To open long positions on GBP/USD, you need:

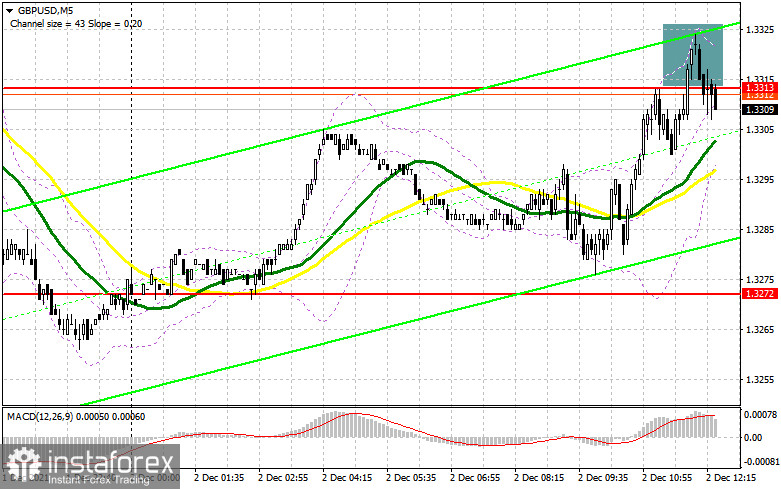

The British pound rose slightly in the first half of the day but rested against the resistance of 1.3313, where the further upward trend slowed sharply. Let's look at the 5-minute chart and figure out the entry points. As a result of an unsuccessful attempt to increase GBP/USD above 1.3313, a false breakdown was formed, as well as a signal to open short positions. At the time of writing, the bears did not show much activity, which calls into question the correction of the pair. A lot will now be decided by the economic data on the United States and the speeches of the Fed representatives. Therefore, I recommend exiting short positions and waiting for new information. The technical picture has undergone minimal changes.

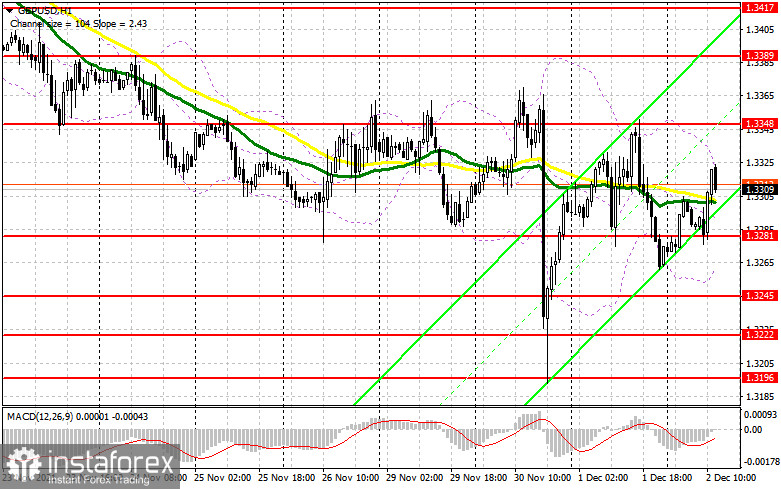

As I have already said, today in the afternoon the market may show a slightly more cheerful dynamics, as a report on the number of initial applications for unemployment benefits in the United States will be released. However, the speeches of representatives of the Federal Reserve System in the person of Rafael Bostic and Mary Daly will attract more attention. If they support the hawkish statements made by Jerome Powell on Tuesday, then the demand for the US dollar may strengthen. Let me remind you that the Fed plans to more actively take up the reduction of measures to support the economy already during the December meeting. This will be done to curb serious inflationary pressure in the country. While trading is conducted in the middle of the side channel and I do not recommend rushing to make decisions. The most optimal signal to buy the pound will be the formation of a false breakdown in the support area of 1.3281, which was formed following the results of the European session. In this case, we can count on a larger growth in the area of the upper boundary of the side channel 1.3348. Only a breakthrough of 1.3348 and a test of this level from top to bottom will lead to the formation of an additional buy signal with the prospect of stopping the bearish momentum and restoring GBP/USD to the area of 1.3389, where I recommend fixing the profits. The resistance of 1.3417 remains a longer-range target. In the scenario of a decline in the pound during the US session after a strong report on the labor market and hawkish statements by Fed representatives, as well as a lack of activity around 1.3281 on the part of buyers, I advise you to open new long positions only after updating the next lows: 1.3245 and 1.3222. However, I advise you to buy a pound there as well only after a false breakdown. It is possible to open long positions immediately for a rebound from the minimum of 1.3196, counting on a correction of 20-25 points within a day.

To open short positions on GBP/USD, you need:

Bears seem to keep control of the market, but they failed to declare themselves in the first half of the day. A return to the area of the moving averages locks the pair in a side channel, which may persist until tomorrow. All that is required from sellers in the afternoon is the protection of resistance 1.3348. The formation of a false breakdown at this level will lead to the formation of an entry point into short positions, followed by a return to the area of the lower boundary of the 1.3281 side channel, which could not be broken below. This is a very important level and buyers are not going to let it go just like that. A breakdown of this range and a reverse test of 1.3281 from the bottom up will give an excellent entry point into the market, which will push the pair to new lows: 1.3245 and 1.3222, where I recommend fixing the profits. The support of 1.3196 will be a more distant target. In the case of GBP/USD growth during the US session and weak sellers' activity at 1.3348, it is best to postpone sales to a larger resistance of 1.3389. I advise you to open short positions there only in case of a false breakdown. It is possible to sell GBP/USD immediately for a rebound from a large resistance of 1.3417, or even higher - from a new maximum in the area of 1.3446, counting on the pair's rebound down by 20-25 points inside the day.

The COT reports (Commitment of Traders) for November 23 recorded an increase in short positions and a reduction in long ones, which led to an even greater increase in the negative delta. Dovish statements by the governor of the Bank of England last week kept the pressure on the British pound even amid risks associated with higher inflationary pressures than previously expected. The aggravation of the situation with coronavirus and the new strain of Omicron in the European part of the continent did not add to optimism. It is also not clear what is with the question about the Server Ireland protocol, which the UK authorities plan to suspend. At the same time, in the United States of America, we are witnessing an increase in inflation and increased talk about the need for an earlier increase in interest rates next year, which provides significant support to the US dollar. However, I recommend sticking to the strategy of buying the pair in case of very large falls, which will occur against the background of uncertainty in the policy of the central bank. The COT report indicates that long non-profit positions decreased from the level of 50,443 to the level of 50,122, while short non-profit positions increased from the level of 82,042 to the level of 84,701. This led to an increase in the negative non-commercial net position: the delta was -34,579 against -31,599 a week earlier. The weekly closing price decreased not so significantly - from 1.3410 to 1.3397.

Signals of indicators:

Moving averages

Trading is conducted around 30 and 50 daily moving averages, which indicates some market confusion with the further direction of the pair.

Note: The period and prices of moving averages are considered by the author on the hourly chart H1 and differ from the general definition of the classic daily moving averages on the daily chart D1.

Bollinger Bands

A breakthrough of the upper limit of the indicator in the area of 1.3315 will lead to a new wave of growth of the pound. In case of a decline, the pound will be supported by the lower limit of the indicator in the area of 1.3260.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence/divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-profit speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română