The USD/JPY pair was trading at 145.70 at the time of writing. The bias remains bullish, so further growth is natural. Still, after its upwards movement, we cannot exclude a temporary retreat. The price could test and retest the near-term support levels before jumping higher again.

Today, the Japanese Current Account came in at -0.53T above -0.56T expected and compared to -0.63T in the previous reporting period, while Economy Watchers Sentiment was reported at 48.4 points above 47.6 points expected. On the other hand, the US NFIB Small Business Index and IBD/TIPP Economic Optimism came in better than expected.

Tomorrow, the FOMC Meeting Minutes and the PPI represent high-impact events and could move the price.

USD/JPY Uptrend Intact!

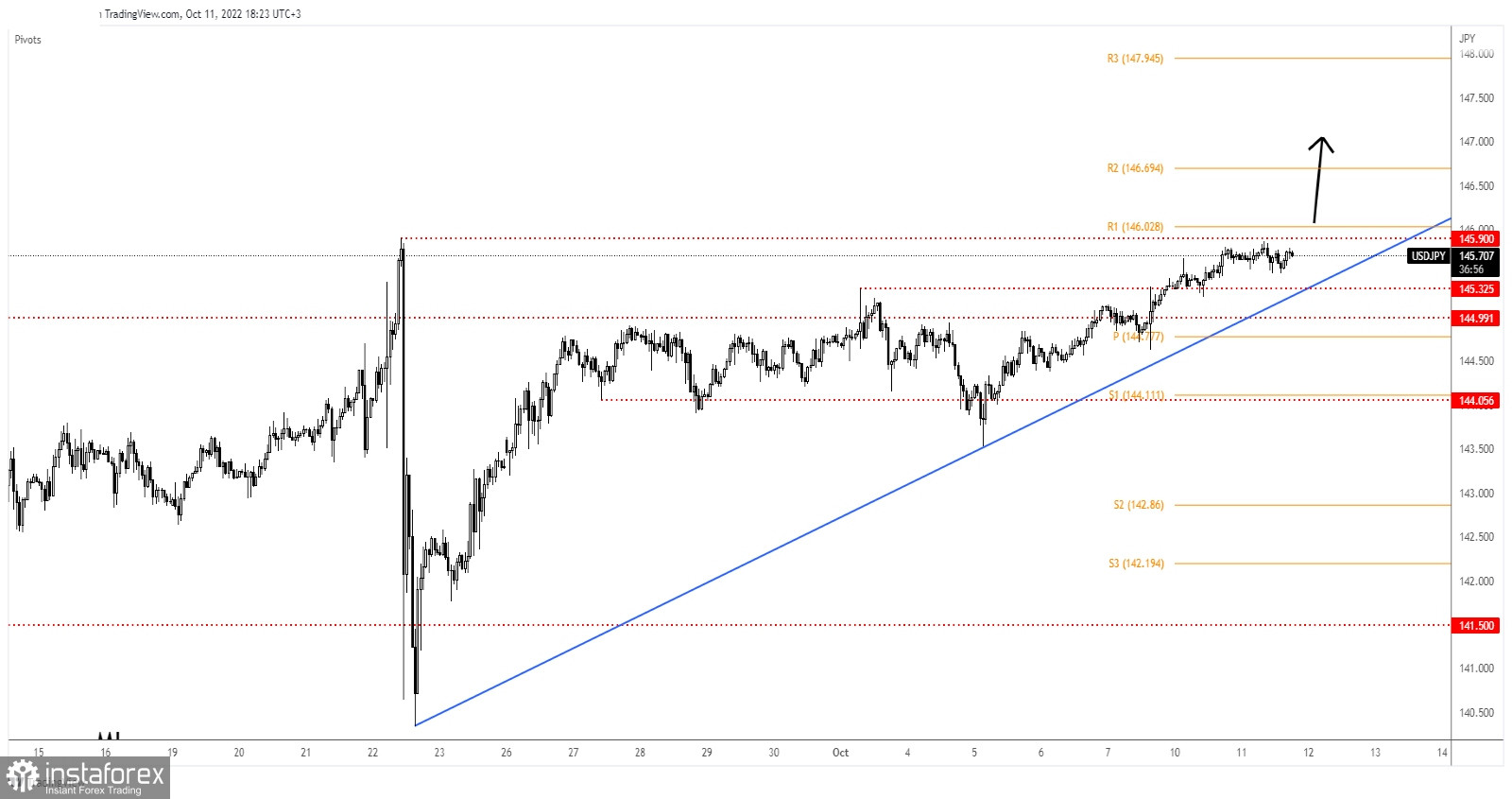

As you can see on the H1 chart, the USD/JPY pair was almost to reach the 145.90 key level. Now, it moves somehow sideways in the short term signaling that the price tries to accumulate more bullish energy before extending its growth.

As long as it stays above the uptrend line, the pair could resume its growth despite temporary retreats. Testing and retesting the uptrend line may signal new bullish momentum.

USD/JPY Forecast!

A valid breakout above 145.90 and through the R1 (146.02) activates further growth and brings new long opportunities. Also, false breakdowns with great separation below the uptrend line could bring long opportunities as well.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română