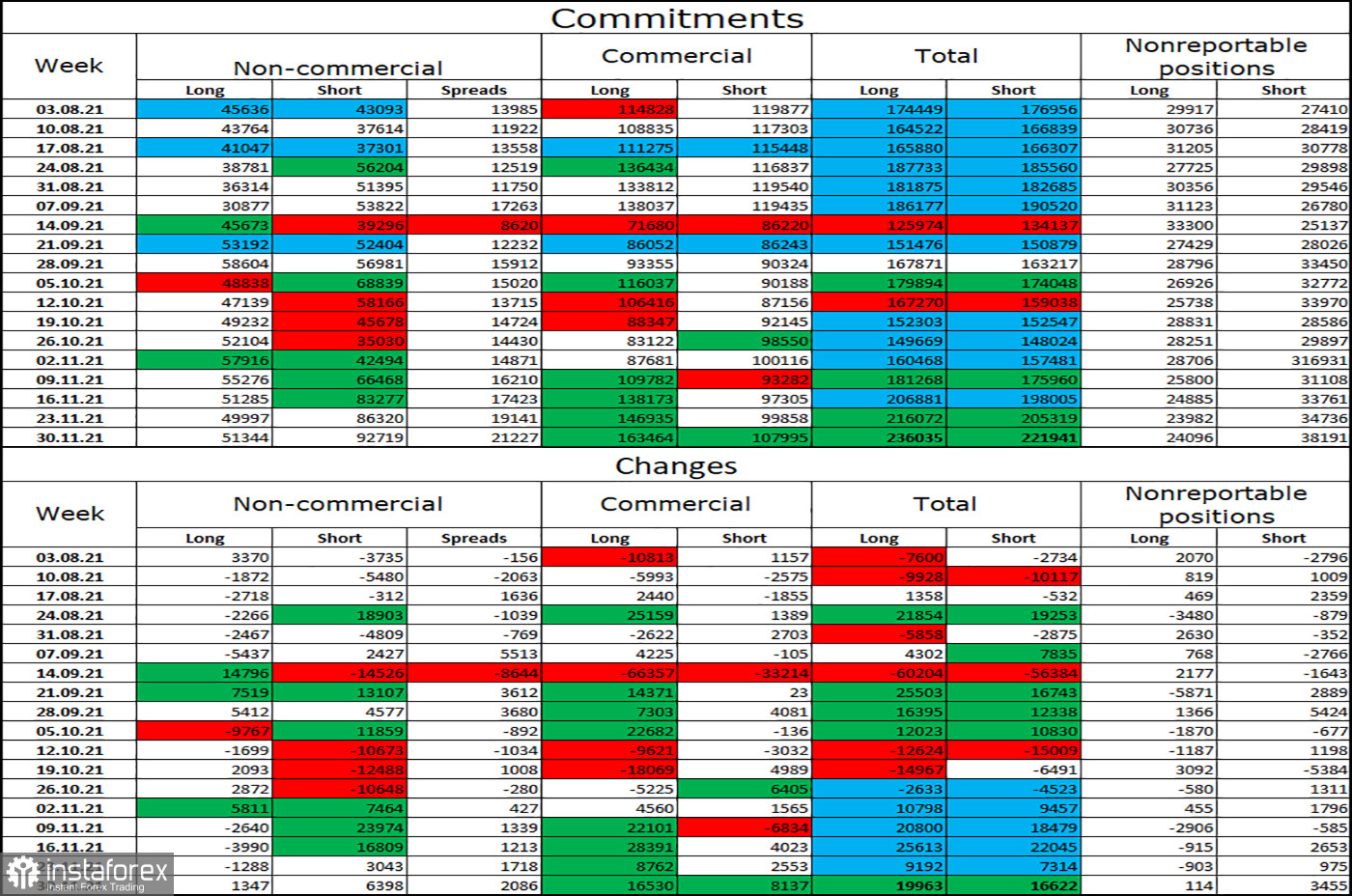

COT (Commitments of traders) report:

The latest COT report on the British currency on November 30 showed that the major market players' sentiment has become more bearish. This trend has been observed for the fifth week in a row. During the reporting week, speculators opened 1,347 long and 6,398 short contracts. In total, over the last month speculators opened about 56,000 short contracts, i.e. more than all long contracts held by them now. Consequently, in recent weeks speculators have demonstrated a strong bearish sentiment, indicating a possible further decline of the British pound. Graphical analysis partly favours this assumption as the pound is unwilling to grow. The total number of opened long and short contracts for all categories of traders is almost equal now.

GBP/USD outlook and recommendations for traders:

I recommend buying the pound if a close on the 4-hour chart above the corridor with targets 1.3411 and 1.3457 is completed. I recommend selling the pair on a close below 1.3274 with a target of 1.3150. However, due to bullish divergence this signal is inactive.

TERMS:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency not for speculative profit, but for ensuring current activities or export-import operations.

"Non-reportable positions" - small traders who have no significant influence on the price.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română