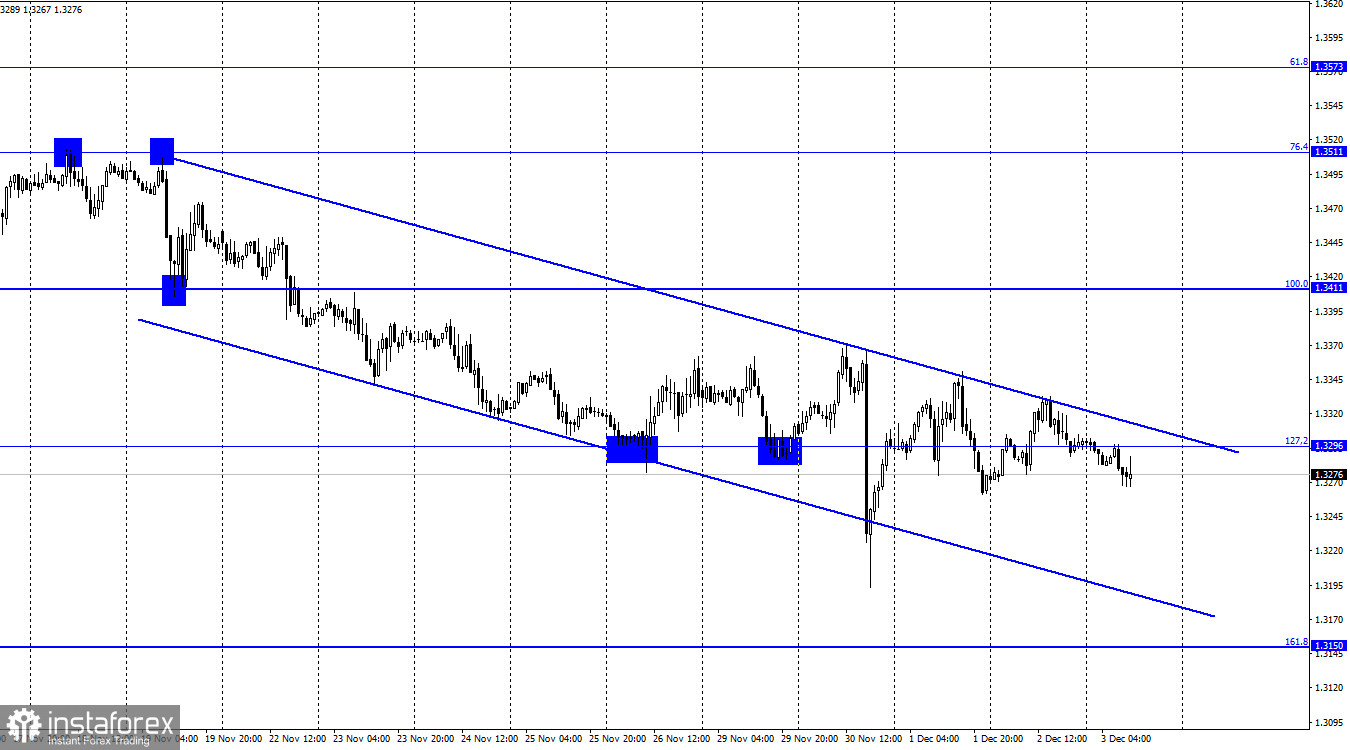

GBP/USD – 1H.

On the hourly chart on Thursday, the GBP/USD pair made a new rebound from the upper boundary of the descending trading channel, reversed and resumed the decline towards the correctional level of 161.8% Fibo - 1.3150. However, today the situation may change quickly. In a few hours important economic statistics will be released in the US, which may seriously influence the market sentiment. The pair may close the trading day above the descending trading channel, which is likely to push the prices higher towards the next correction level of 100.0% Fibo, 1.3411. The upcoming reports will show what may happen next. Meanwhile, experts at the European Center for Disease Prevention and Control said that the Omicron strain may soon displace the Delta strain. Omicron has more mutations than any other strain of the coronavirus, so it is potentially more dangerous.

The UK is also subject to these fears. Boris Johnson has already ordered a tightening of quarantine measures, but this tightening was related to the Delta variant. According to John Hopkins' website, the fourth wave of the pandemic, which began back in June, is continuing in the UK. In other words, it has been going on for more than five months! In the last few weeks, Germany has had a greater number of cases than the UK. However, unlike the German or Austrian authorities, which understand the danger of the new strain and the new wave of the pandemic, the UK authorities appealed to wear masks in public places and that was it. The government of Boris Johnson cannot agree with Brussels on the issue of protocol on the border with Northern Ireland and with Paris on the fishing issue. Thus, it is rather difficult for the UK economy to show growth now. If the US reports show strong data, the pound may resume the decline.

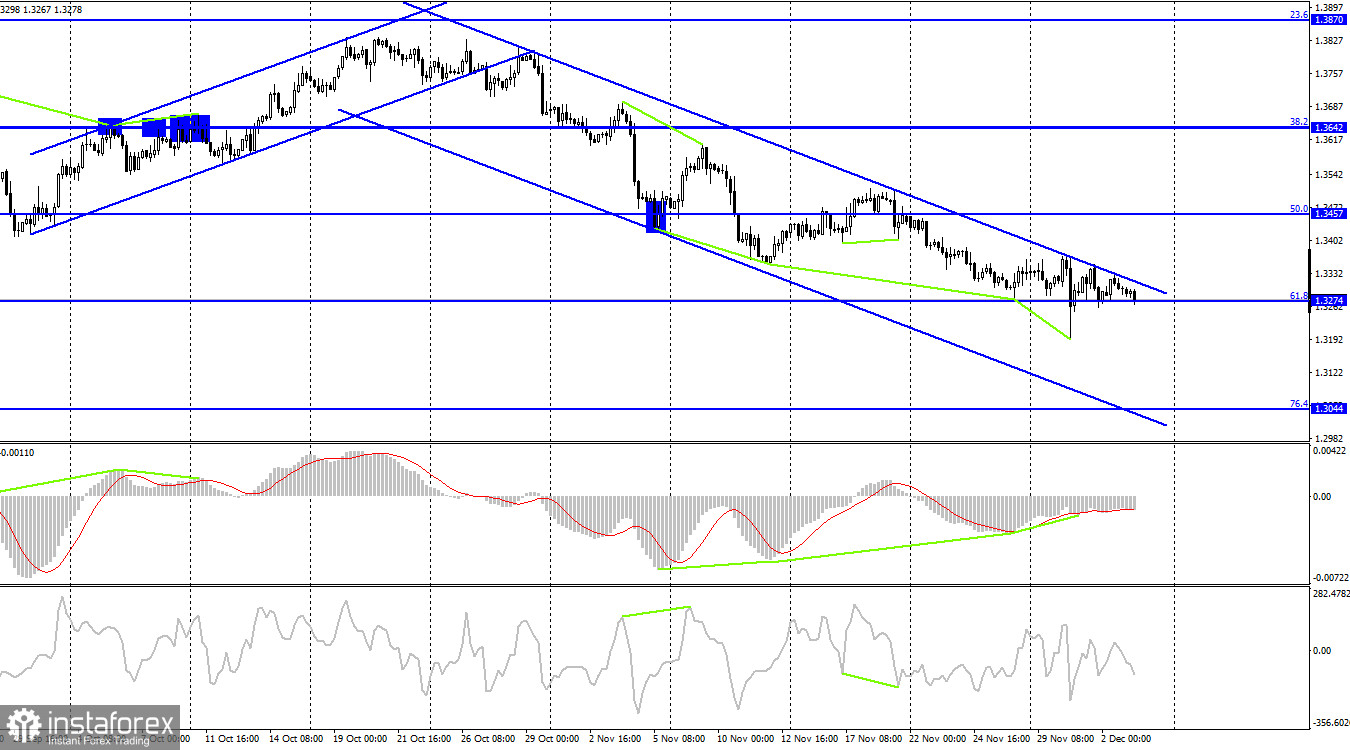

GBP/USD – 4H.

On the 4-hour chart, the GBP/USD pair cannot close under the 61.8% retracement level at 1.3274, but it also cannot close the trading day above the downward channel, which proves bearish sentiment in the market. Thus, if the pair closes above the channel, it is likely to drag GBP towards the 50.0% retracement level of 1.3457. If the price fixes below 1.3274, it is likely to continue the decline towards 76.4% Fibo, 1.3044.

The US and the UK economic data:

US - Unemployment Rate (13-30 UTC).

US - Non-Farm Employment Change (13-30 UTC).

US - ISM Services PMI (15-00 UTC).

On Friday, the UK economic calendar is almost completely empty. In the US there will be a lot of important reports, so all the most influential data will be released in just a few hours. The data may strongly influence the market sentiment.

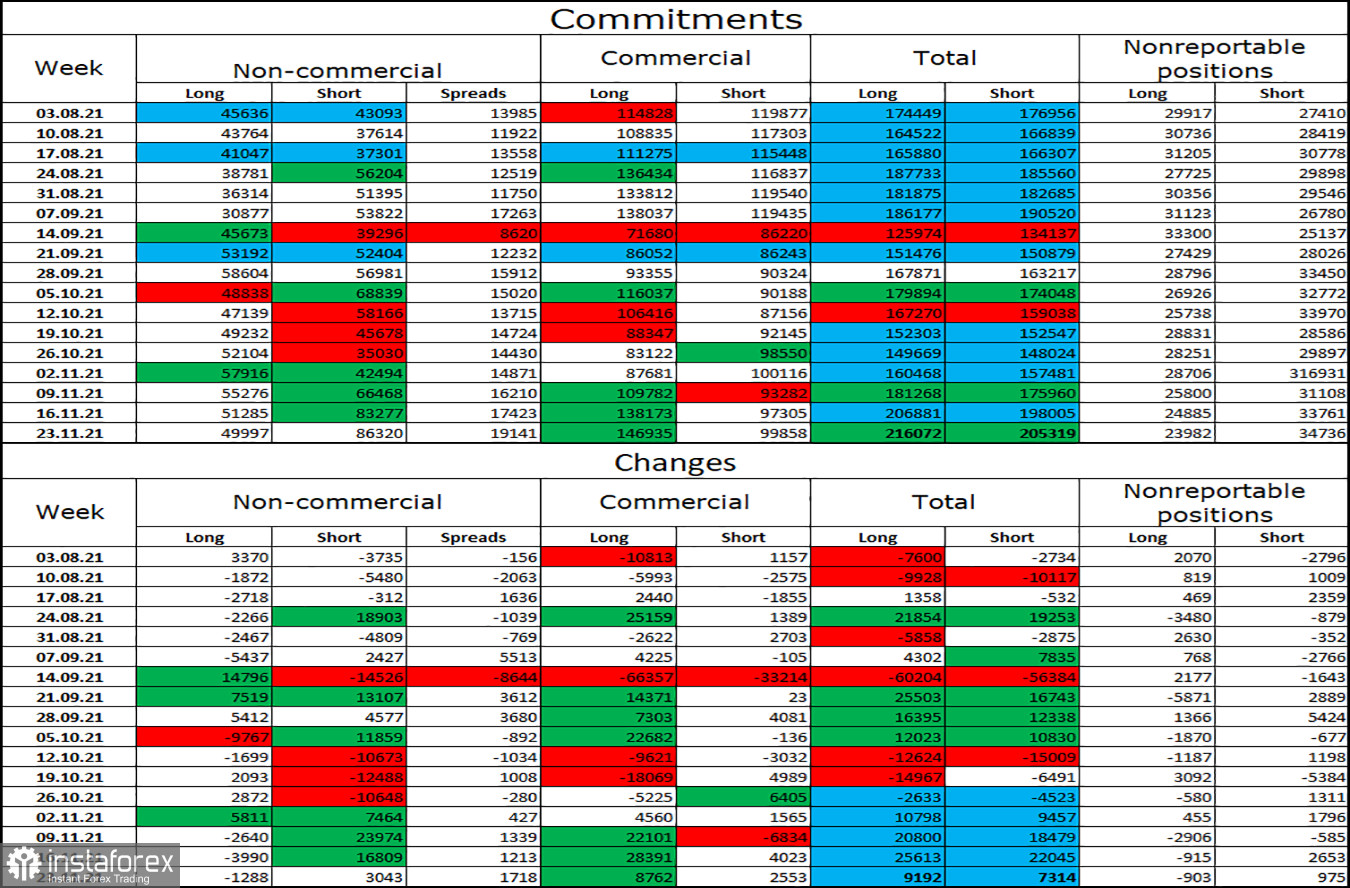

COT (Commitments of Traders) report:

The recent COT report of November 23 for GBP showed that the sentiment of the big players has become more bearish. This trend has been observed for the fourth week in a row. During the reporting week, traders closed 1,288 long positions and opened 3,043 short positions. Altogether over the last month, traders opened about 50,000 short positions. That is as many as there are long positions. Thus, traders' sentiment shows a possible decline in the pound. The graphical analysis also confirms this, as the pound does not increase. The total number of open long and short positions is almost equal now.

Forecast on GBP/USD and recommendations:

I recommend opening new positions if the pair closes above the trading channel with targets located at 1.3411 and 1.3457 on the 4-hour chart. I recommend selling the pair at closing below the level of 1.3274 with the target of 1.3150.

TERMINOLOGY:

"Non-commercial" - Large market players: banks, hedge funds, investment funds, private large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency, not for speculative profit, but to support current operations or export-import operations.

"Non-reportable positions" - traders who have no significant influence on the price.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română