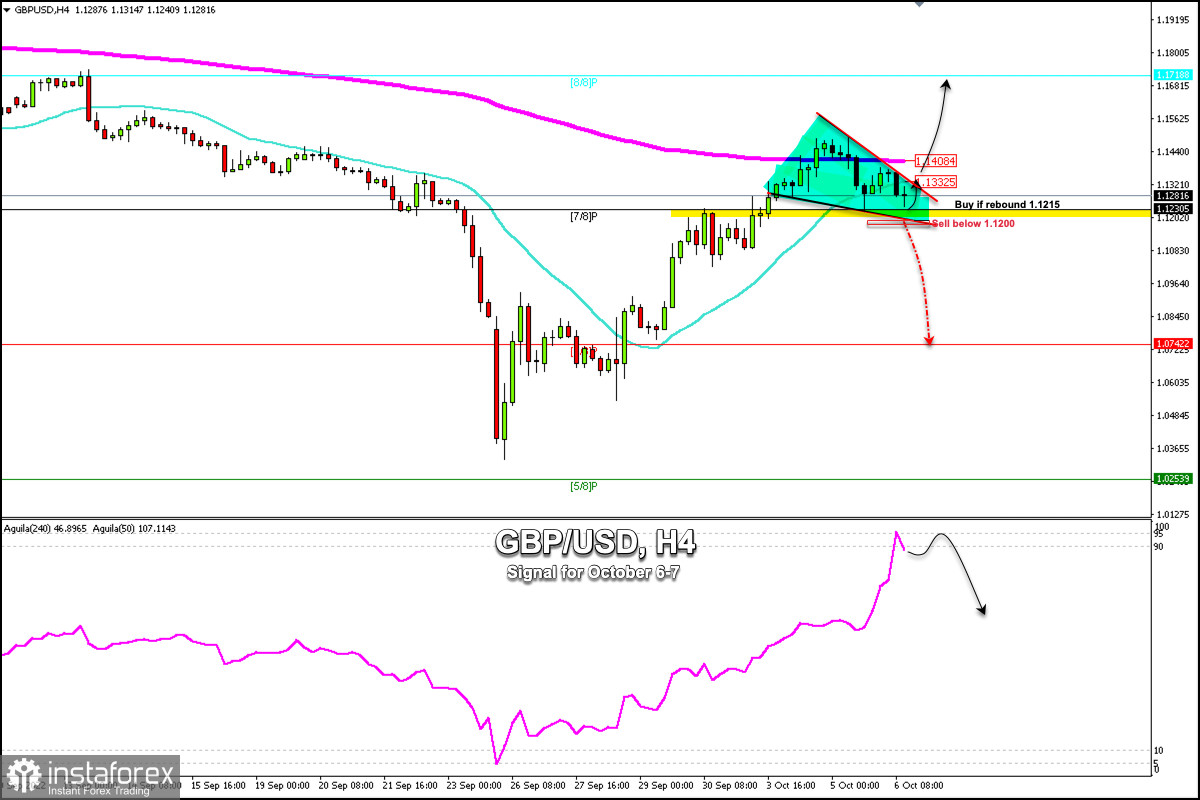

Early in the American session, the British pound is trading around 1.1281 inside a symmetrical triangle and below the 21 SMA and 200 EMA. Importantly, the pound is under bearish pressure but is approaching a critical level of strong support and could resume its bullish cycle.

The break of the symmetrical triangle below 1.1200 could mean a negative signal for the pound and it could resume its main bearish cycle and the pair could fall towards 6/8 Murray located at 1.0742.

On the other hand, the British pound is likely to trade in a range between 1.1230 (7/8 Murray) towards 1.1330 (21 SMA) in the coming hours. Investors will be waiting for the announcement of the non-farm payrolls (NFP) that will be published tomorrow in the American session and then the volatility of the pair could decrease.

Several Fed officials reaffirmed the commitment to control inflation and the prospect of another rate hike of 0.75% in November. This news is benefitting the US dollar and as a consequence could keep the GBP/USD pair under bearish pressure.

7/8 Murray located at 1.1230 represents critical support of confluence and a technical reversal. A convincing break below will suggest that the corrective rally is over and will change the bias in favor of the bears.

On the other hand, the area of 1.1332 (21 SMA) - 1.1408 (200 EMA) seems to have become an immediate barrier. Sustained strength beyond these levels should allow the GBP/USD pair to retest the psychological level of 1.15. With a daily close above 1.1410, the bulls could target the resistance of 8/8 Murray at 1.1718.

Meanwhile, in the coming hours, the GBP/USD pair will remain in a consolidation phase ahead of the US official employment data.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română