Fed Chairman Jerome Powell's hawkish comments are affecting the sentiment of the gold market.

The latest survey does not show a clear direction of market development, as prices are kept below $ 1800 per ounce. Wall Street analysts have maintained a three-way relationship of short-term forecasts for gold prices for two consecutive weeks.

At the same time, the mood among retail investors has plummeted. Economists said that concerns about rising inflation are justified by expectations that the Federal Reserve may tighten monetary policy faster than expected.

Some of them believe that, despite the fact that Friday's unemployment figures are disappointing, they are not weak enough to prevent the Fed from increasing the pace of reducing monthly bond purchases.

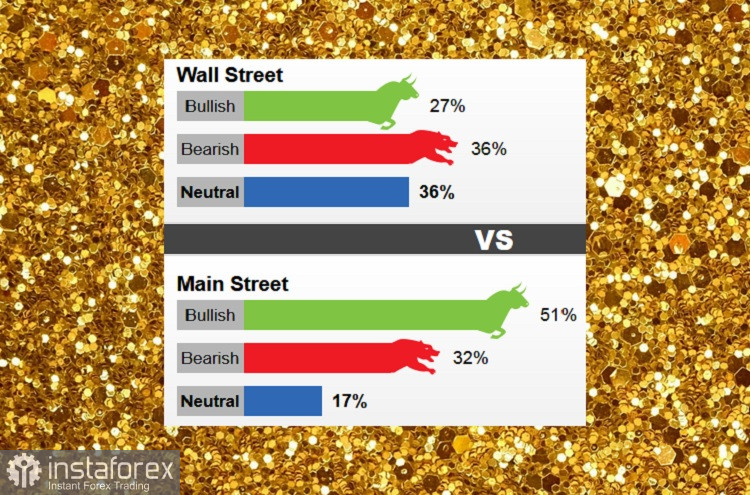

Last week, 14 Wall Street analysts took part in the gold survey. Among the participants, 4, or 27% consider gold to increase prices. At the same time, bearish and neutral investors turned out to be equal, each of which received five votes or 36%.

984 votes were cast in the Main Street online polls. Of these, 501 voters, or 51%, expected prices to rise. Another 319 or 32% voted for the price decline, and 164 voters or 17% were neutral.

Compared to the previous survey, sentiment has declined.

ABC Bullion's general manager Nicholas Frappell said that support at $1,760 an ounce is a critical level to pay attention to. He also added that if gold can hold above this level, it increases the likelihood that prices will test short-term resistance at $ 1,811 per ounce, and disappointing employment data will continue to support prices.

Despite the fact that Powell has intensified his hawkish rhetoric, saying that inflation is no longer temporary, some analysts believe that significant changes in monetary policy are not expected in the near future.

Some economists are not sure that gold will be able to withstand the growing expectations that the Fed will tighten monetary policy.

Bannockburn Global Forex Managing Director Marc Chandler said that, in his opinion, gold prices will retest support at $1,750 per ounce anytime soon since the Fed is still reducing its monthly bond purchases and is going to accelerate this process.

According to Ole Hansen, Saxo Bank's head of the commodity strategy, it is difficult to remain optimistic about gold when the rally meets new pressure from sellers. He supported the general manager of ABC Bullion, Nicholas Frappell, that it is worth keeping an eye on the level of $ 1,760 per ounce.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română