Gold is gradually sliding down and is now trading near the lowest levels for the month. It seems that market players, who bet on precious metals in the midst of panic due to inflation, have become disillusioned with this asset.

The news about Omicron played a role here. The main fundamental factor playing against gold is the Fed's hawkish rhetoric. Faster stimulus cuts and rate hikes in the U.S. have diminished interest in gold as a hedge against inflationary risks.

It is unusual that the precious metal continues to decline, despite the uncertain and contradictory dynamics of the dollar.

The U.S. Dollar Currency Index is completing the trading week in line with the upward trend. Volatility is increasing due to the news about Omicron, but, on the other hand, is dampened by expectations of an earlier rate hike. The upside potential for the dollar remains, which suggests medium-term pressure on other assets, including gold.

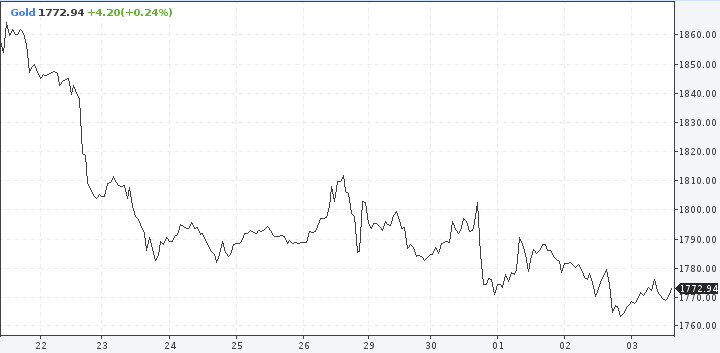

Investors began to buy gold from October, an obvious upward price jump took place from the beginning of November. In the 20th, the quote was located near the 50- and 200-day moving averages and was in a state of perfect balance. Something went wrong and by the end of November the bulls had lost control of the situation and the bears became the main dominant force. Judging by the chart, the November growth was completely leveled, and, what is more important, the quote went below important technical and psychological levels.

Looking at the weekly timeframe, it is obvious that the price has returned under the 20-week SMA. If Friday's trading closes at current levels, it will be the lowest weekly close since early October.

All indications are that the local sell impulse will be the main one in the coming sessions. The bears' sentiment can be traced to move the quote to the $1,730 area. The next target will be the level of $1,680. There will most likely be a stop here. It is unlikely that it will be possible to sell gold below as quickly. The $1,680 mark acts as a more significant support line, from where buyers have been able to buy back more than once this year and thereby keep the precious metal from falling deeper.

However, the picture for gold already looks pessimistic. A blockage below the $1,730 mark will be a clear signal that the situation is out of control and that we are no longer talking about a corrective pullback. The breakdown of the strong level of $1,680 can be considered a control shot by sellers.

If this scenario really comes true, then market players will witness a repeat of the 2011-2012 situation. The upward prospect will be postponed, and in 2022 it will be possible to tune in to a price decrease in the $1,300-1,500 region.

Until the $1,680 level is broken through, an alternative scenario, namely growth after a downward correction, should be kept in mind. As soon as gold is confidently on the track of an upward trend, the price will rush further up. Here a new leap for $2,600 is possible in a year.

Meanwhile, markets' focus on Friday is on the release of key data on the US labor market. Strong results from the NFP report could put pressure on gold, as it strengthens investors' expectations for a Fed rate hike in the first half of next year. This will cause a break of the $1,760 support level, to begin with, and head towards $1,730.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română