For the past 20 months, oil has fallen multiple times amid reports about the emergence of new COVID-19 variants. Nevertheless, it recovered quickly owing to expectations of a rise in global demand. However, Omicron turned out to be a special case. This coronavirus variant that originated from South Africa is believed to be resistant to all the existing vaccines. Amid the bad news, crude oil was sent into a tailspin. Benchmarks Brent and WTI lost about 12% on Friday. A similar drop took place 7 years ago when OPEC was waging war against US oil producers.

This time, there is also a confrontation between the cartel and its allies, on the one hand, and the United States represented by Joe Biden and his administration, on the other. The White House has recently announced the release of 50 million barrels of oil from the nation's Strategic Petroleum Reserve, which put pressure on oil prices, triggering a correction. Rumors began to spread in early November, but if it were not for Omicron, buying on facts would have followed. Alas, the new coronavirus variant delivered a severe blow to Brent and WTI bulls. Although Goldman Sachs and other companies are talking about a mass sell-off in the late fall, nobody knows exactly how deep it could actually be. All will depend on the news about the new COVID-19 variant.

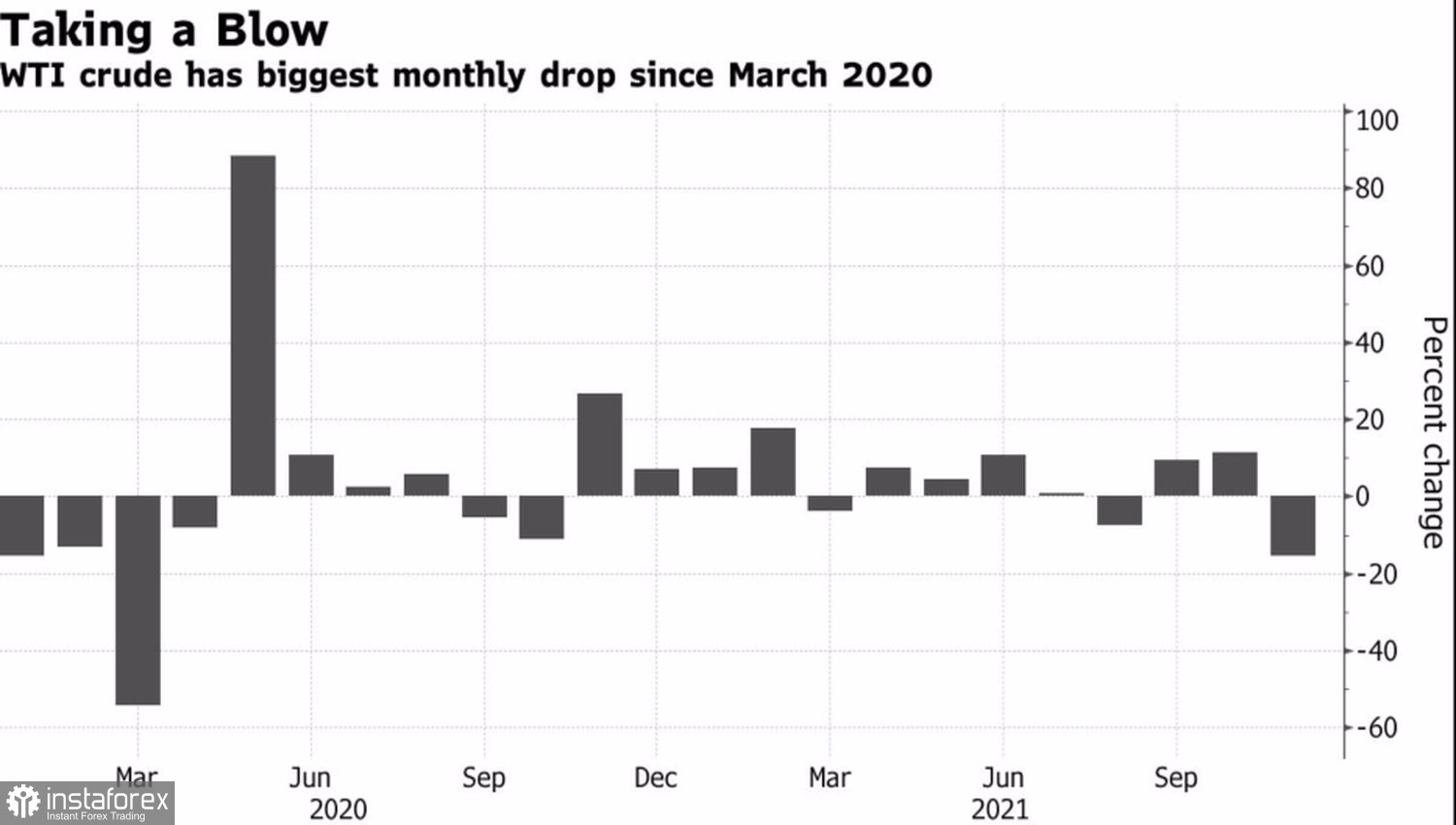

Amid the spread of the Omicron strain, oil showed a plunge unseen since March 2020. Back then, global demand for crude oil tumbled 20%, with WTI falling below the zero level at some point. Perhaps market jitters were caused by fears that the same scenario could play out again. Therefore, bulls are now selling off oil and locking in profits.

Crude oil monthly price change

Due to a sharp drop in oil prices, there have been rumors that OPEC+ would decide not to raise production by 400,000 barrels at the next summit. Moreover, the cartel forecast that the oil market would flip into surplus in the first half of 2022 if the US and its allies release over 66 million barrels from their strategic reserves.

So far, information about the new COVID-19 strain has been mixed. Moderna doubts that existing vaccines would be able to adequately resist the virus. Meanwhile, doctors from South Africa report that patients with Omicron have mild symptoms. Given all that, panic spreads across the oil market. According to Jerome Powell, the new coronavirus variant could create problems for the Fed in fulfilling its dual mandate. So, if the regulator changes its monetary policy tightening plans, the greenback is likely to come under pressure, thus having a positive effect on crude oil.

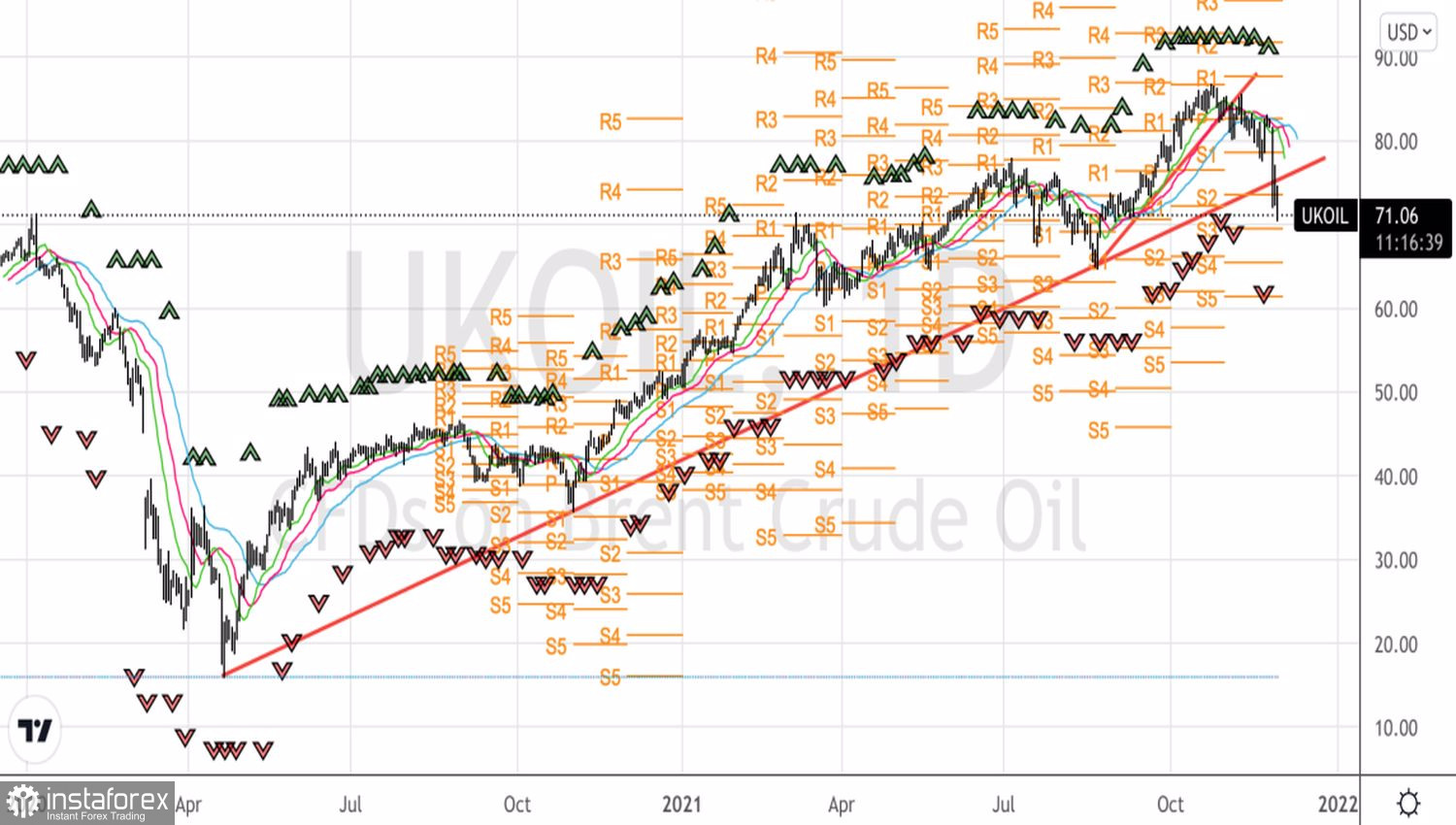

A breakout of the trend line of the Bump and Run Reversal (BARR) pattern will not be beneficial for Brent bulls. Only iIf the quote returns above $75.5 per barrel, the uptrend is likely to resume, and traders could go long.

Brent, daily chart

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română