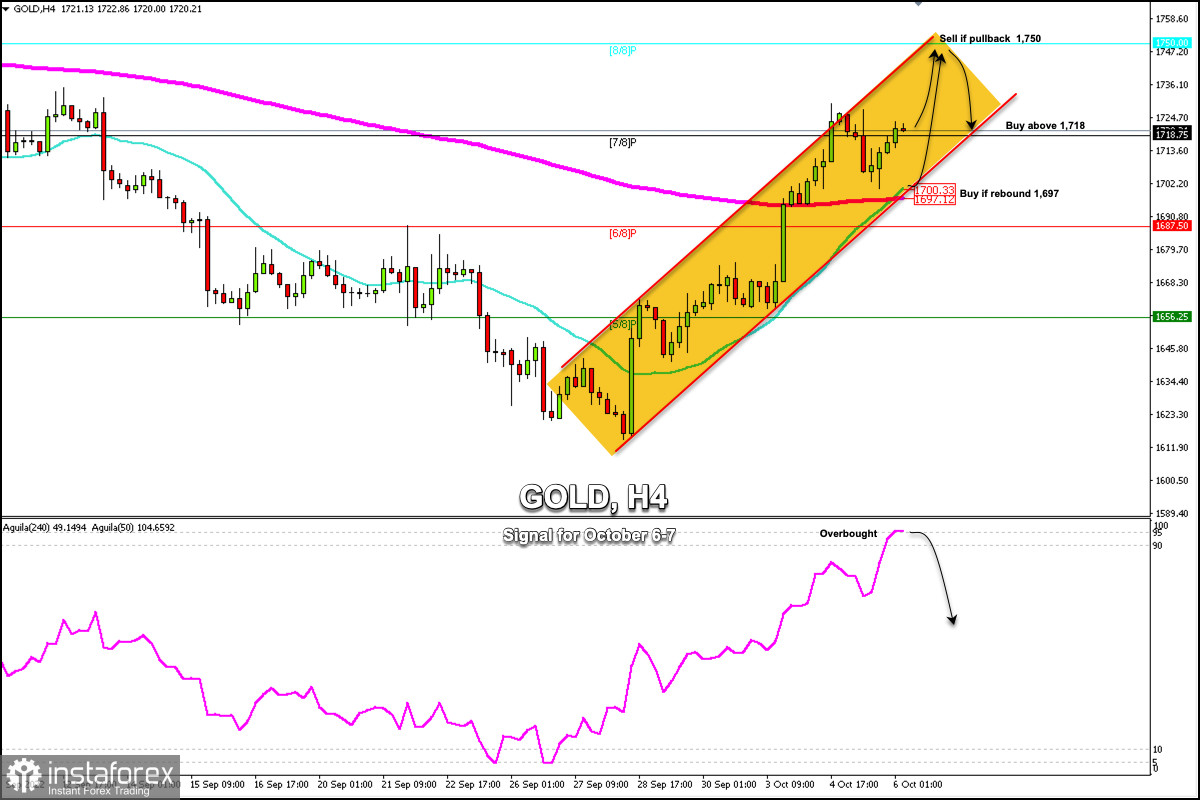

Gold (XAU/USD) is trading at around 1,720, above 7/8 Murray (1,718), above the 200 EMA, and the 21 SMA, providing a strong positive signal. If the metal keeps trading above this area in the next few hours, it could reach the strong resistance of 8/8 Murray located at 1,750.

Yesterday in the American session, XAU/USD came under strong bearish pressure. As a result, it failed to consolidate above the strong resistance of 1,735. We can see that gold found support around the 200 EMA on the 4-hour chart. Around this area is the psychological level of 1,700 which could offer a positive outlook in the coming days.

The US dollar index resumed its bullish cycle on expectations of an aggressive tightening by the FED. Markets are pricing in a 70% chance of an increase of 0.75% in interest rate in November.

Strengthening of the US dollar is benefitting Treasury bond yields which is a situation that means gold could once again come under bearish pressure.

According to the 4-hour chart, Gold reached the top of the uptrend channel. During a technical correction, the price printed a low of 1,700. From that level, XAU/USD rose again and could now gain momentum and reach 1,750.

On the contrary, in case gold falls below the psychological level of 1,700 and consolidates below the 200 EMA and below the 6/8 Murray, it could mean that the bearish pressure has resumed and could be a negative sign. In this case, gold could reach 5/8 Murray at 1,656 and could even drop to the psychological level of 1,600.

A sustained break above strong resistance at 1,735 is needed to challenge the 1,750 level. On the downside, critical support is seen between 1,700-1,687. A break of this level could change the trend and gold could turn bearish.

The strong support at $1,680 will be the last line of defence for the gold bulls. This level is located at 6/8 Murray (1,687). The price could drop towards 1,656 and 1,615 if it closes below this level.

Our trading plan for the next few hours is to buy above 7/8 Murray, with targets at 1,750. On the other hand, to grasp a good opportunity to buy, we should wait for a technical bounce around the 200 EMA located at 1,700, with targets at 1,718 and at 1,750.

The eagle indicator is showing overbought signals. So, if gold fails to stay above 7/8 Murray, it will be a clear signal to sell below 1,718 with targets at 1,697 and 1,685.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română