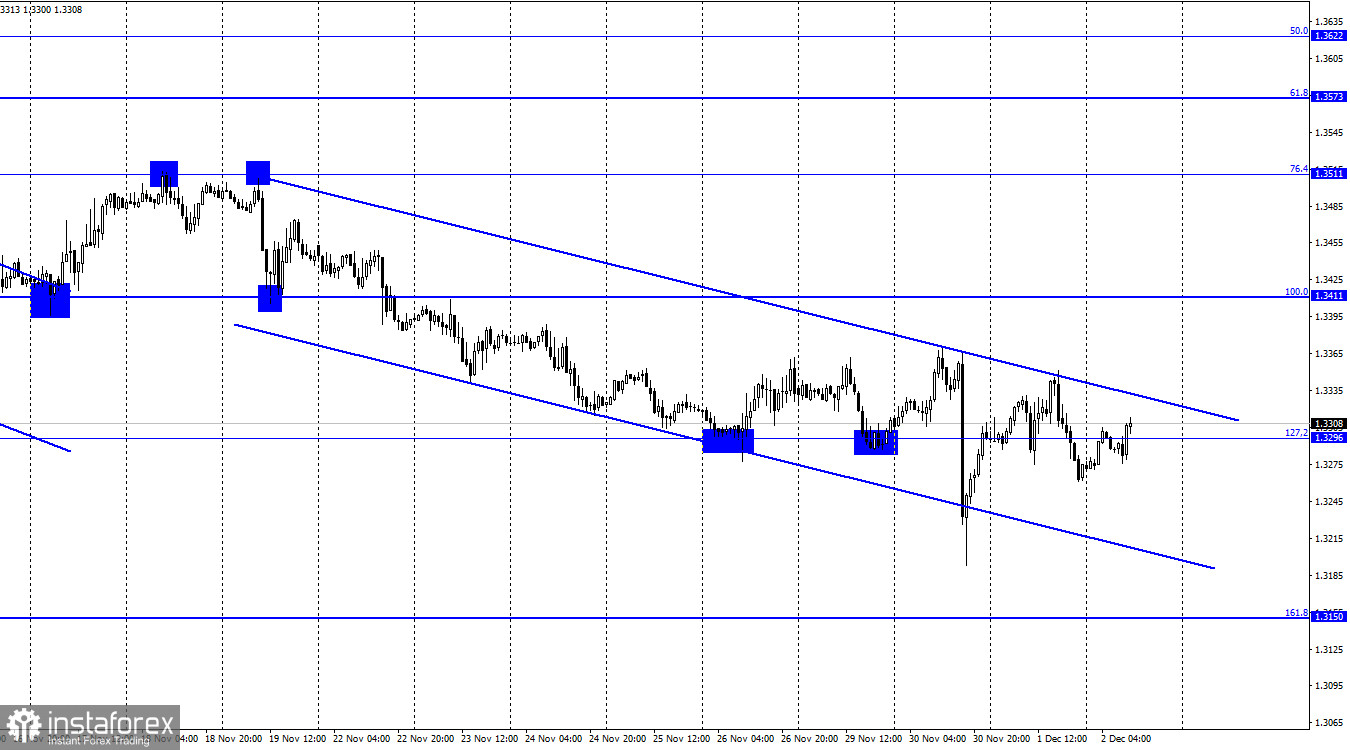

GBP/USD – 1H.

On the hourly chart, GBP/USD on Wednesday rose to the upper boundary of a new downtrend corridor, rebounded from it, and started a new downward process. The correction level of 127.2% (1.3296) is now being completely ignored by traders. A consolidation of the pair above the downward corridor, which described the current mood of traders as bearish, would be in favor of the UK currency and continued growth towards the corrective level of 100.0% (1.3411). The information backdrop yesterday was quite varied. The US ADP and ISM reports provided little support for the dollar. Andrew Bailey and Jerome Powell's speeches gave no new information to react to. The UK Manufacturing Business Activity Index was unchanged from the November value and traders' expectations. Thus, there were many events, but hardly any really important information.

This evening there was also the publication of the Beige Book, the Fed's economic survey of the US regions. It stated that economic activity prior to the Fed meeting in November was rising in all US regions at rates ranging from subdued to moderate. Some FRBs reported labor shortages and persistent supply chain bottlenecks. Production continues to lag behind demand growth. Low inventories in warehouses limit sales. Consumer spending is rising, but mainly due to inflation. Production costs are growing due to higher raw material prices. Inflation continues to be high. Activity in the tourism and leisure sectors has started to pick up as the delta strain has gone down in some regions. It is not the kind of information that could cause a strong movement, but it is interesting nonetheless. Most importantly, inflation remains at high levels, and risks of further increases persist. The new Omicron strain could exacerbate the current situation. In the next two weeks, just before the next Fed meeting, it will become clear what consequences to expect from the new COVID strain.

GBP/USD – 4H.

Based on the 4-hour chart, the pair has failed to close neither below the 61.8% retracement level (1.3274) nor above the descending trend corridor that reflects bearish market sentiment. In other words, if the quote closes above the corridor, the price is likely to head towards the 50.0% retracement level (1.3457). Consolidation below 1.3274 could increase the likelihood of a fall to the 76.4% Fibonacci level (1.3044).

Macroeconomic calendar

US - Number of initial jobless claims (13-30 UTC).

US - Speech of Treasury Secretary Janet Yellen (14-00 UTC).

There are no important economic events in the UK on Thursday. In the USA there will only be sideshows and reports. Thus, the information backdrop today will be extremely weak.

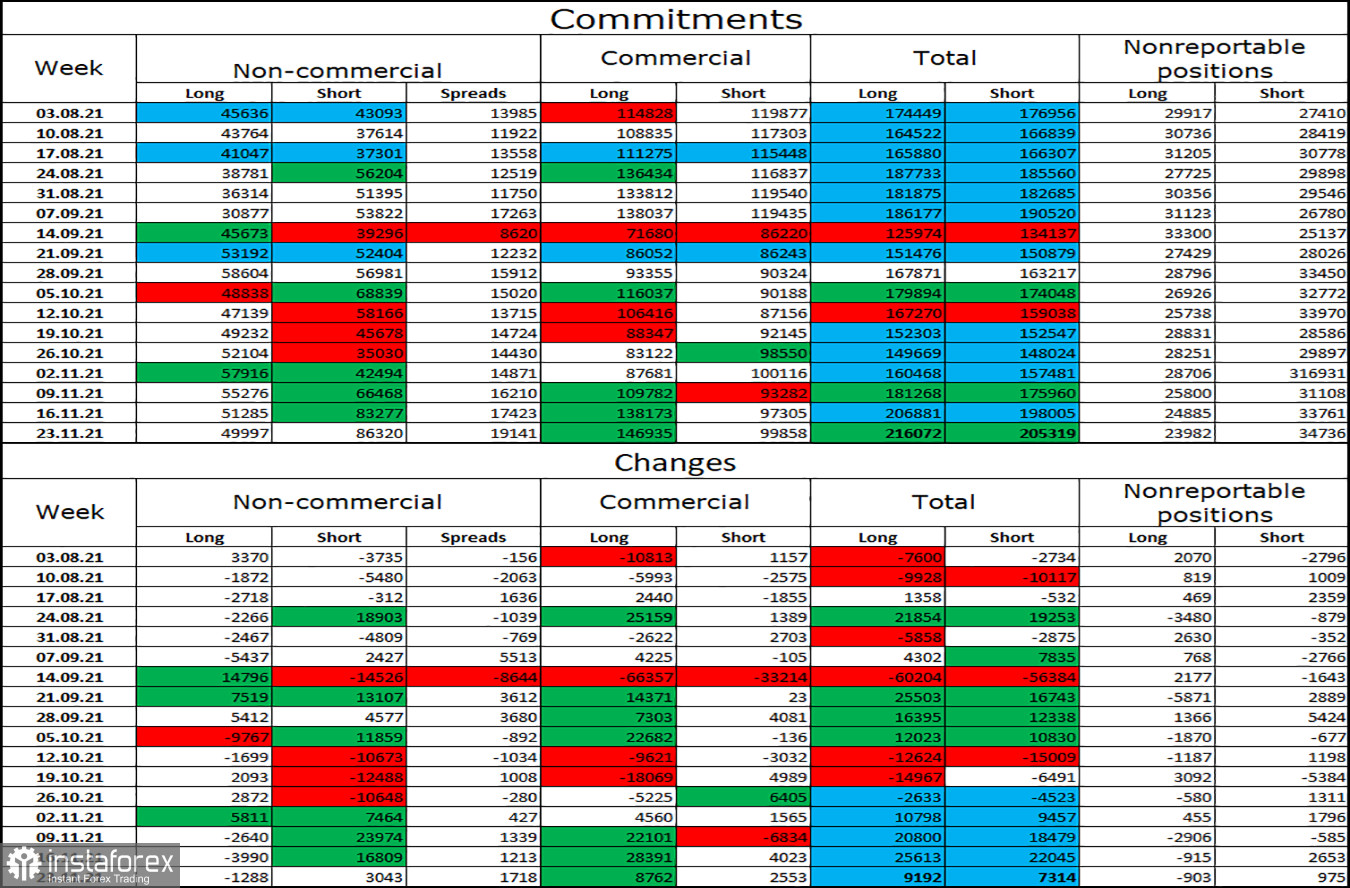

COT (Commitments of Traders) report:

The latest COT report as of November 23 logged an increase in bearish sentiment in the group of non-commercial traders. This trend has been observed in the market for the fourth consecutive week. Speculators closed 1,288 long positions and opened 3,043 short positions during the reporting week. Overall, speculators opened about 50,000 short positions in the previous month. The same number of long positions is now held open by speculators. Thus, market sentiment is turning bearish, indicating the possibility of a fall in the pound sterling. Chart analysis also signals the likelihood of a downtrend. The total number of open long positions almost equals the number of short ones.

Outlook for GBP/USD:

New purchases of the GBP are recommended if the 4-hour chart closes above the corridor with targets 1.3411 and 1.3457. I recommend selling the pair at a close below 1.3274 with a target of 1.3150.

TERMS:

Non-commercial traders are major market players: banks, hedge funds, investment funds, as well as private and large investors.

Commercial traders are commercial enterprises, firms, banks, corporations, and companies that buy currency not to obtain speculative profit, but to ensure current activities or export-import operations.

Non-reportable positions are small traders who do not have a significant impact on the price.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română