Curiously enough, any member of a major central bank is primarily a politician rather than an economist or a banker. It means that they have a unique skill to talk about an important subject without giving away some crucial details. As a result, they may give a long but obscure speech.

Speaking on Friday morning, Christine Lagarde, as a true politician, delivered a long yet controversial speech. On the one hand, her speech was quite interesting as Lagarde gave lots of historical references. However, on the other hand, she did not say anything specific.

Another distinct feature of politicians is their ability to add to their speeches sentences or words that may be interpreted in different ways as if they have hidden meanings. Lagarde used the word "changes" too often. It is quite a wise move given that the ECB December meeting is just around the corner. The regulator will sum up the results of the current year as well as announce its plan for the coming year. Investors believe that Lagarde might be hinting at the fact that the ECB will announce changes in the parameters of its monetary policy in a couple of weeks. Otherwise, there is no other explanation why the single currency began to grow rapidly immediately after Lagarde's speech. It also boosted the growth of many other currencies, especially the pound sterling.

Usually, politicians hide the true meaning of their words for a reason. It is quite wise as their opponents cannot blame them later for not doing what was said in the speech. Time will show whether market participants understood Lagarde's words correctly or not. Her speech is so vague that it is hard to discern the true message.

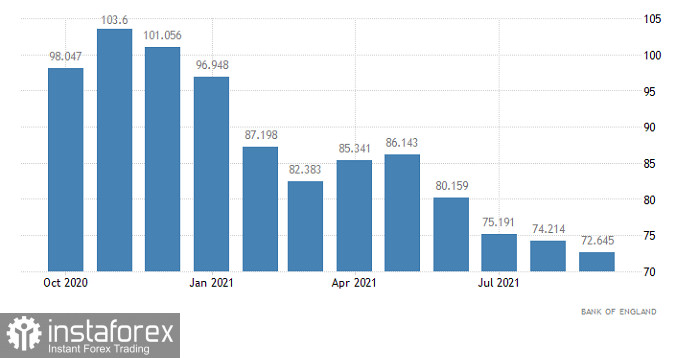

Today, the pound sterling is likely to lose momentum due to mixed consumer lending data. The figure is expected to amount to £0.5 billion, which is much better than the October reading of £0.2 billion. Yet, this is the only positive news.

For instance, the number of mortgage approvals is envisaged to total only 70,100 versus the October figure of 72,600. As seen, a drop is quite significant. Moreover, the volume of mortgage lending came in at £9.5 billion a month earlier. Now, the indicator is likely to be £4.8 billion. If so, we will see a twofold slowdown in mortgage lending.

Such news usually fuels bearish sentiment in the market as traders primarily consider elite property such as castles or houses in central London for investment. So, the decline in mortgage lending hints at a drop in demand, which will inevitably lead to price stagnation. Prices for certain categories of elite real estate may decrease, taking into account maintenance costs. It may pose risks of colossal losses. This is why the pound sterling is likely to decline.

UK Mortgage Approvals:

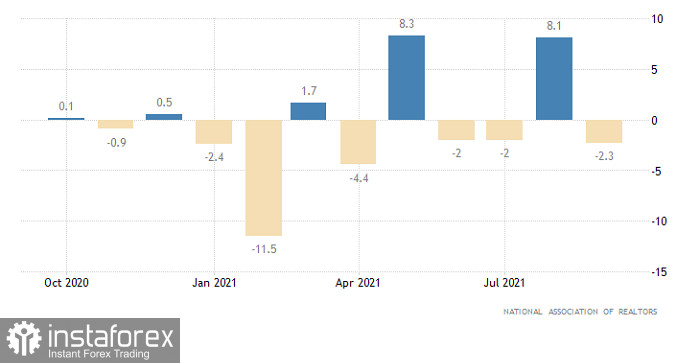

Meanwhile, economists expect a positive report on the US housing market. Pending home sales are projected to rise by 1.3% in November, which will slow down the decline to -7.0% from -8.0%. In general, the indicator is likely to grow slightly next month. Notably, traders pay great attention to this data. Therefore, positive reading is sure to fuel optimism in the market.

US Pending Home Sales:

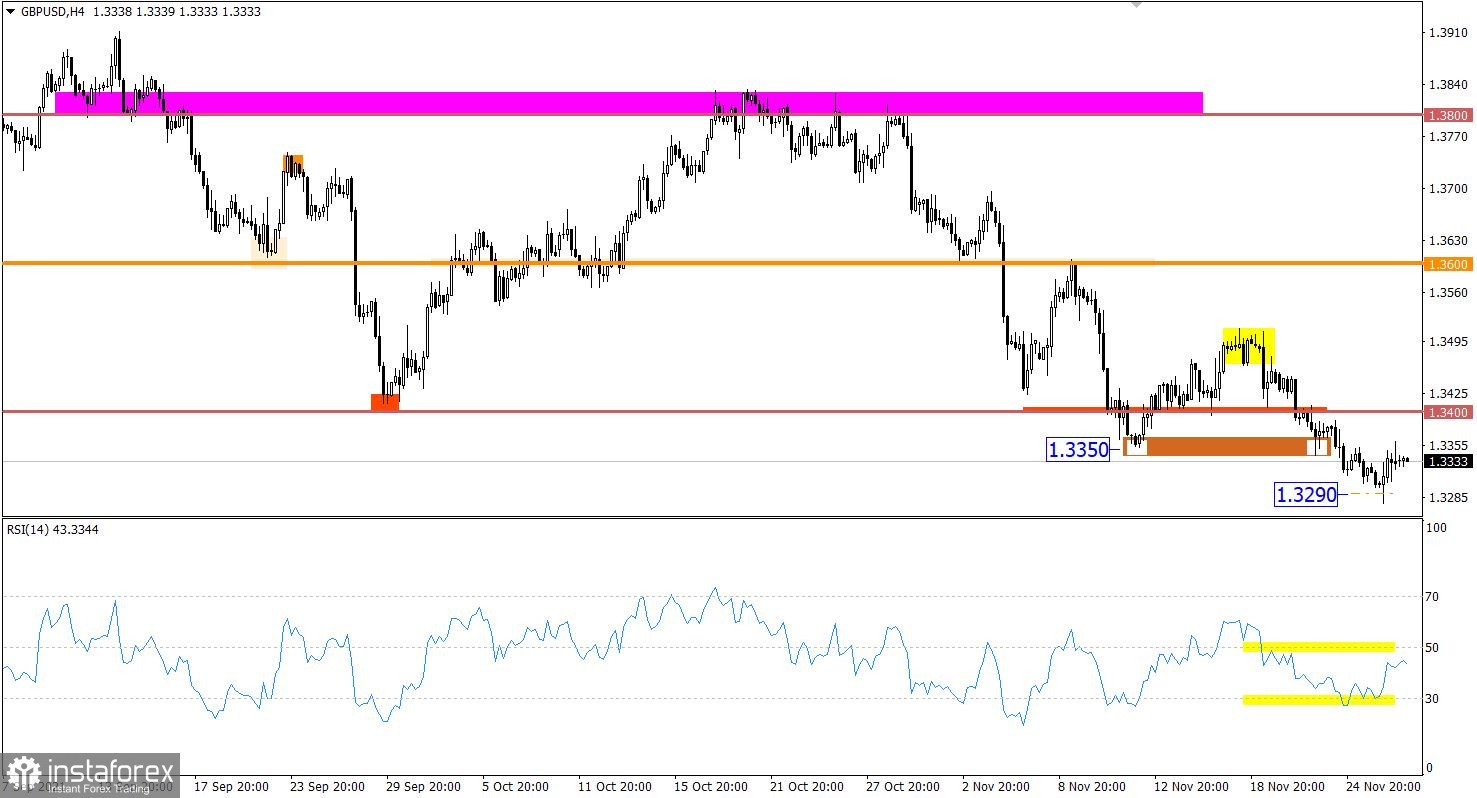

Last Friday, the GBP/USD pair managed to reach a new low of the current downward cycle. However, the price change was not so big.

As a result, the price performed a pullback with the support level of 1.3300.

The RSI technical instrument has been moving between the 30 and 50 lines for the sixth consecutive trading day on the 4H and D1 charts. It signals an increase in the volume of short positions among market participants.

On the D1 chart, there is a downward movement with swings and corrections. It indicates the likelihood of a medium-term downward movement.

Outlook:

Apparently, the bearish sentiment remains strong. The descending cycle is likely to continue. The subsequent signal to sell the pound sterling will appear if the price fixes below 1.3290 on the 4H chart. If this scenario comes true, it may well decline to 1.3150.

The complex indicator analysis gives a sell signal on short-term, intraday, and medium-term charts due to the downward cycle.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română