EUR/USD

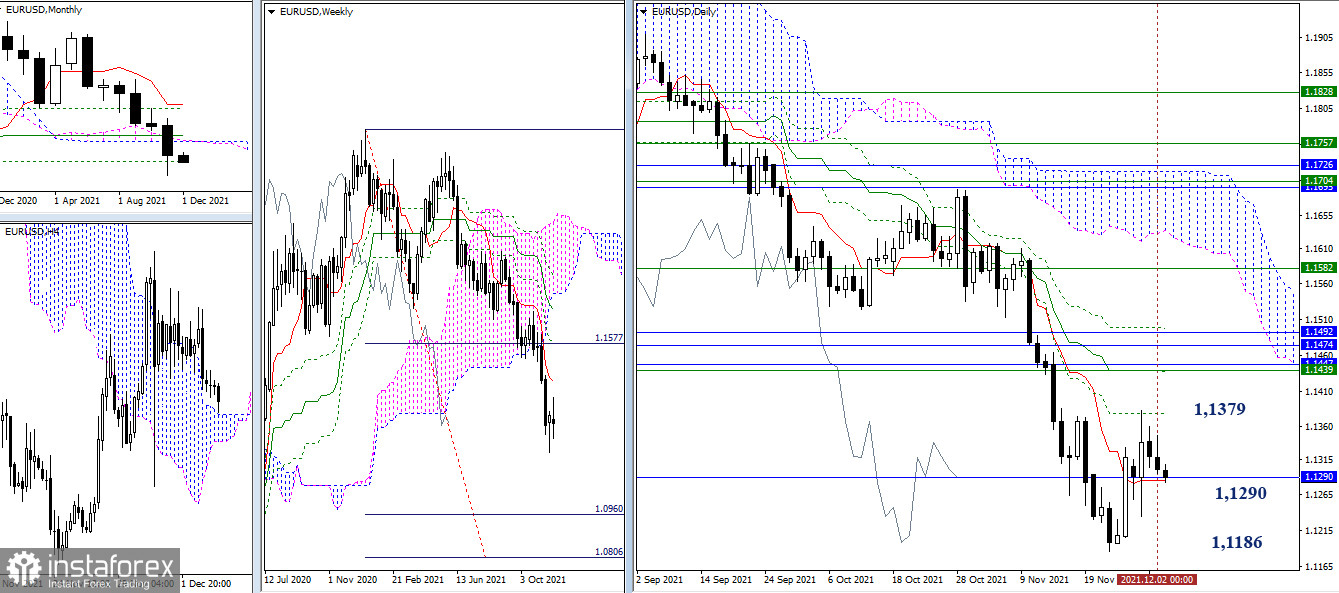

The end of the current week is approaching. This week was not distinguished by the effectiveness and scale of the movement, one can only highlight the surge in activity that was observed at the close of November. Therefore, at the time of analysis, the form of the weekly candle supports uncertainty more. The movement is still attracted and influenced by the combined efforts of the monthly Fibo Kijun (1.1290) and the daily short-term trend (1.1280). The nearest resistance is the daily Fibo Kijun (1.1379), and the first bearish pivot point is the minimum extreme (1.1186).

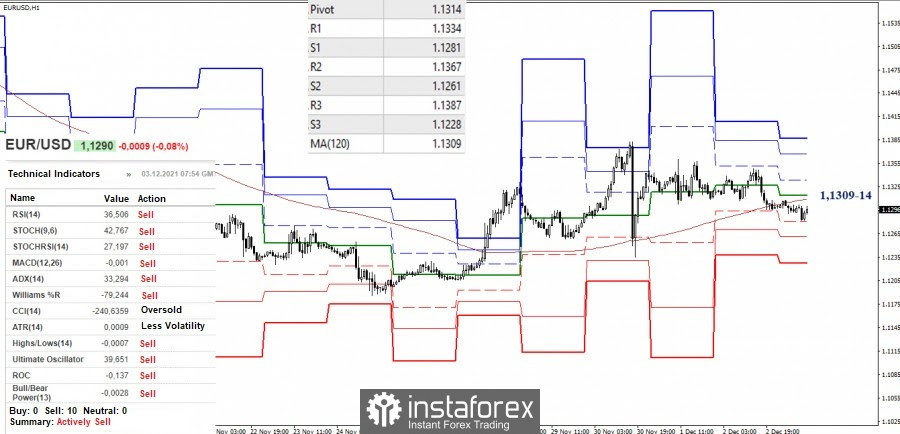

A long time of sideways movement and downward correction in the smaller timeframes led to the fact that the pair went below the key levels, which are now almost connected in the area of 1.1309-14 (central pivot level + weekly long-term trend). Currently, the first support of the classic pivot levels (1.1281) is being tested, which is strengthened by the support (1.1290-80) of the higher timeframes. Further, we have the next supports of S2 (1.1261) and S3 (1.1228).

After the reversal of the moving average and the continuation of the decline, the main task of the bears will be to update the minimum extremum of the 1.1186 area. The main border for the return of bullish prospects, after the bulls return to the key levels of 1.1309-14, will be the maximum extremum (1.1383) and the resistance (1.1379) in the higher periods.

GBP/USD

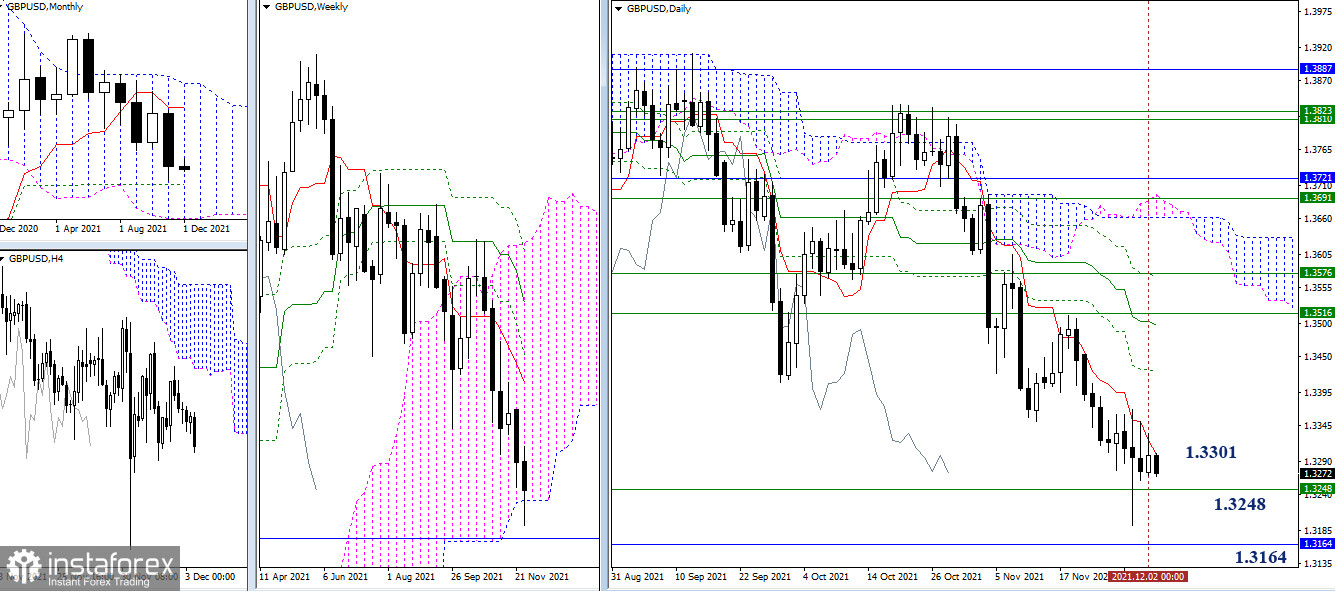

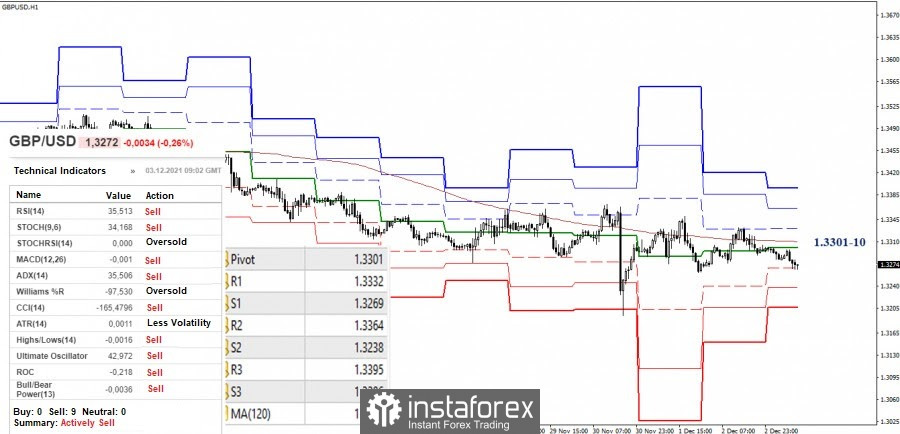

Today, we are closing the week. The main trading recently has been carried out to break through the lower limit of the weekly cloud (1.3248). The result is interesting. If the bears manage to close the week below the level, then they will then enter the fight for the monthly Fibo Kijun (1.3164). If a long lower shadow is formed at the close, and the daily short-term trend, which is now the level of 1.3301, returns to the bullish side, then the formation and development of a rebound from the support encountered will have more chances to be implemented.

The actions unfold around the key levels, the pound then rises higher, then consolidates lower, but at the same time does not leave their attraction and influence zone. The key levels have almost joined around 1.3301-10 (central pivot level + a weekly long-term trend) today. At the moment, the first support of the classic pivot levels (1.3269) is being tested, then S2 (1.3238) and S3 (1.3206) can enter trading with a decline. In turn, a consolidation above the key levels of 1.3301-10 will return relevance to the upward pivot points, which are the resistances of classic pivot levels (1.3332 - 1.3364 - 1.3395 ).

***

Ichimoku Kinko Hyo (9.26.52) and Kijun-sen levels in the higher time frames, as well as classic Pivot Points and Moving Average (120) on the H1 chart, are used in the technical analysis of the trading instruments.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română