Wave pattern

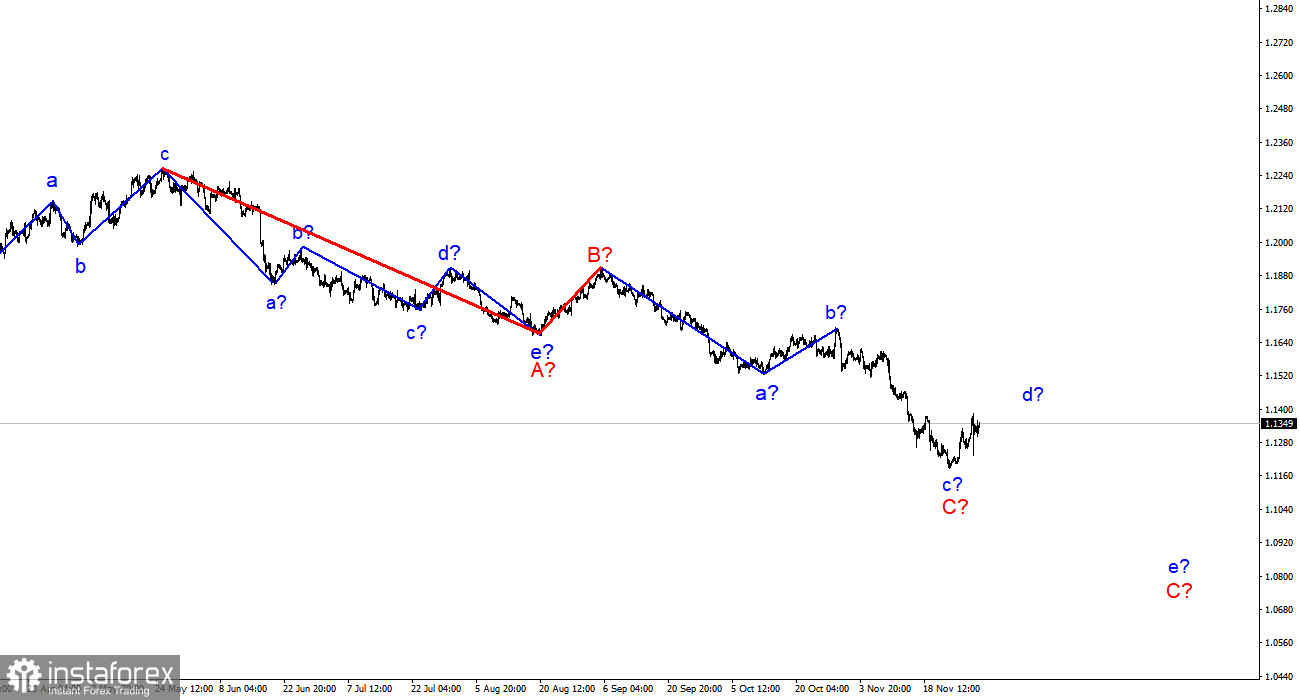

On the 4H chart, the wave marking for the euro/dollar pair remains integral. It does not require any changes. The a-b-c-d-e trend line, which has been forming since the beginning of the year, is interpreted as wave A. The subsequent increase in the pair is interpreted as wave B. Thus, the construction of the proposed wave C is unfolding now. It may also take a very extended form. The pullback of the pair from the lows will indicate that the construction of the proposed wave c in C is completed. If so, the construction of a new upward wave has begun presumably d in C. Wave C may take a five-wave, but at the same time a corrective form. A successful attempt to break through the 100.0% Fibonacci retracement will signal the readiness of traders to open long positions. There is also a possibility that wave C has taken a three-wave form and has already been completed. Nevertheless, we should expect an increase in the quotes this week.

The US dollar managed to develop a short-lived rally following Jerome Powell's comments on inflation

On Wednesday, despite the fact that the economic calendar contained many macrocosmic reports for EUR/USD, they had little effect on it. The main reason for it was Jerome Powell's speech. Market participants are still mulling over some of his statements. Powell said that the regulator would retire the term transitory inflation. As a result, demand for the US currency soared last night. However, the euphoria has eased quickly as it has long been clear that inflation will not decline in a few months. Therefore, an hour after a strong decline in the pair, it began to climb, which was in line with the current wave markup. Today, the pair did not resume its downward movement. Its fluctuations totaled about 30 pips. Thus, wave d continues its construction. The euro may rise by another 50-100 pips. This week, Christine Lagarde is scheduled to give a speech. Analysts suppose that some of her statements may trigger volatility in markets. The US will publish the Nonfarm Payrolls report. Both of these events will take place on Friday. This is why traders should be extremely cautious on Friday when making decisions. If the Nonfarm Payrolls report turns out to be better than forecasts, the US dollar may face bearish pressure. However, usually, it fuels demand for the US dollar. currently, market participants are trying to figure out what to expect from the FOMC December Meeting. If the regulator decides to tighten monetary policy, the greenback is sure to surge. A strong NFP report may lower the likelihood of an additional tapering of asset purchases.

Conclusion

Taking into account the above analysis, the construction of the descending wave C may be completed. However, the collapse of the euro in the second half of Tuesday casts doubt on the continuation of the construction of the proposed wave d. Such sharp movements usually break the wave pattern. Wave d is still the most likely option, which means that the pair may still resume the downward movement. It is recommended to be extremely cautious when opening long positions.

Large timeframe

The wave marking on long-term charts looks quite convincing. The pair is trading with a bearish bias. Now, the downward section of the trend, which has originated on May 25, takes the form of a three-wave correction structure A-B-C. Thus, the decline may continue for another month or two until wave C is fully completed (it should take a five-wave form in this case). However, it may also take a three-wave form.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română