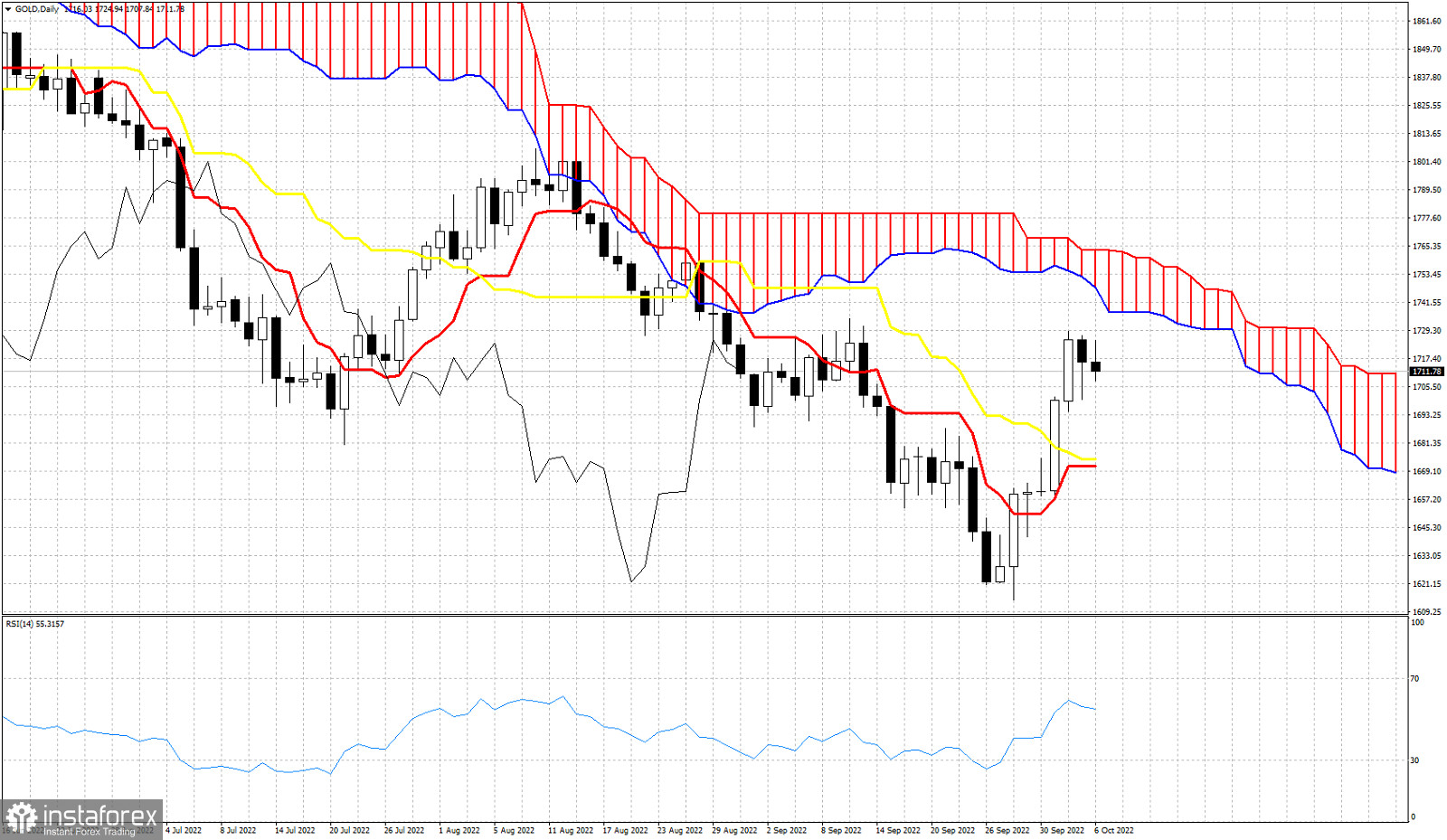

Gold price is trading around $1,710-$1,720. Short-term trend technically and according to the Ichimoku cloud indicator is bullish as price is making higher highs and higher lows and in the 4 hour chart price is above the Kumo (cloud). However in the Daily chart price remains below the Kumo and thus trend is bearish. We talked about the medium-term trend remaining bearish in previous posts. There are still important resistance levels above to break in order for this trend to change. The Ichimoku cloud resistance is at $1,737-$1,763. As long as price is below this resistance area (shown by the Kumo) we remain medium-term bearish and so does the Daily trend. Support is at $1,674-70 where we find the kijun-sen (yellow line indicator) and the tenkan-sen (red line indicator). Bulls must defend this support level. A break below this support level will open the way for a move to new lows. Ideally bulls will back test the support at $1,670-74 and form a higher low. Then a break above the cloud would signal the trend change. Inability to break above the cloud if combined with a break below $1,670 would be a new bearish signal.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română