The Australian dollar continues to dive down. Paired with the US currency, the aussie returned to the area of the 70th figure, approaching the annual minimum, which was updated just the day before yesterday (0.7064). The last time the price was in this area was in November last year when the AUD/USD bears unsuccessfully tried to break through the 0.7000 support level. This is the main target of the sellers at the moment.

If buyers win this confrontation, the probability of a large-scale correction will increase significantly. And vice versa – if sellers take over, the pair will roll down, and it will be more difficult for traders to return back, including due to the cascading execution of stops.

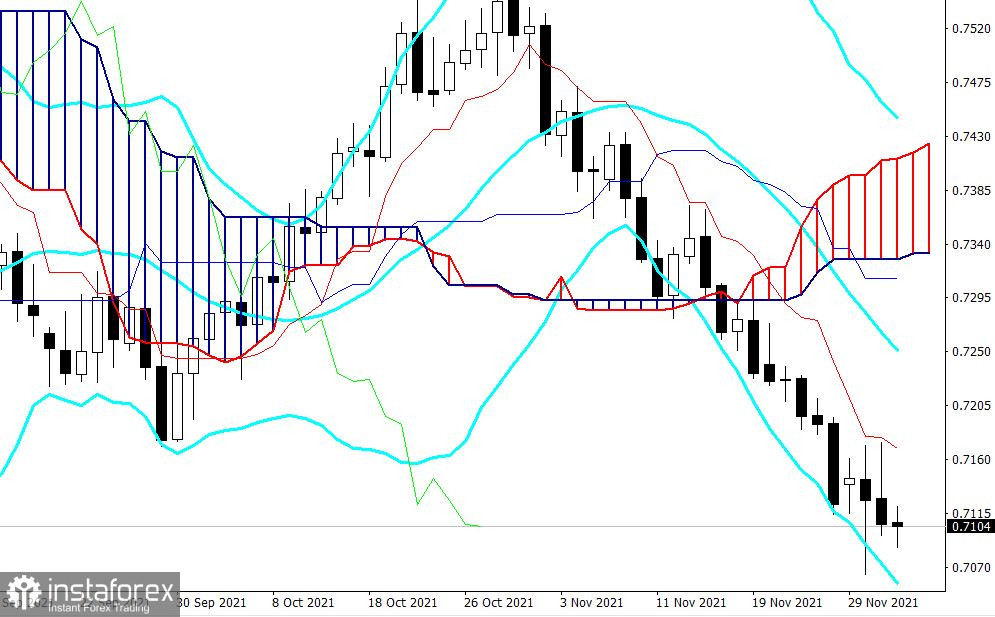

However, on the way to the main price barrier of 0.7000 there is an intermediate, but at the same time quite important support level of 0.7050 (the lower line of the Bollinger Bands indicator on the D1 timeframe). Overcoming it can serve as a signal to increase the downward pressure.

Therefore, it is not surprising that the downside waves are fading in the area of this target. Traders take profits, not daring to keep trading orders open when approaching the support level.

So, at the moment, the 0.7050 mark turned out to be too much for the bears of the AUD/USD pair. Despite the impulse decline in prices, the general strengthening of the US currency, and the decline in the value of iron ore, the Aussie repelled the sellers' attack and held the "height." And it is likely that this is a "long game". After all, overcoming the above target will allow the bears to approach the "sacred" price level.

Note that last summer, AUD/USD bulls besieged the 0.7000 mark for two months when it served as a resistance level. Now there is a mirror situation where this price level plays the role of support. The bears of the pair tried to organize a blitzkrieg to overcome 0.7050 and approach the base of the 70th figure. But after reaching the 0.7064 mark, the price turned 180 degrees, retreating to its previous positions.

In my opinion, this is just a tactical retreat. It is still advisable to use the upside bursts to open short positions. On the greenback's side is the hawkish position not only of individual Fed representatives, but also personally of Jerome Powell, who this week changed "anger to mercy."

The head of the Federal Reserve finally admitted that high inflation in the United States has ceased to be temporary. Moreover, he announced the early curtailment of QE, which should now be completed not in July, but in March-April. And although Powell has so far avoided the issue of raising the rate, hawkish sentiment in the market has significantly intensified. Many experts admit the possibility that the Fed will raise the rate twice or even three times within 2022.

Against the background of such events, the dollar feels quite comfortable - especially paired with the Australian currency, which is under the yoke of the "dovish" position of the RBA and the "Omicron factor." As of Thursday, Australia has detected 8 cases of the Omicron variant. Everyone shows asymptomatic or very mild symptoms, but the very "penetration" of Omicron on the continent alarmed traders. After all, Australia has just relaxed the quarantine restrictions, returning to normal life.

Tomorrow, the US dollar may receive additional support due to the release of the US Nonfarm Payrolls report. Preliminary signals are encouraging. For example, Wednesday's ADP report came out in the "green zone," stating the creation of more than half a million jobs in the private sector. A month ago, this report showed a fairly high correlation with the official release, so the strong November figures suggested that, on Friday, the main components of the publication will please dollar bulls with a "green color."

Forecasts for November Nonfarm Payrolls also suggest that the American labor market will at least not disappoint. Thus, the unemployment rate should decrease to 4.5% (a systematic decline in the indicator has been observed for 15 months in a row), and the number of employed in September should increase by 528,000. The half-million result will certainly support the US currency. On Thursday, the US has recorded a weekly increase in initial claims for unemployment benefits. It also came out in the "green zone" noting 222,000 with a growth forecast of 240,000. This fact also provided indirect support to the greenback.

All this suggests that short positions on the AUD/USD pair are still relevant. Technically, the pair on the D1 timeframe is between the middle and lower lines of the Bollinger Bands indicator and below all the lines of the Ichimoku indicator, which in turn demonstrates the bearish "Parade of Lines" signal. The first target of the downside movement is the level of 0.7050 (the lower line of the Bollinger Bands). The main price barrier is located at 0.7000.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română