The platinum and nickel markets are expected to see a surplus in 2022, while palladium will be in deficit.

Nornickel, the world's largest producer of palladium and high-quality nickel, yesterday released its eighth review of the nickel and platinum group metals markets.

According to the report, this year the automotive industry, which is the main consumer of platinum and palladium, faced a disruption in chip supply.

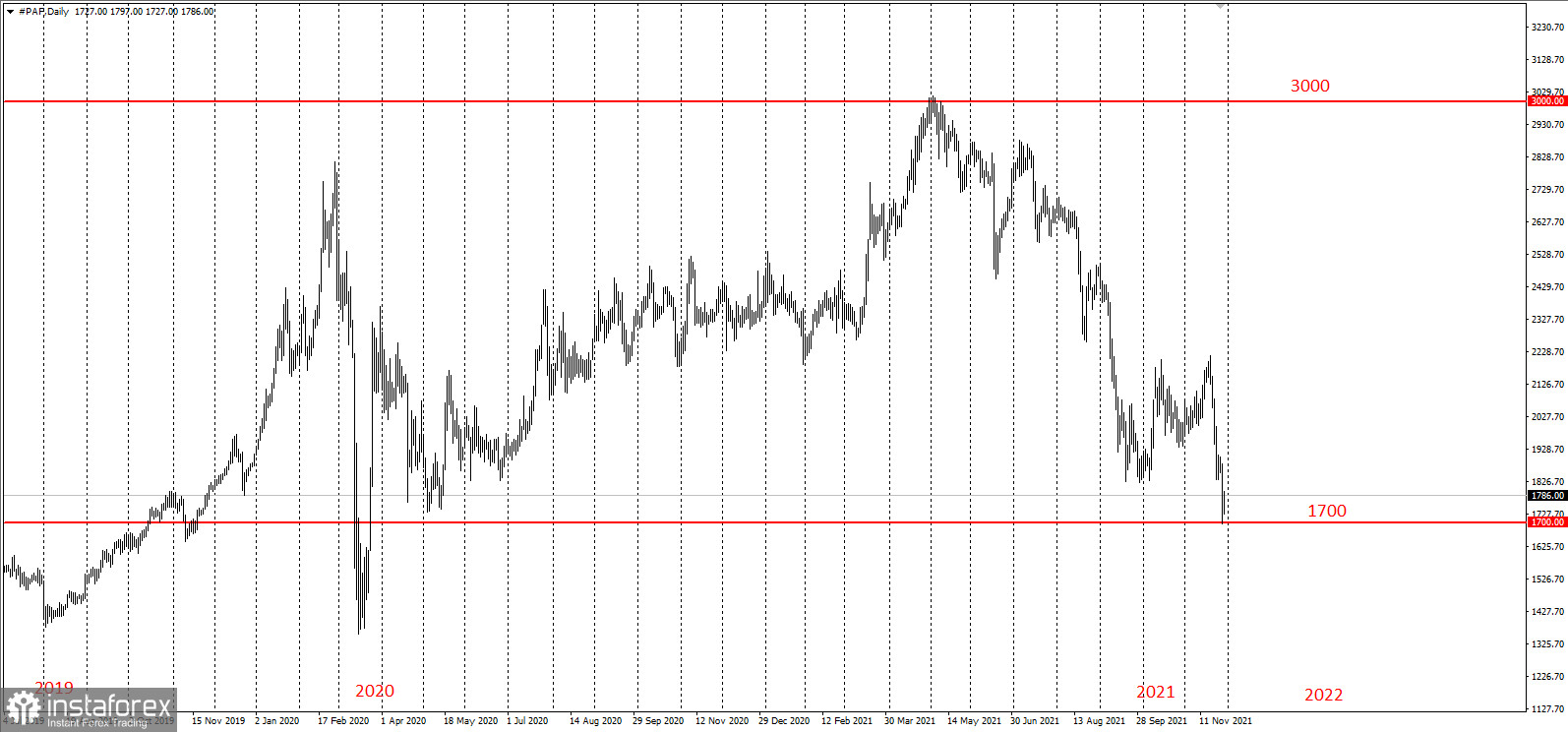

The company said that the auto market has not yet recovered, thus affecting the palladium market more severely than the platinum market. The use of palladium is more concentrated in the industry, and demand recovery in other industries could provide only a partial relief.

The primary supply of palladium added more than 0.5 million ounces this year mainly due to the recovering production in South Africa.

This was enough to offset the decline in output in Russia. The market balance has been revised this year towards a moderate deficit of 0.2 Moz. However, even the lower deficit did not prevent the price of palladium from reaching a new all-time high.

According to Nickel forecasts, the supply of chips will recover in the second half of 2022.

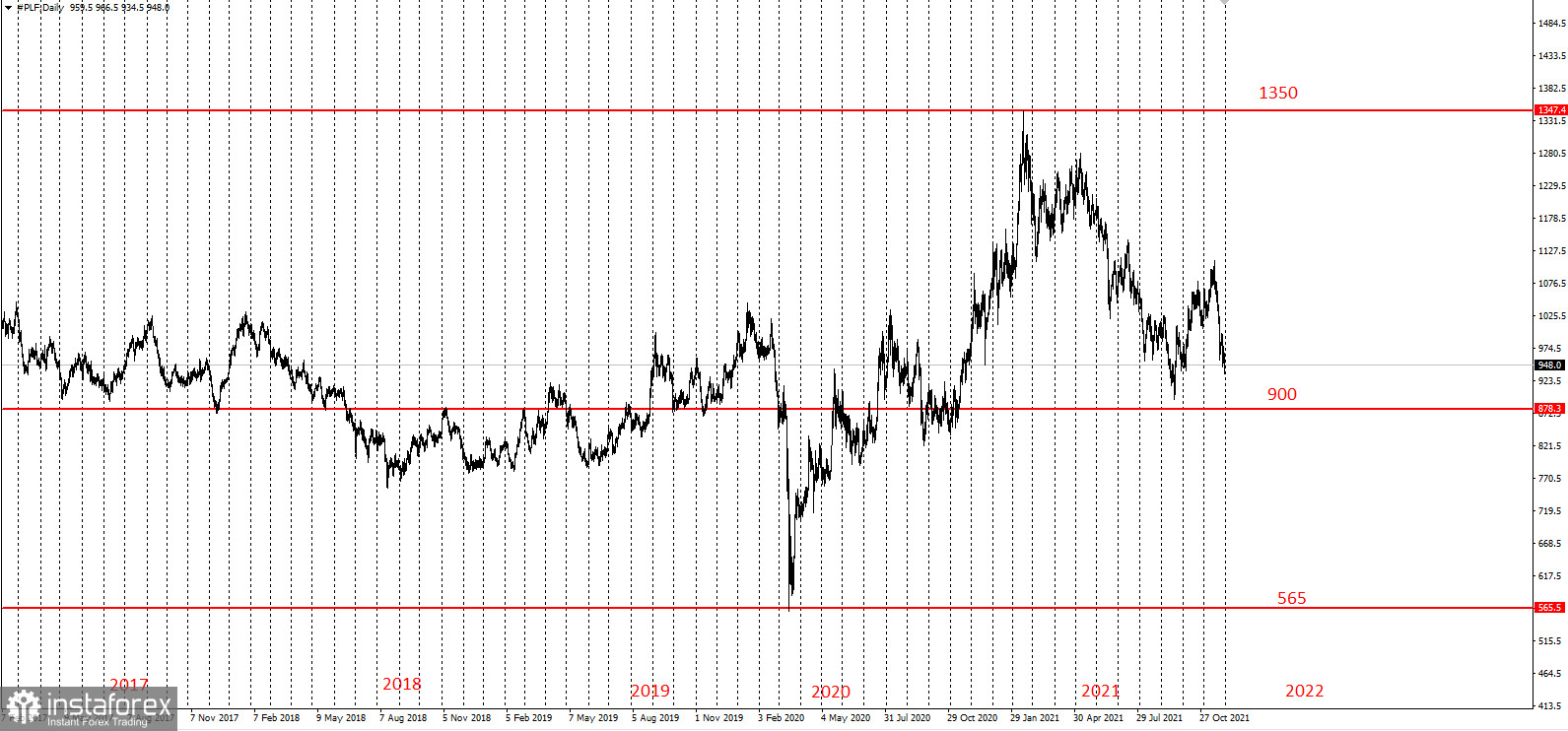

Excluding investment demand, the platinum market is expected to have a surplus of 0.9 Moz in 2021 because rising consumption cannot absorb the additional supply of the 1.5 Moz that is coming from South Africa.

Norilsk Nickel said it has revised the 2021 market balance. According to the forecast, the nickel market is still in deficit, but in 2022 there will be a surplus of 59 thousand tons. This surplus applies to low-grade nickel, which will be balanced by a shortage of high-grade nickel.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română