The tension in the markets eased after the statement of WHO representatives that according to preliminary studies, the COVID-19 Omicron strain is not seriously dangerous compared to the previous two, Beta and Delta.

As assumed, the news that Omicron may not pose a serious threat led to an increase in optimism in the markets. Shares of companies whose activities in a broad sense depend on the resumption of economic activity have received significant support. First of all, the securities of consumer sector companies, air carriers and the like have grown.

Now, it can be said that the coronavirus topic is fading into the background for now and the focus of investors' attention will be the publication of fresh November data on US consumer inflation expected this Friday. We should immediately note that their impact on the markets will be significant because they will defeat the Fed either to continue tough rhetoric regarding the possibility of an earlier start of interest rate hikes or, conversely, to slow down a little. Earlier, we repeatedly pointed out the high importance of inflation data for November and December, since if they demonstrate continued strengthening of inflationary pressure, the Central Bank will have to start raising rates in the first quarter with all the consequences for the value of assets. But if, on the contrary, there is a slight slowdown in monthly terms, then this may lead to the postponement of the start of the excess rates in the fall of this year for the summer or even for the fall of 2022.

What should be expected in the markets before the publication of inflation data from America?

We believe that the recovery of stock markets may continue, which will be helped by the sidelining of the Omicron topic. We believe that the growth of shares of companies that fully depend on the state of economic growth in the United States will continue. It is difficult to say how active this movement will be, but it may most likely slow down by Friday due to the expectation of the publication of consumer inflation data. At the same time, if Friday's monthly values of the consumer price index show at least the predicted values, we may witness the start of a Christmas rally on world markets. In these conditions, commodity and raw material assets will also receive support. The US dollar in the currency market is likely to make a downward correction.

Forecast for the day:

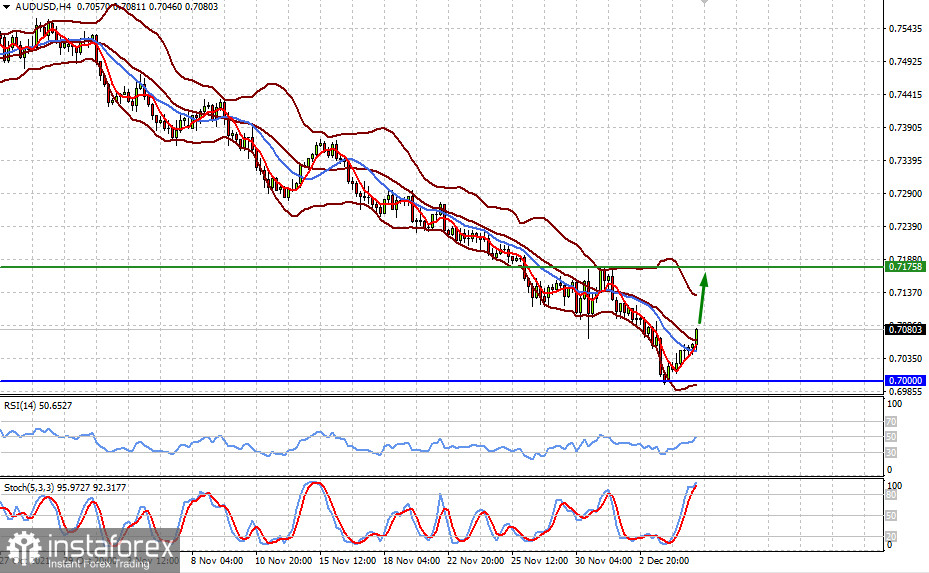

The AUD/USD pair found support at 0.7000 and turned up amid rising demand for risky assets. We believe that the persistence of such sentiments will lead to its further growth to the level of 0.7175.

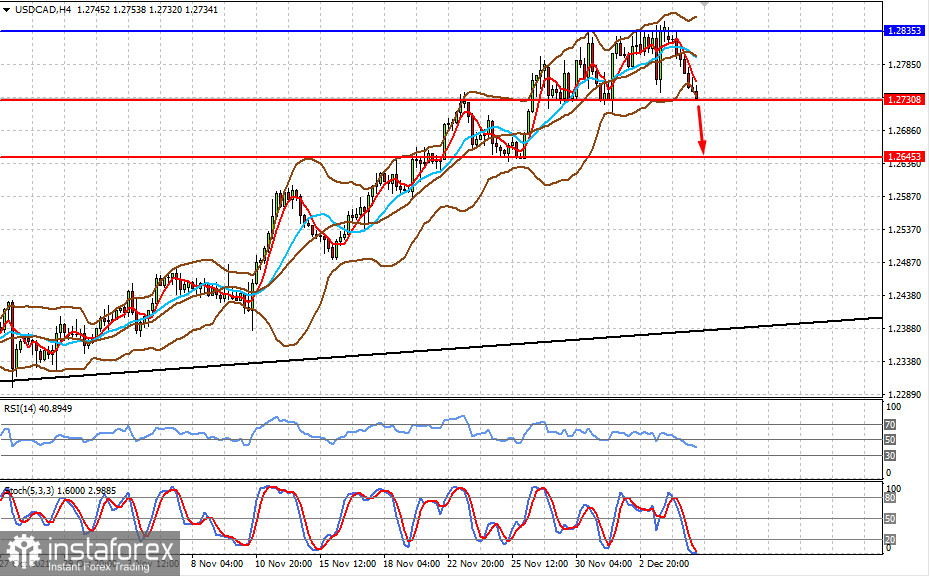

The USD/CAD pair is already approaching the previous target of 1.2730 amid rising crude oil prices and expectations that the monetary rate is unlikely to change following the Central Bank of Canada's meeting. The pair is also declining due to the prospective possible weakening of the US dollar against the background of slowing inflation in America. In this case, we expect the level of 1.2730 to breakdown and a price drop to 1.2645.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română