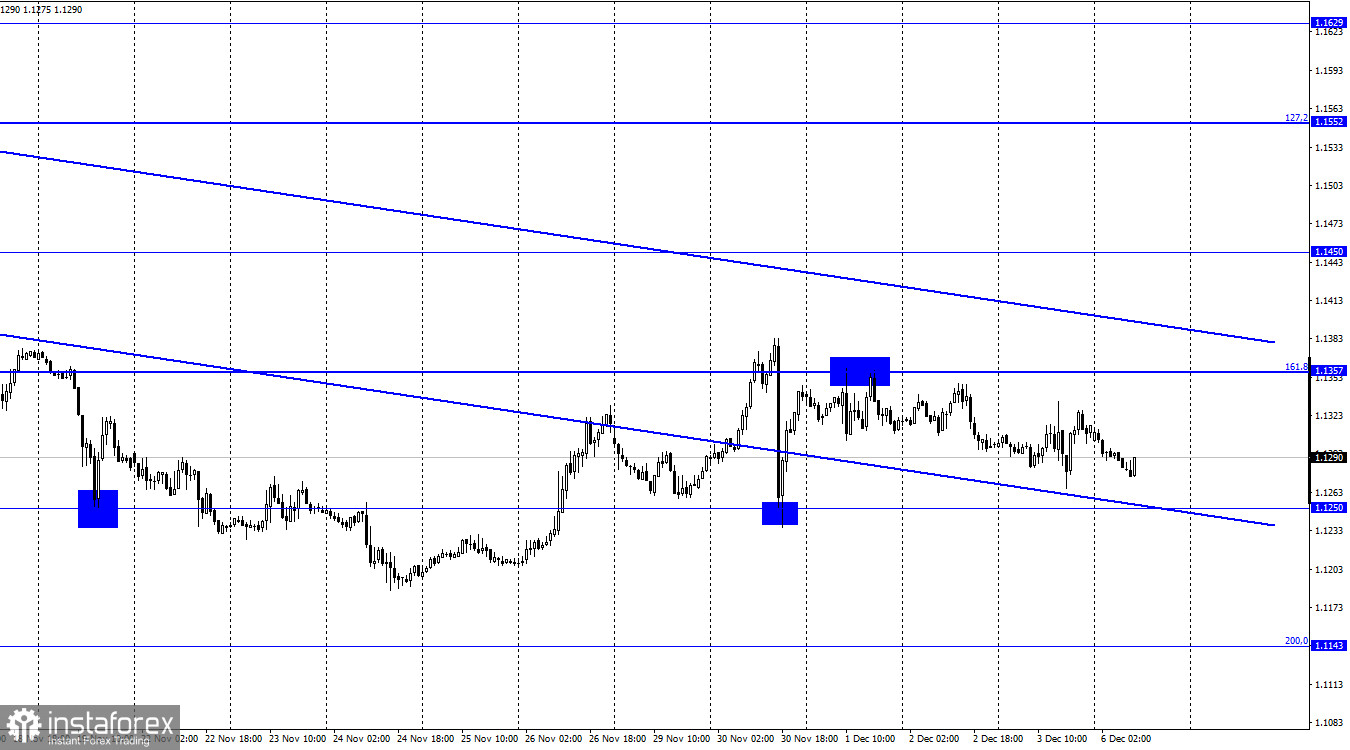

EUR/USD – 1H.

Hi, dear traders!

EUR/USD traded mixed on Friday, as market activity remained weak in the run-up to the release of US labor market and unemployment data. The unemployment rate reached 4.2% in November, beating market expectations. Job growth data turned up to be unexpectedly weak - only 210,000 new jobs were created in the US in November. Economists expected the amount of new jobs to reach 553,000. These two reports counteracted each other, preventing any strong upside or downside movement. EUR/USD is on the decline for a fourth straight trading day, following the quote's earlier bounce downwards off the 161.8% Fibonacci retracement level. The pair continues to be on the downside and cannot reach the 1.1250 level. The ongoing downward trend channel indicates a predominantly bearish mood among traders, and the pair is unlikely to show a strong upside movement until it consolidates above 1.1250.

This week's economic calendar is rather light. In the EU, ECB president Christine Lagarde is set to give speeches on Wednesday and Friday - she could provide new information on EU monetary policy adjustments. In the US, inflation data is due on Friday, which will be the most important report of the week. Market players expect inflation to rise further, and December's Fed meeting could accelerate QE tapering, potentially pushing the US dollar up. The euro has been trying to break out of the current downtrend over the past week and a half, but the US currency is likely to rise further, particularly on high inflation data. Therefore, the pair could continue its fall.

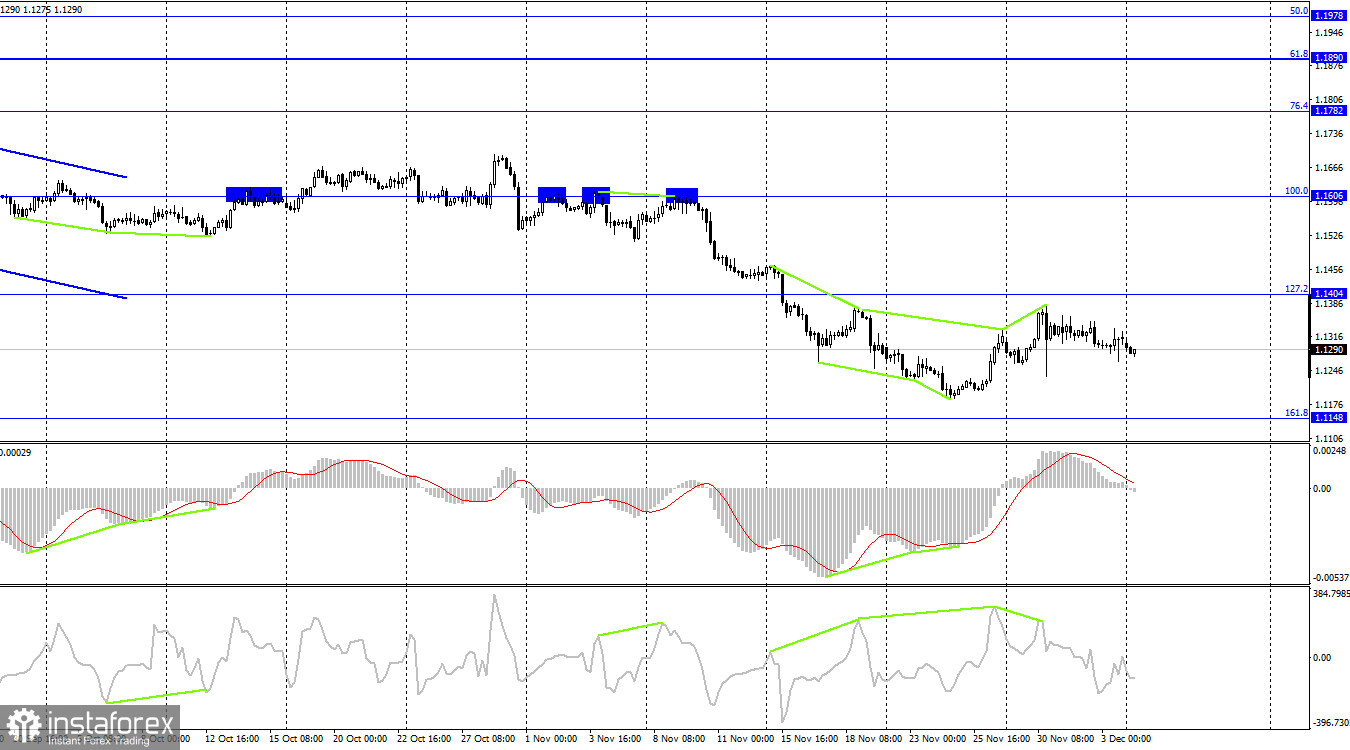

EUR/USD – 4H

According to the 4H chart, the pair performed a downward reversal following the formation of a bearish divergence. It is now falling towards the 161.8% Fibonacci retracement level (1.1148), but its downside movement is rather limited at the moment. No indicator is showing any emerging divergences. If the pair settles above the 127.2% Fibonacci retracement level (1.1404), it could resume its upward movement towards the 100% Fibonacci level (1.1606).

US and EU economic calendar:

There are no events scheduled in the US and EU today.

COT (Commitments of traders) report:

The latest COT report again indicates an increasingly bearish mood among Non-commercial traders. 15,080 Long positions and 8,662 Short positions were closed by market players, bringing the total amount of Long and Short positions down to 191,000 and 220,000 respectively. This indicates an increasingly bearish trend in the market. The COT report shows no sign of a possible long-term uptrend for the euro. The pair is likely to resume its downside movement in the near future.

Outlook for EUR/USD:

Traders are advised to open short positions if the pair bounces off 1.1357 on the 1-hour chart, targeting 1.1250. Long positions can be opened if EUR/USD again bounces off 1.1250 on the 1-hour chart with 1.1357 being the target, or if it closes above 1.1357 with the target at 1.1450.

Terms:

Non-commercial traders are major market players: banks, hedge funds, investment funds, and large private investors.

Commercial traders are commercial enterprises, firms, banks, corporations, companies that buy currency not to obtain profit, but to maintain current activities or import-export operations.

The category of non-reportable positions includes small traders who do not have a significant impact on the price.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română