The cryptocurrency market is taking a local break for correction and stabilization. The main reason for this is bitcoin, which is in a precarious position due to negative fundamental news. Following BTC, the entire altcoin market starts a correction owing to total dependence on the first cryptocurrency. Only ETH manages to recover above a significant support zone and slow the pace of correction. Judging by the latest research, in the near future ether will continue to become a more independent asset of BTC and can even replace it.

This statement was made by JPMorgan bank experts, who are confident that the main altcoin will take the lead from bitcoin and become the key cryptocurrency. The analysts provide the data, according to which ETH grew by 500% during the current year, while BTC rose only by 96%. Notably, almost the whole year the coins were following the bullish market trend, and then were approximately in equal conditions. According to the charts, ethereum outperforms bitcoin many times in terms of development and usage. Another significant feature of this forecast is the Fed head's statement of the government stimulus program's tapering by $15 billion a month. Potentially, it will reduce the growth of inflation and consequently investment in bitcoin as a means of protection against inflation.

Notably, JPMorgan named risk hedging as the main reason for the current bullish rally of BTC amid worsening the coronavirus pandemic. In this case, ETH also has a definite advantage. The coin has grown significantly as an asset capable of protecting funds from inflation and has increased investment flows from large companies. However, beyond these aspects the main reason for ether's rapid growth is the DeFi market boom, a major part of which is based on the altcoin blockchain. The number of funds locked up in decentralized protocols has surpassed $500 billion. Besides, taking into account the lack of clear plans for the government regulation, it is possible to expect the continued investment growth of this sector. Moreover, in 2022, experts predict a significant influx of institutions in the decentralized finance market, having a beneficial effect on the price of the main altcoin.

Meanwhile, a bearish triangle pattern is forming on bitcoin's daily chart, which is likely to be broken in a downward direction. First of all, it is confirmed by a failed attempt of buyers to form a bullish takeover, resulting in a further decline in the price. It indicates the dominance of sellers in this range of cryptocurrency movement, and therefore the decrease to the key support zone at $55,300. Besides, it is also confirmed by the technical indicators of bitcoin: MACD is moving flat in the red zone, while a bearish divergence is forming on the stochastic and the relative strength index. All these aspects indicate a slowdown in the upward momentum and a lack of opportunities to keep the price in the current price range. Taking this into account, the probability of movement to the Fibo level of 0.618 increases significantly. At the same time, a rebound above $57,400 is possible. However, the current bitcoin picture indicates a likely price decline.

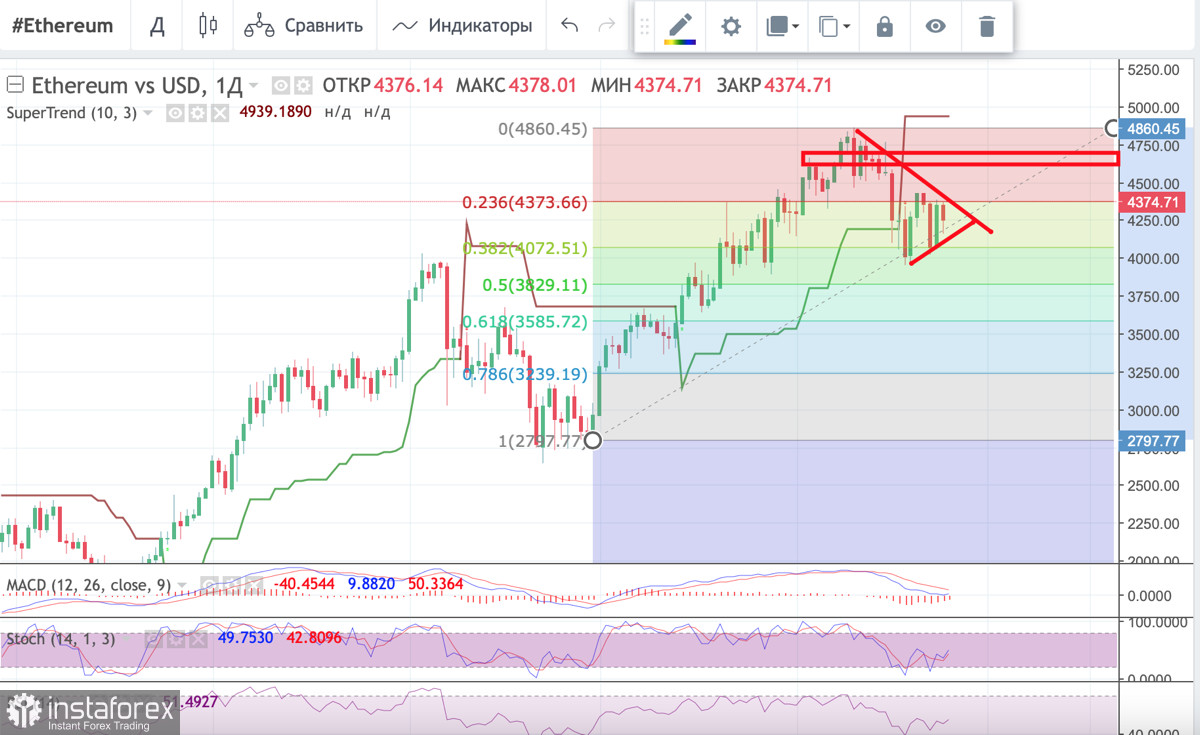

On the daily chart of ether, the situation is favorable for a dramatic rise after a short consolidation period. The coin managed to consolidate above $4,300, which is considered to be a bullish signal. The coin has to break the Fibo level of 0.236 at $4375 to fix the current success. Then the cryptocurrency will continue to move to new highs. At the same time, there is a probability of decrease as buyers failed to form a bullish absorption candle due to pressure from the Fibo level of 0.236. Consequently, the price resumed the downward movement and was pushed above $4,300 by bulls. The price reaction to reaching $4375 will determine the further movement vector of ether quotes for the nearest future. If the asset manages to break the Fibo level of 0.236, the price will rush to the absolute maximum zone. In case of a failed breakout, ETH quotes will decrease to $3,900 with a high probability of breaking this zone. Technical indicators show confidence in a further upward price movement. The MACD is recovering above the red zone and may form a bullish cross in the future, while the stochastic and the relative strength index are above 40, which is considered to be a bullish zone. Taking this into account, it is possible to assume that buyers are ready to support the current bullish momentum and make a successful break of the 0.236 Fibo level. In that case, climbing to the previous high by the end of the current week is a realistic objective. Otherwise, the altcoin will further consolidate in the range of $3,900-$4,300 with the attempts to break the extreme lines of the resistance area.

According to the current state of the major cryptocurrencies, there is no doubt that both coins will again update their all-time highs. However, ether is becoming more and more favourable due to its versatility, while bitcoin remains a specific asset, which is only occasionally in demand outside the investment field.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română