Ray Dalio said that when investors flee from US stocks, it is necessary to stay away from cash.

After Powell's speeches about accelerating the reduction of the aid program and the emergence of information about the new virus, Ray Dalio of Bridgewater Associates reminded investors to stay away from cash, saying that inflation would make them suffer.

Dalio explained that during periods of market volatility, a well-balanced portfolio is key, stating that wealth is changing.

The billionaire advised to balance the portfolio: when stocks fall, one can switch to the bond market. Wealth is not destroyed to the extent that it is transferred. The most important thing is when an investor knows how to balance his investments. The risk can be reduced without reducing the profitability.

Dalio's comments were made in connection with the fall of the US stock market after Fed Chairman Jerome Powell announced an acceleration in the reduction of asset purchases with problematic inflation.

Powell told the U.S. Senate on Tuesday that the U.S. Central Bank would consider pulling back the cuts a few months earlier.

According to Powell, the threat of ever-increasing inflation has grown, and the Fed is going to use all the tools to ensure that higher inflation will not take hold.

The Fed failed to anticipate supply-side problems, Powell acknowledged.

In response to Jerome Powell's hawkish comments, the Dow Jones Industrial Average fell by 625 points:

S&P 500 also plunged by 1.7%:

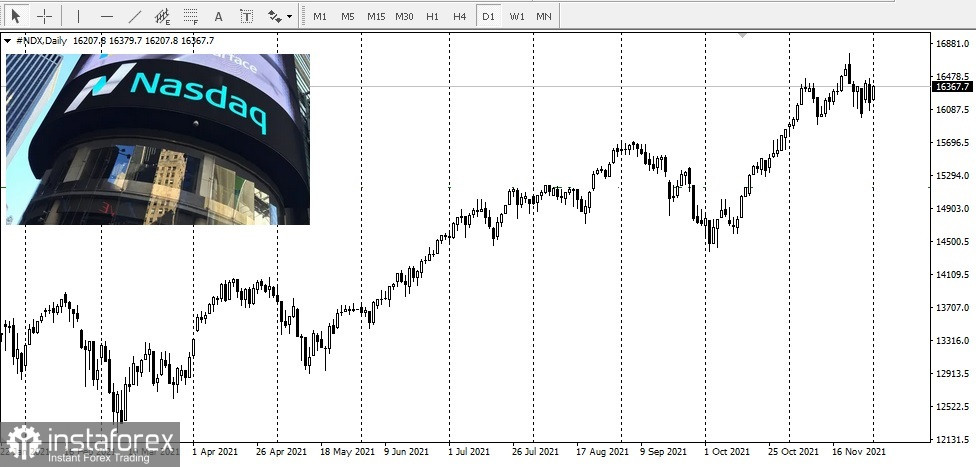

Nasdaq also did so by 1.3%:

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română