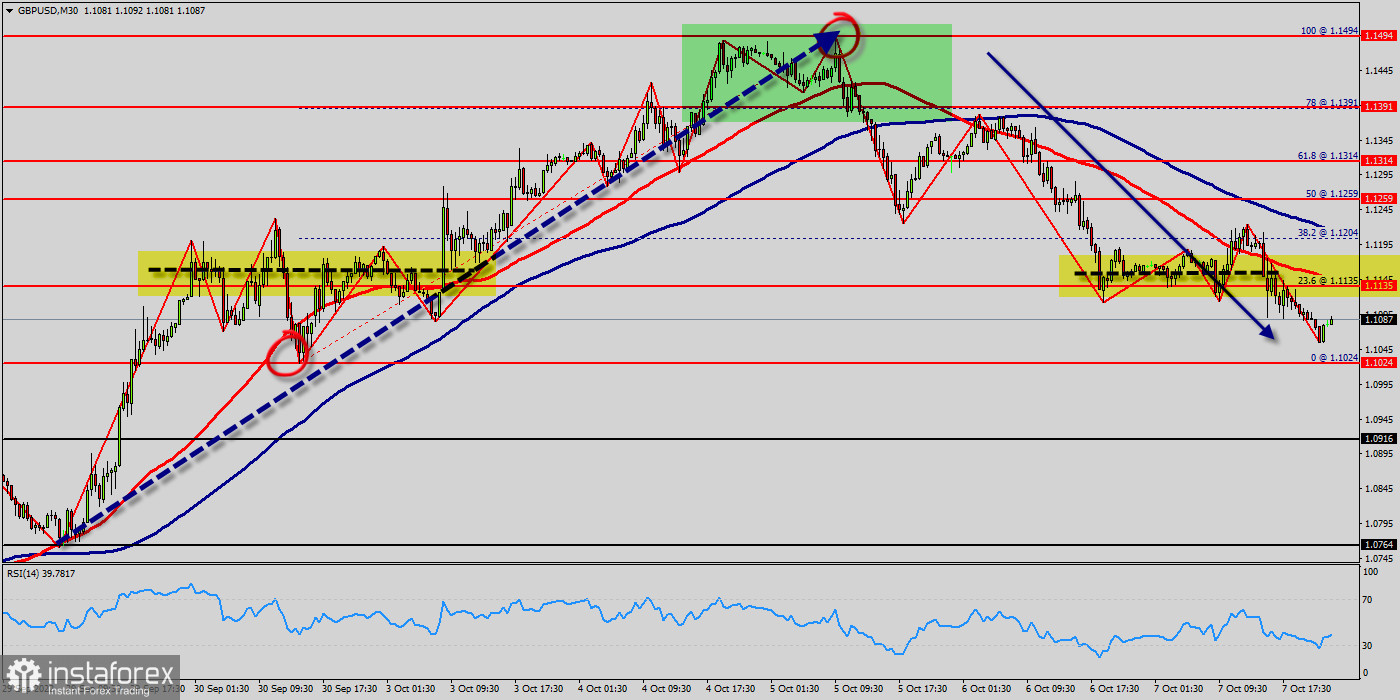

Although GBP/USD managed to erase a small portion of its daily losses, it continues to trade in negative territory near 1.1087. The renewed dollar strength on upbeat labour market data from the US weighs on the pair, which remains on track to end the week little changed.

The Relative Strength Index (RSI) indicator on the four-hour chart is moving sideways near 50, reflecting the pair's indecisiveness. On the upside, 1.1135 (Fibonacci 23.6% retracement of the latest uptrend) aligns as initial resistance before 1.2024 (50-period EMA) and 1.1135 (100-period EMA).

The GBP/USD pair will continue to rise from the level of 1.1129 in the long term. It should be noted that the support is established at the level of 1.1129 which represents the daily pivot point on the M30chart. All elements being clearly bullish, it would be possible for traders to trade only long positions on the GBP/USD pair as long as the price remains well above the golden ratio of 1.1129. The buyers' bullish objective is set at 1.1494. The price is likely to form a double top in the same time frame. Accordingly, the GBP/USD pair is showing signs of strength following a breakout of the highest level of 1.1494.

So, buy above the level of 1.1284 with the first target at 1.1350 in order to test the daily resistance 1. The level of 1.1494 is a good place to take profits. Moreover, the RSI is still signaling that the trend is upward as it remains strong above the moving average (100). This suggests that the pair will probably go up in coming hours. A bullish break in this resistance would boost the bullish momentum.

Together with the relatively large distance to the fast-rising 100-day moving average (1.1284), there are some arguments for a relief rally in coming months on the table. The buyers could then target the resistance located at 1.1494. If there is any crossing, the next objective would be the resistance located at 1.1494. If the trend is able to break the level of 1.1494, then the market will call for a strong bullish market towards the objective of 1.1550 today.

The GBP/USD pair is at highest against the dollar around the spot of 1.1284 for two weeks - the GBP/USD pair is inside in upward channel. For three weeks the GBP/USD pair decreased within an up channel, for that the GBP/USD pair its new highest 1.1550. Be careful, given the powerful bullish rally underway, excesses could lead to a possible correction in the short term. If this is the case, remember that trading against the trend may be riskier. It would seem more appropriate to wait for a signal indicating reversal of the trend.

Be ware, the short term currently seems to be losing ground compared to the basic trend. Longer time units should be analysed to identify possible overbought items that could be a sign of a possible short-term correction. Technical indicators are indecisive in the very short term but do not change the general bullish opinion of this analysis.

On the other hand, in case a reversal takes place and the GBP/USD pair breaks through the support level of 1.1129, a further decline to 1.1007 can occur. It would indicate a bearish market.

At the same time, the breakup of 1.1129 will allow the pair to go further up to the levels of 1.1494 in order to retest the double top again. It might be noted that the level of 1.1550 is a good place to take profit because it will form a new double top in coming hours. The general bullish opinion of this analysis is in opposition with technical indicators.

As long as the invalidation level of this analysis is not breached, the bullish direction is still favored, however the current short-term correction should be carefully watched. The bulls must break through 1.1100 in order to resume the uptrend.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română