Buying shares of Unilever (#UL), a British multinational consumer goods company.

On the weekly chart, the price reversed upward from the price channel line during the emerging convergence. It could be a 38.2% retracement before the continuation of the downtrend. This upside potential corresponds to the price level of 55.30.

On the daily chart, the price settled above the Kruzenshtern line. The Marlin oscillator is headed upward. The price is expected to extend its upward movement.

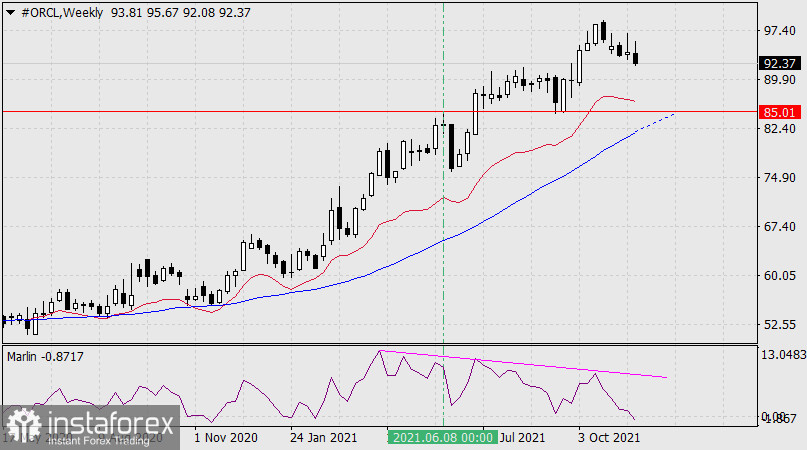

Selling shares of Oracle Corporation (#ORCL), an American software producer.

On the weekly chart, a double divergence was formed. The signal line of the Marlin oscillator is in the bearish zone. The quote is expected to reach the June high of 85.01. The Kruzenshtern line is approaching this level as well.

On the daily chart, the price consolidated below the balance and Kruzenshtern lines. The Marlin oscillator is in the bearish zone. The price is expected to move further down.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română