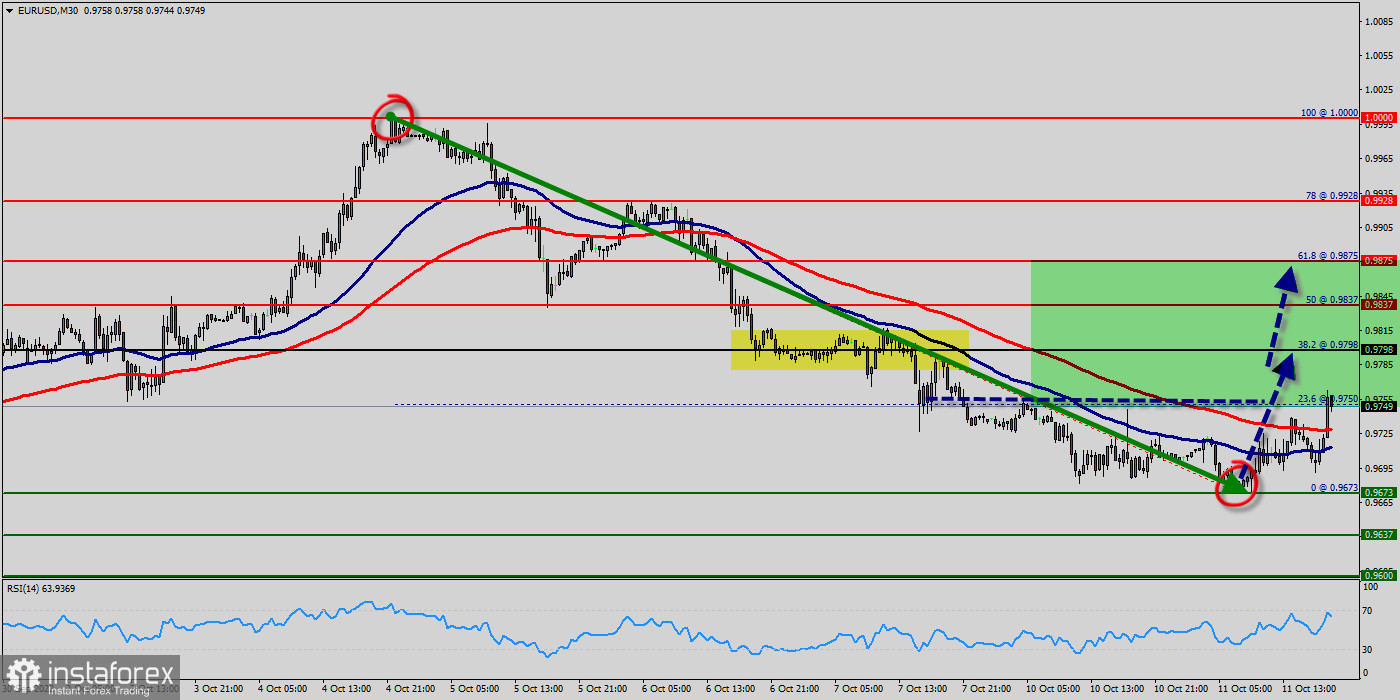

The market of EUR/USD pair is in the buy zone; however, after four consecutive bear bars, fewer bulls will be eager to buy, which means the first reversal up will likely be minor. Bulls see this as a higher low major trend reversal and will likely want a micro double bottom (0.9673) before being convinced of higher prices. Otherwise, those bulls will want to see consecutive strong bull bars before looking to buy.

The EUR/USD pair has been forming a major support and lower highs during the past few days, which can be witnessed by the following mid-term ascending trend line from the level of 0.9673 (double bottom, 00% of Fibonacci retracement levels). The trend line has rejected the price twice (marked by red circle) and initiated a new bullish leg. The price has to break above the trend line to then aim for the long-term descending channel's upper boundary, marked green square. The EUR/USD pair has risen from their recent lows, signaling an increase in volatility in the near term from the prices of 0.9673.

Today, it should be noticed that 1 Euro equals 0.9764 (up +110 | -1.35%). Yesterday, the EUR/USD pair reached the top at 0.9750, then the trend couldn't be rebounded from the price of 0.9750 to close at 0.9764.

The EUR/USD pair rallied to the 100-week moving average on October 11, a level that could act as a battleground between the bulls and the bears. Several analysts are watching this level because a break and close above it could be the first sign that the bear market may be ending on the hourly chart. However, the near-term outlook remains bullish for the greenback from the major area of 0.9700 - 0.9764.

On the local time frame, the EUR/USD pair is trading between the support level at 0.9673 formed by the true breakout and the resistance at 0.9763.

Daily range between the price of 0.9700 and 0.9837. Therefore, at the moment the price is near the upper level, which means that one can expect the test of the 0.9798 mark soon in order to re-reach the double top again.

We should expect an attempt to develop a rise in the price of Euro against the US Dollar and a test of the support area near the level of 0.9700. Where can we expect a rebound up again and a continuation of the climb in the quotes of the EUR/USD pair.

The pair stayed above the psychological level of 0.9700 over the weekend, indicating a lack of urgency to accumulate at the current levels. The bulls are attempting to extend the pair's rise above 0.9700 in the week beginning 10 October 2022.

After finding bids reach to 0.9700, the EUR/USD pair recovered above 0.9700. Initial the trend support lies near the 0.9750 level (23.6% of Fibonacci retracement levels).

A decent breakout and follow-up move above 0.9750 could open the gate for a push towards the 0.9798 level.

The main resistance remains near the zone of 0.9798 - 0.9837. Also it should be noted that the EUR/USD pair and currencies unite as the bears lose their momentum. The market is indicating a bullish opportunity above the above-mentioned support levels, for that the bullish outlook remains the same as long as the 100 EMA is headed to the upside.

An uptrend will start as soon, as the market rises above resistance level 0.9798, which will be followed by moving up to resistance level 0.9837. Further close above the high end may cause a rally towards 0.9875.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română