To open long positions on EUR/USD you need:

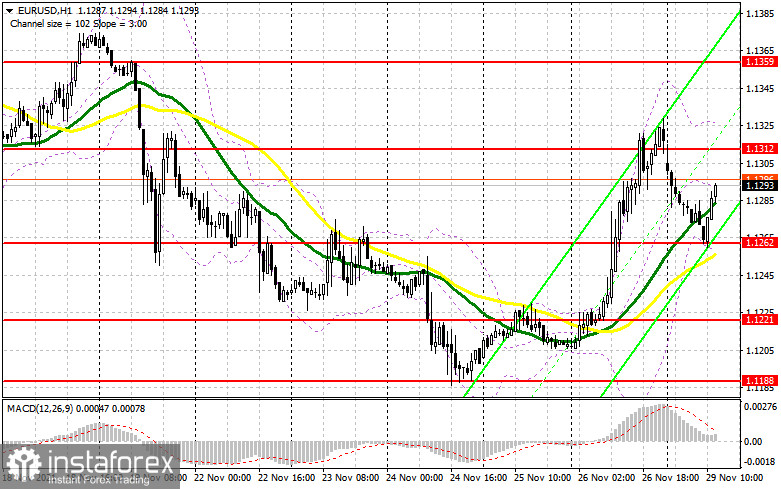

Euro buyers managed to fulfil their objective and defended the support at 1.1262, forming a clear buy signal there. Let's observe the 5-minute chart and analyze it. In my morning forecast, I focused on 1.1262 and recommended making a decision, taking this level into account. A failed fixation below 1.1262 and a false break resulted in a favourable entry point to long positions to continue Friday's trend. At the time of writing the article, the pair has already surged by more than 30 pips. From the technical point of view, the situation has not changed.

As long as trade is conducted above 1.1262, an upward correction is possible. Besides, weak data on changes in the volume of US pending home sales should be beneficial for euro buyers. In case the pair declines, only another formation around 1.1262 with the moving averages favourable for buyers, will set the market entry point against the downtrend, counting on the pair's correction. Another challenging target is the resistance at 1.1312. Bulls failed to reach it in the first half of the day and they are now focusing on it. A breakout and test of 1.1312, as well as a strong report on German consumer prices growth above 5.0% year on year will provide an excellent entry point into the market with the prospect of renewing the highs of 1.1359 and 1.1417. A further target will be 1.1462, where I recommend taking profit. In case EUR/USD declines to 1.1262 and bulls demonstrate no activity, it is better not to hurry to buy. I recommend awaiting the pair's next fall and formation of a false break at the low of 1.1221. It is possible to open long positions on EUR/USD immediately at a rebound from 1.1188 or even lower, from 1.1155, expecting a correction of 15-20 pips during the day.

To open short positions on EUR/USD you need:

Bears have failed to achieve their target so far and have not broken below 1.1262. However, taking into account that the technical picture has not changed, the situation is under bears' control. Now, their main task for the second half of the day is to protect the resistance at 1.1312. It is strongly prohibited for the European currency to break above this level. The formation of a false break there will provide an excellent entry point to short positions. Besides, the Fed Chairman's speech and his hawkish statements on the monetary policy will make sellers, willing to buy at the current favourable prices, enter the market again. Moreover, the new variant of the coronavirus will also keep the pair from a rapid recovery in the near term. Therefore, a key task for the EUR/USD sellers is to regain control of the support at 1.1262, which they failed to do in the first half of the day. Its breakdown and the test from the bottom upwards will give a signal to open short positions with the prospect of falling to the area of 1.1221. A further target is support at 1.1188, where I recommend taking profit. In case of the euro's rise and lack of bearish activity at 1.1312, it is better not to sell. Short positions at a false break at 1.1359 would be the best scenario. It is possible to open short positions immediately at a rebound from the highs of 1.1417 and 1.1462 with the target of a downward correction of 15-20 pips.

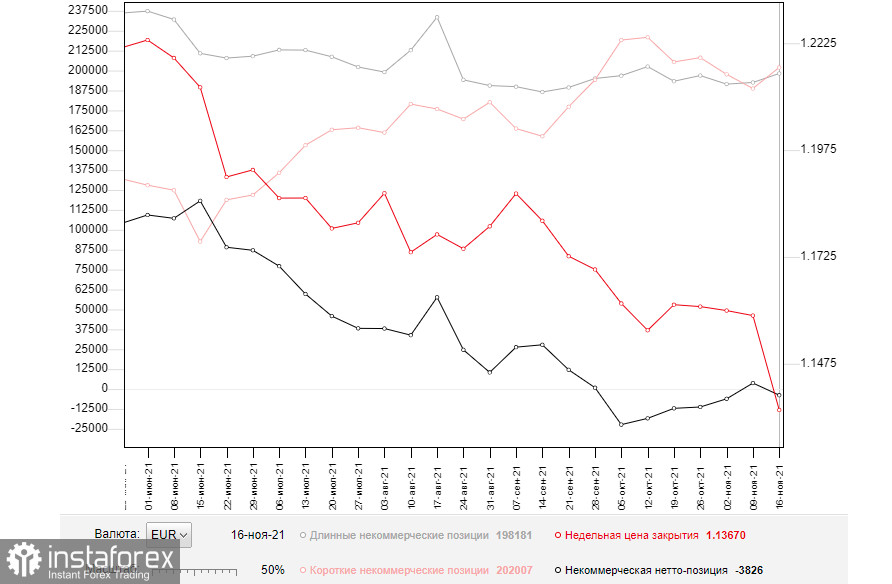

The COT report (Commitment of Traders) for November 16 recorded an increase in both short and long positions. However, the former were numerous, which led to a further negative delta. Although it has been balancing in the same range near the zero level for quite a long time, it is not favourable for euro buyers. The risk of another coronavirus outbreak and the EU countries' lockdown caused further pressure on the European currency, which has not managed to recover from the European Central Bank's continued extra dovish monetary policy yet, even amid inflationary growth. Judging this aspect, ECB policymakers have taken a fairly right stance. Austria has already returned to lockdown restrictions and strict isolation measures, while German authorities are considering them. Besides, it is a very clear signal for a further weakening of the euro against the dollar. Meanwhile, the US high inflationary pressures is further beneficial to the greenback. Many investors expect an earlier interest rate hike by the Federal Reserve next year and are already following the market in that direction. The latest November COT report indicated that long non-commercial positions rose from 192,544 to 198,181, while short non-commercial positions also jumped from 188,771 to 202,007. At the end of the week, the total non-commercial net position relapsed negative to -3,826 versus 3,773. The weekly closing price declined significantly to 1.1367 versus 1.1587.

Indicator Signals:

Moving averages

Trading is conducted above the 30 and 50 day moving averages, indicating a possible further euro's rise.

Note. The period and prices of moving averages are considered by the author on hourly chart H1 and differ from the common definition of classic daily moving averages on daily chart D1.

Bollinger Bands

A break of the lower boundary of the indicator at 1.1262 will increase the pressure on the euro. In the case of growth, the upper boundary of the indicator at 1.1325 will act as resistance.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. On the chart, it is marked in yellow;

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. On the chart, it is marked in green;

- MACD (Moving Average Convergence/Divergence - moving average convergence/divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20;

- Non-commercial traders are speculators, such as individual traders, hedge funds and large institutions, which use the futures market for speculative purposes and meet certain requirements;

- Long non-commercial positions represent the total long open position of non-commercial traders;

- Short non-commercial positions represent the total short open position of non-commercial traders;

- The total non-commercial net position is the difference between short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română