Ahead of Nonfarm Payrolls

Hello, dear colleagues!

Markets are awaiting the release of the US labor market data for November. It seems that the main currency pair in the forex market has traded sluggishly for the last 2 days for the same reason. In November, the unemployment rate is projected to fall to 4.5% versus 4.6% in the previous month. The average hourly earnings are estimated to rise by 0.4%, unchanged from October. The release of Nonfarm Payrolls for November will be the central event today. As a reminder, the US economy added 531,000 new jobs in October and is expected to have added 550,000 Nonfarm Payrolls through November.

Expectations about the US labor market are rather high. The employment data is believed to have an enormous impact on the close of weekly trading on EUR/USD and other currency pairs containing USD. The greenback is gradually easing pressure on its main counterparts even despite a more hawkish US Federal Reserve. Yesterday, Federal Reserve Bank of Atlanta President Raphael Bostic said he would like to get the regulator in position to accelerate the pace of bond-buying taper. The policymaker believes that the quantitative easing (QE) program has served its purpose and is no longer needed. At the same time, Bostic is sure that the American economy is in good condition, and either new COVID-19 waves or any virus strains could hardly harm economic growth in the country. Above all else, the president of the Federal Reserve Bank of Atlanta suggests that speeding up QE taper will allow the Fed to announce interest rate hikes earlier. Why did the market show a sluggish reaction to hawkish statements from the Fed's representative? The answer is simple, the market got used to hawkish Bostic.

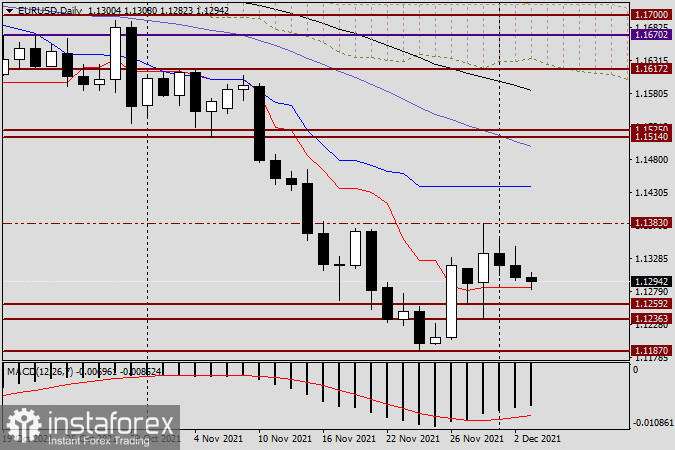

Daily chart

The US dollar showed modest growth versus the euro yesterday. After consolidation above the red Tenkan Sen, the pair came under pressure. At the moment of writing, the price was trying to return below the Tenkan Sen. Technically, after consolidation above the Tenkan Sen, this line may well provide good support for the euro/dollar pair. The outcome of weekly trading on EUR/USD will become known only after the release of the US labor market data. Technically, the quote is likely to show growth. Traders who doubt such a possibility should switch to the weekly chart and look at the previous reversal candlestick. Taking into account the last trading day of the week and the upcoming Nonfarm Payrolls report, I will refrain from making a forecast for the pair today.

Have a nice weekend!

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română