Analyzing the situation in the foreign exchange market using the Elliott theory.

While Thanksgiving is celebrated in the United States, economic news is coming out in the eurozone, which may affect the market. At 12:30 UTC, the publication of the minutes of the ECB meeting on monetary policy is expected. Then at 13:30 UTC, ECB President Christine Lagarde will give a speech.

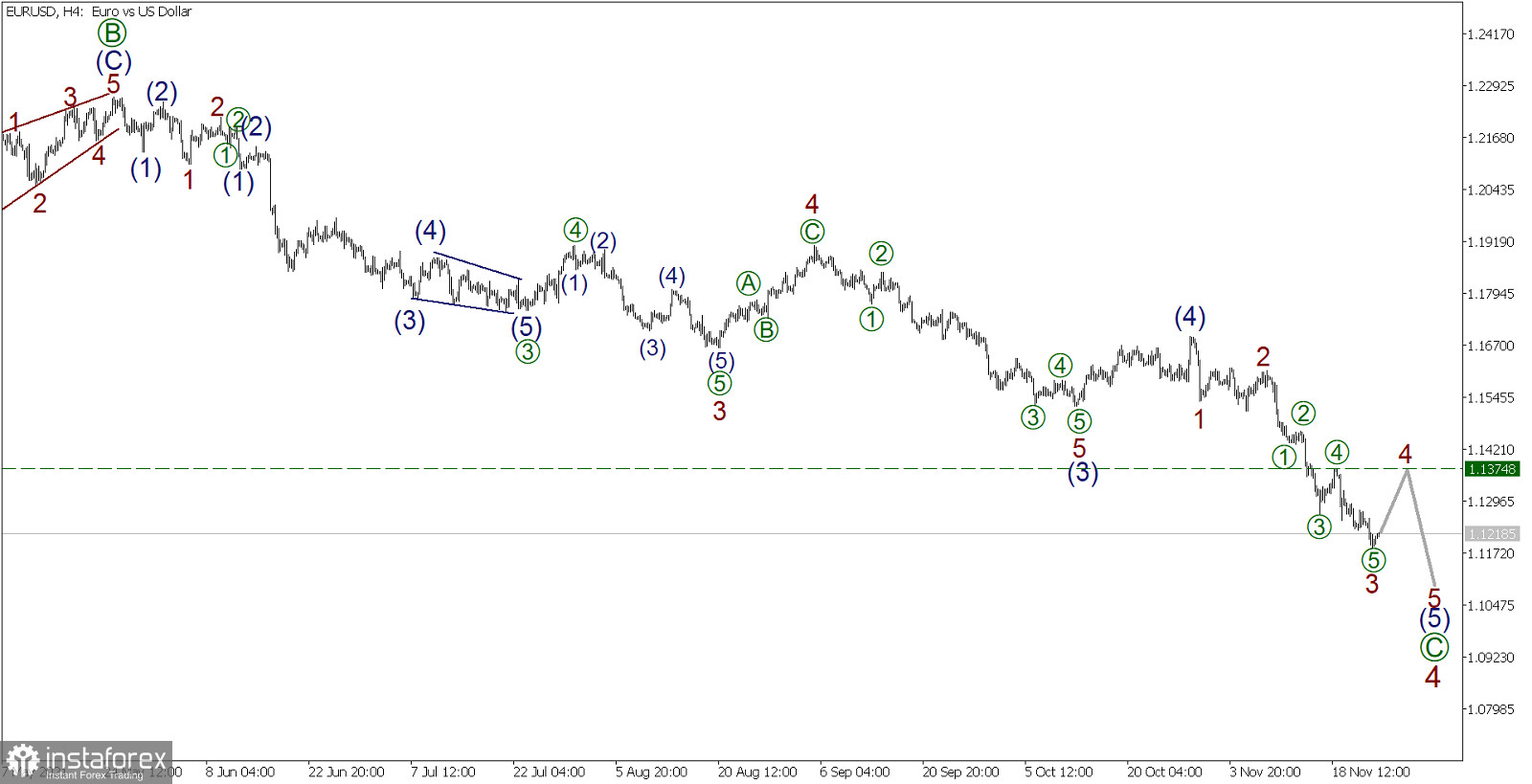

EURUSD, H4:

For EURUSD, the development of a large impulse continues, within which corrective wave 4 is coming to an end. On the four-hour timeframe, we see the second half of this correction.

The final wave of correction 4, that is, wave [C], takes the form of a five-wave impulse (1)-(2)-(3)-(4)-(5). Subwaves (5) are currently under development, where subwaves 1-2-3 are built as part of it. Thus, in the near future, the price correction is expected within wave 4. Its end is expected in the area of the 1.1374 level, where the correction was completed earlier [4].

After the full completion of wave 4, the price will continue to decline in the final wave 5, as indicated on the chart. In the current situation, it is recommended to consider opening buy deals in order to take profit at the level of 1.1374.

Trading recommendations: buy from the current level, take profit 1.1374.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română