Wave pattern

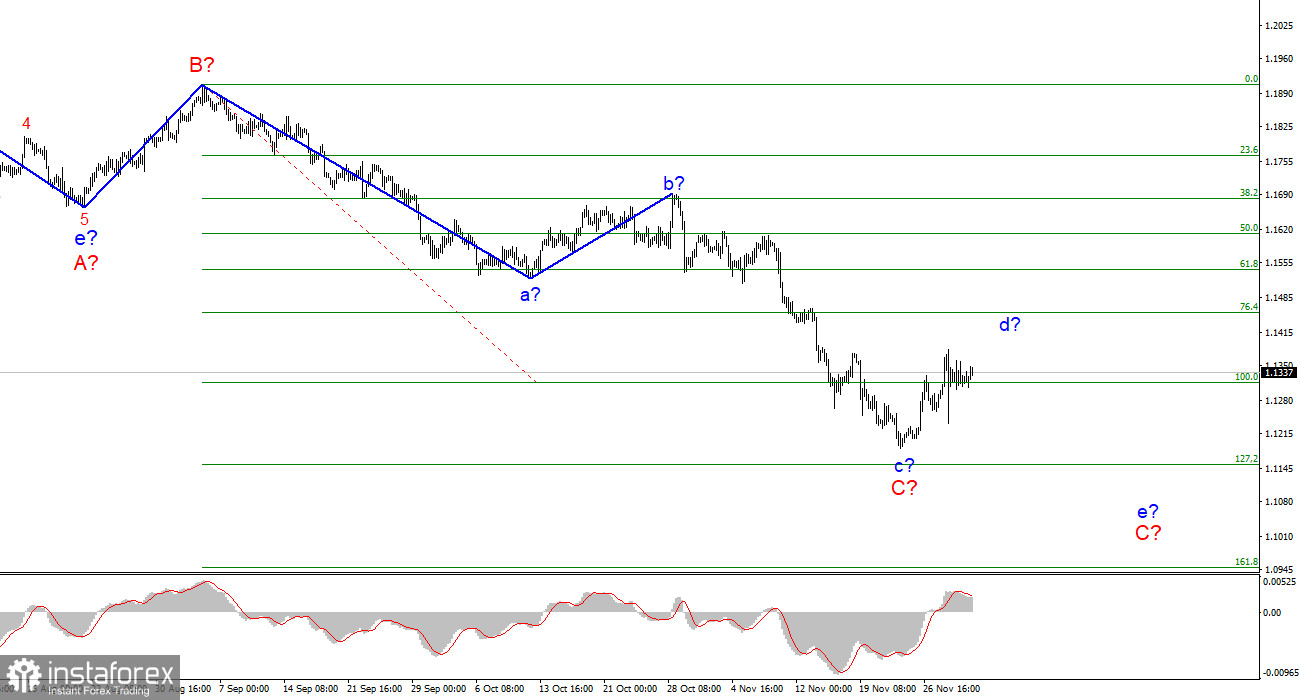

The wave layout for EUR/USD on the 4-hour chart remains complete and does not require any changes. The a-b-c-d-e section of the trend, which was formed at the very beginning of the year, should be interpreted as a wave A, and the subsequent rise in the instrument is seen as a wave B. Thus, the formation of the assumed wave C continues, and can take a very extended form. Then we have an interesting situation. The rebound of the quotes from the recent lows suggests that the formation of the expected wave c in C is completed. If this is true, then a new ascending wave is being formed at the moment, presumably the wave d in C. The C wave may take a five-wave corrective structure. A successful attempt to break through the 100.0% Fibonacci level will indicate that the market is ready to go bullish on the instrument. So, the d wave may continue its formation towards the estimated target of 1.1455 which corresponds to the 76.4% Fibonacci retracement. Another scenario is possible when the C wave takes on a three-wave form and turns out to be completed. In any case, quotes are expected to rise in the coming week.

Will USD rise as markets digest Jerome Powell's comments on inflation?

On Thursday, the news background for EUR/USD was much weaker than a day earlier. And days earlier, it was very weak. Thus, I am not surprised that the pair moved by only 20 pips during the day. Although volatility was higher yesterday, the pair has been stuck in a limited range for two days in a row. Amid the lack of important market events, we can analyze the fundamental background. In particular, analysts at Bank of America said yesterday they expect to see three US rate hikes in 2022. Let me remind you that before only two upcoming rate hikes were discussed. The Fed officials do not deny this scenario, with at least half of them supporting a rate hike next year. However, the new coronavirus strain, which is in focus of all scientists and medical workers right now, can also make its adjustments. If the epidemiological situation keeps deteriorating, then the Fed's plans may not come true. For your reference, a couple of months ago, inflation expectations were set at 4-5%. Now we are talking about further growth of the consumer price index from the current levels to 6.2%. So, the Federal Reserve will have to consider a stronger rollback of the QE program in December. The same can happen with the Omicron variant as it may not be what it seems.

Conclusion

Based on the analysis above, I can conclude that the formation of the descending wave C is likely to be completed. However, a rapid drop in the euro quotes on Tuesday afternoon puts further formation of the d wave under question. Such sharp movements tend to change the wave layout. Meanwhile, the continuation of the d wave seems more likely, and the pair may resume its fall. The most you can do now is open a few long positions on the pair.

Higher time frame

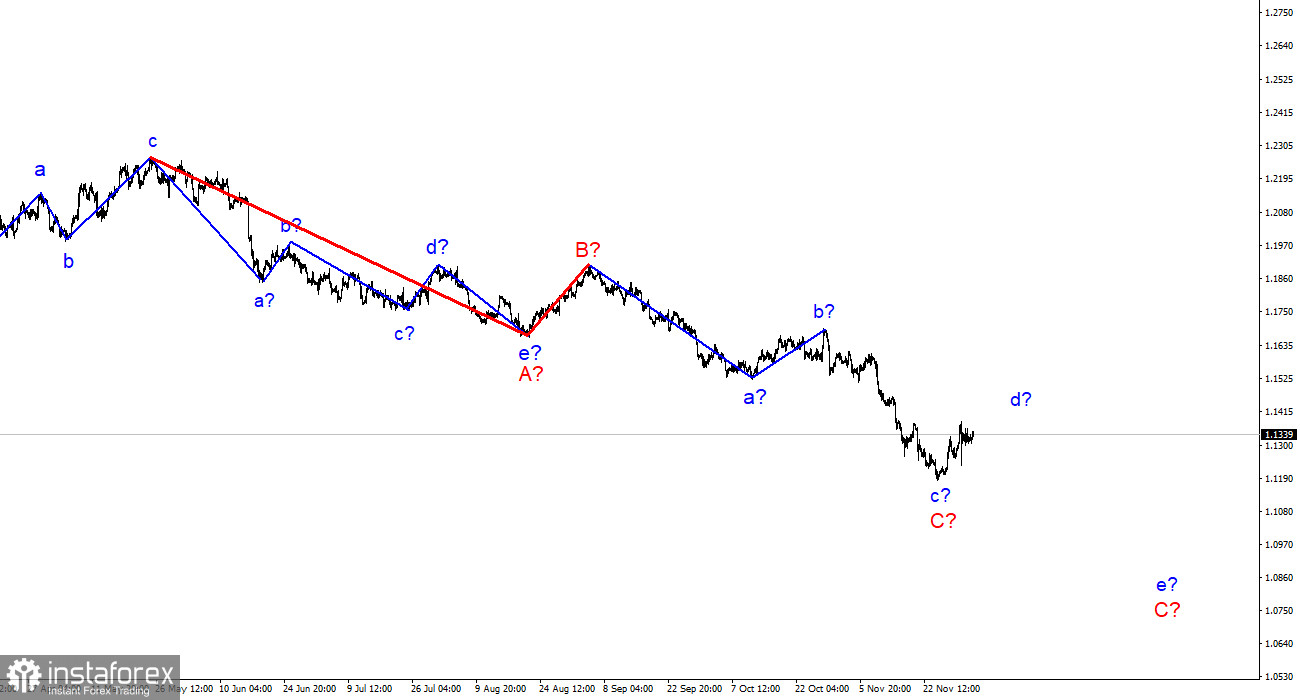

The wave layout on the higher time frame looks quite convincing. The quotes continue to move lower. The descending section of the trend that was initiated on May 25 takes the form of a three-wave correctional pattern A-B-C. This means that the downtrend may continue for another month or two until the C wave is fully completed. It can have either a three- or a five-wave structure.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română