Wave pattern

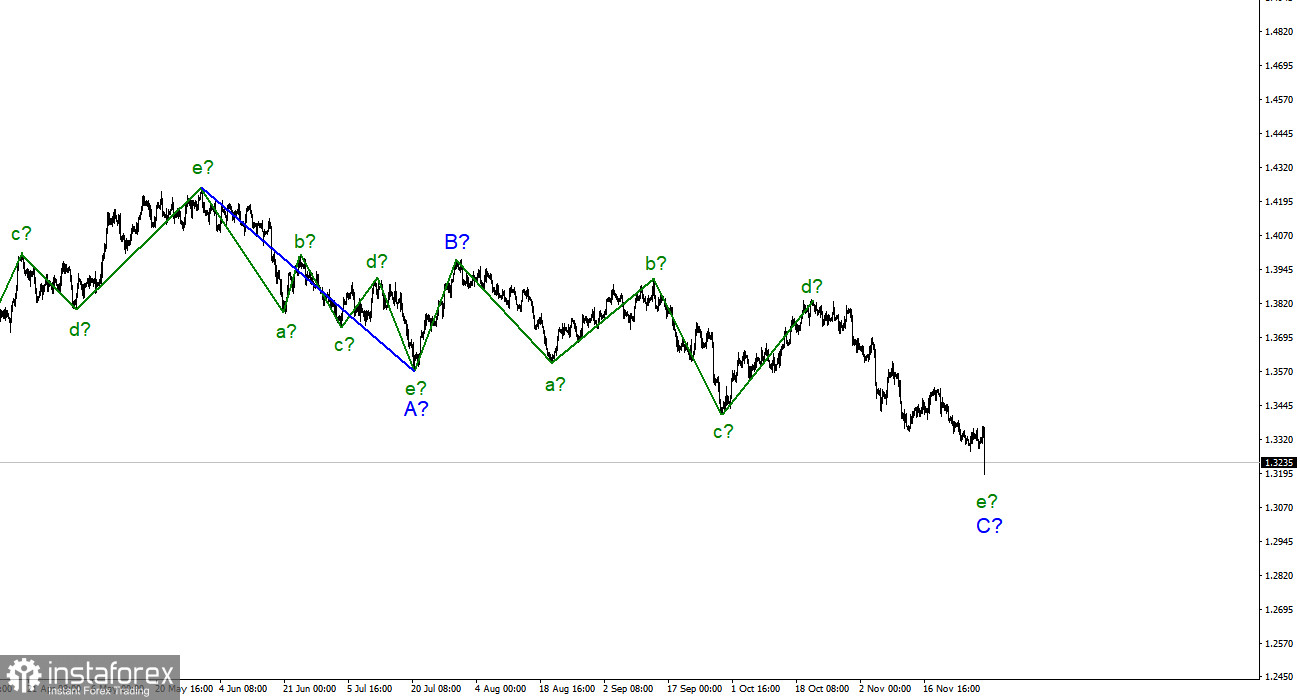

The wave marking for the pound/dollar pair continues to look quite complicated. At the same time, there are also some clear patterns. Five internal waves are visible inside the last wave C. Each subsequent one is approximately equal in size to the previous one. However, taking into account that all the waves in the composition of C or A are almost equal in size, the last wave e may be nearing its completion or already be completed. An unsuccessful attempt to break through the 1.3271 mark may indicate its completion as well as the entire downward section of the trend. However, today in the afternoon, the pair plunged below 1.3271. Please pay attention to the fact that for the euro/dollar and pound/dollar pairs, the descending structures A-B-C are now presumably nearing completion. Thus, both instruments may start building a new upward trend segment in the near future. Until that moment, the US currency is likely to keep growing for some time amid high demand.

The pound sterling was unable to even build a corrective wave

The pound/dollar pair added 60 basis pips on Tuesday but fell by 160 in the afternoon. Thus, the willingness of traders to open long positions on the pound sterling may signal that it is too early for the emergence of a new upward wave. Unfortunately, the wave markup usually reflects the prevailing trend. If the trend and wave pattern do not coincide, the wave marking may become more complicated. The pound sterling is unlikely to gain momentum amid the current market situation. Traders are worried about a new coronavirus strain. They are hesitant to pick up a trend. Yesterday, Jerome Powell delivered a speech. However, it was quite pessimistic. He hinted that the regulator may slightly adjust monetary policy in the coming months. However, the central bank is unlikely to take a hawkish approach. It is still too early to draw such conclusions but one should bear it in mind before choosing s trading strategy. However, if this scenario comes true, the US dollar may extend gains. Something similar happened at the beginning of last year when the coronavirus began to spread around the world. The US dollar had soared by 1,600 pips in seven days. Thus, traders may seek shelter in the US dollar as a safe-haven asset if the epidemiological situation worsens. Moreover, many countries may again impose new quarantine restrictions. If so, it will weigh on market sentiment. Currently, there are only predictions that the US dollar may develop a new rally.

Conclusion

The wave pattern for the pound/dollar pair looks quite comprehensive now. The wave e may be completed soon. Thus, it is recommended to open long positions on the pair counting on the creation of a new trend segment in the near future. This is why we need at least some bullish signal. At the same time, many traders were unable to price in today's decline. Nobody foresaw such a sharp rise of the greenback. Now, it is better to wait for markets to calm down.

Large timeframe

Starting from January 6, the construction of a downward trend section has been unfolding. It may turn out to be almost any size and any length. At this time, the proposed wave C may be nearing its completion (or completed). However, there is no confirmation of this yet. The entire downward section of the trend may be extended, but there are no signals about this as well.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română