GBP/USD

Analysis:

The main trajectory of the British pound is determined by the incomplete descending wave pattern formed on February 24. Its structure is not completed at the moment of writing. In the last 3 weeks, the price has formed an intermediate correction in the form of a sideways channel.

Outlook:

The ascending wave section is expected to be completed over the next 24 hours and is likely to be followed by a reversal and resumption of the downtrend. If the price breaks through the lower boundary of the immediate support, the decline will continue until the next zone.

Potential reversal zones

Resistance:

- 1.3370/1.3400

Support:

- 1.3290/1.3260

- 1.3180/1.3150

Recommendations:

Buying the British pound is not advisable today as it may result in losses. It is recommended to track the emerging signals for selling the instrument when the current pullback comes to an end.

AUD/USD

Analysis:

The descending wave of the Australian dollar that was initiated in late February continues its formation. The quote has approached the upper boundary of the strong potential reversal zone on the weekly chart. The estimated support zones define its boundaries.

Outlook:

A general downward trend is expected to continue today after a possible pullback to the resistance zone. A stop and a sideways movement can be expected in one of the estimated support zones.

Potential reversal zones

Resistance:

- 0.7140/0.7170

Support:

- 0.7080/0.7050

- 0.6990/0.6960

Recommendations:

Currently, there are no conditions for buying the Australian dollar today. It is recommended to monitor emerging signals to sell the pair. When opening positions, you should take into account the limited potential of the current downtrend.

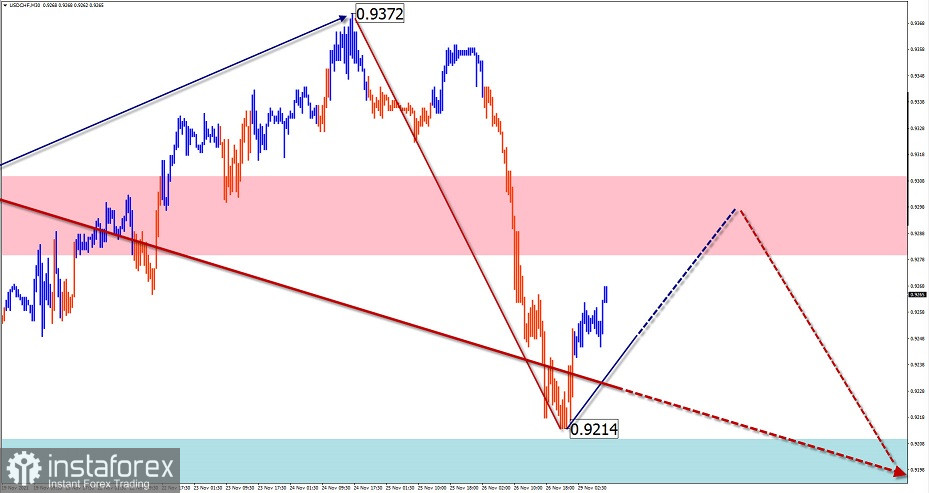

USD/CHF

Analysis:

The bearish wave pattern of the Swiss franc, which dates back to November 24, started to form its final section. Many support/resistance levels of various periods have accumulated near the current price levels.

Outlook:

Today, the price is expected to move mainly sideways between the nearest opposing zones. After probable pressure on the resistance zone, a resumption of the downtrend is expected with a decline to the support area.

Potential reversal zones

Resistance:

- 0.9280/0.9250

Support:

- 0.9210/0.9180

Recommendations:

Trading in the Swiss franc market today is risky and may lead to losses. Short-term selling in small lots from the resistance zone is possible.

USD/CAD

Analysis:

As for the Canadian dollar, the descending wave pattern continues to form on the chart and goes in line with the dominating bearish trend. The price has reached the upper boundary of the strong reversal zone on the weekly chart.

Outlook:

The pair is expected to trade mostly sideways along the resistance zone over the next 24 hours. In the first half of the day, a short-term decline to the support zone is possible. An increase in volatility and a return to the major trend is likely by the end of the day.

Potential reversal zones

Resistance:

- 1.2780/1.2810

Support:

- 1.2700/1.2670

Recommendations:

Today, it is safer to trade USD/CAD in individual trading sessions with fractional lots and according to the expected sequence.

Explanations: In simplified wave analysis (SWA), waves consist of 3 parts (A-B-C). The last unfinished wave is analyzed. The solid arrow background shows the structure that has been formed. The dashed lines show the expected movements.

Note: The wave algorithm does not take into account the duration of the instrument's movements over time!

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română