The EUR/USD pair crashed as the Dollar Index resumed its growth. Now, it is traded at the 0.9701 level. The bias is bearish despite temporary rebounds. DXY's further growth should force the greenback to dominate the currency market.

Today, the US banks are closed in observance of Columbus Day. On the other hand, Euro-zone Sentix Investor Confidence came in at -38.3 points versus the -34.9 expected. As you already know, the EUR/USD pair plunged after the US NFP, and Unemployment Rate came in better than expected while Average Hourly Earnings came in line with expectations on Friday.

The FOMC on Wednesday, US inflation on Thursday, and the US retail sales on Friday are seen as high-impact events and could really shake the markets.

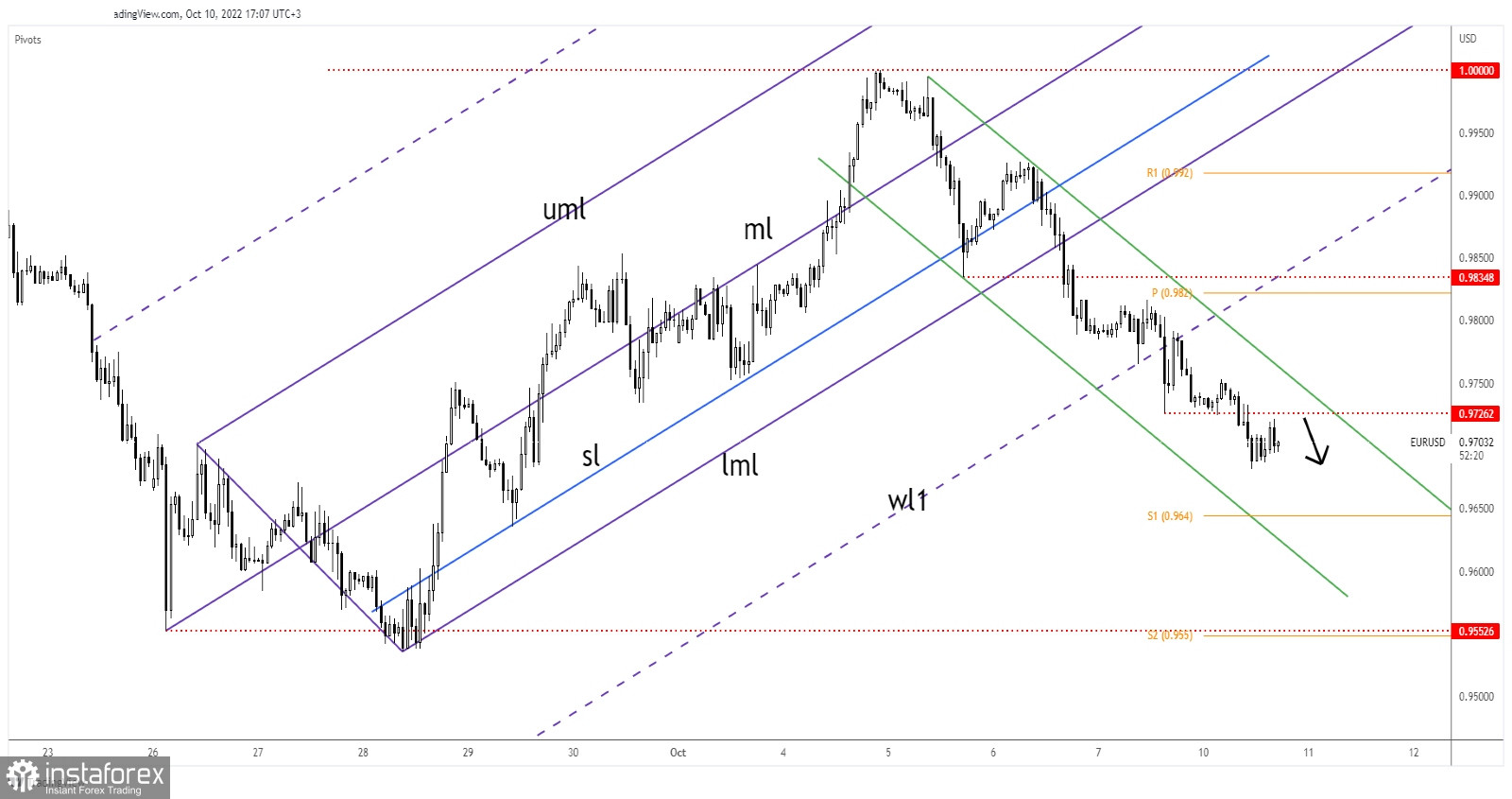

EUR/USD Down-Channel!

As you can see on the H1 chart, EUR/USD found resistance at the 1.0000 psychological level and continues to drop within a down-channel pattern. The 0.9726 former low represents a resistance level. The downtrend line stands as a dynamic resistance.

The rate could drop toward new lows if it stays under these obstacles. A temporary retreat could bring new short opportunities.

EUR/USD Outlook!

Testing and retesting 0.9726 and the downtrend line, registering only false breakouts may signal a new sell-off. A new lower low, dropping and closing below 0.9681 brings new short opportunities with a potential target at S1 (0.9640). 0.9552 represents a major downside target if the rate continues to stay under the downtrend line.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română