Wave pattern

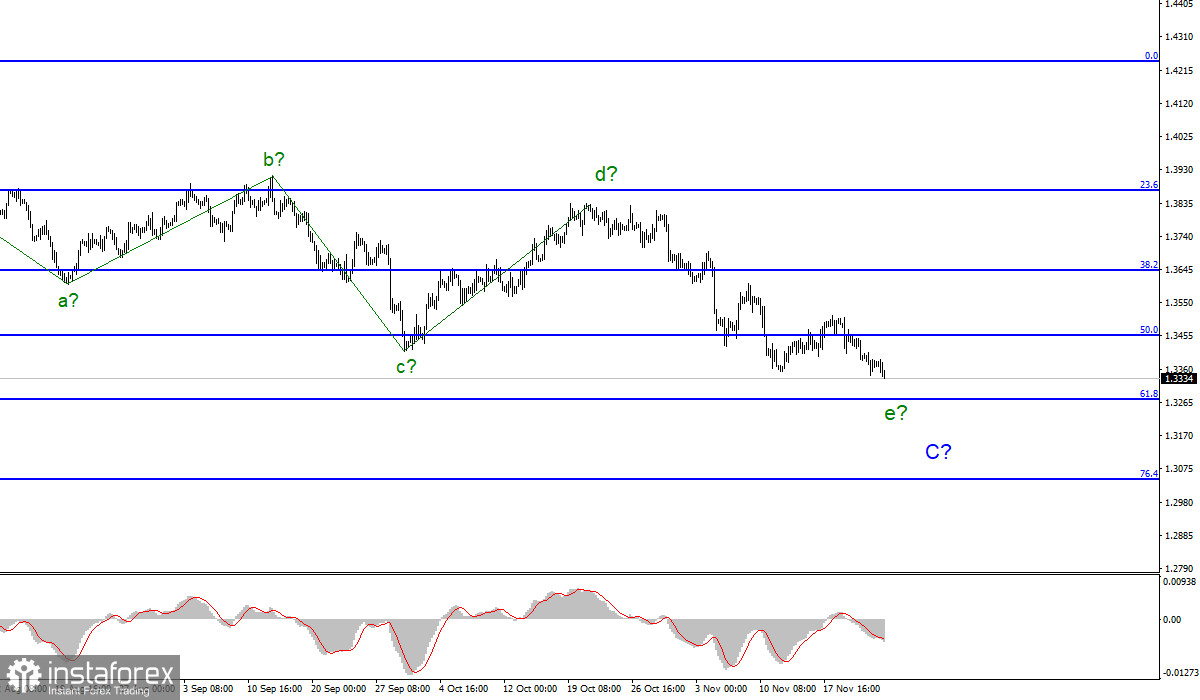

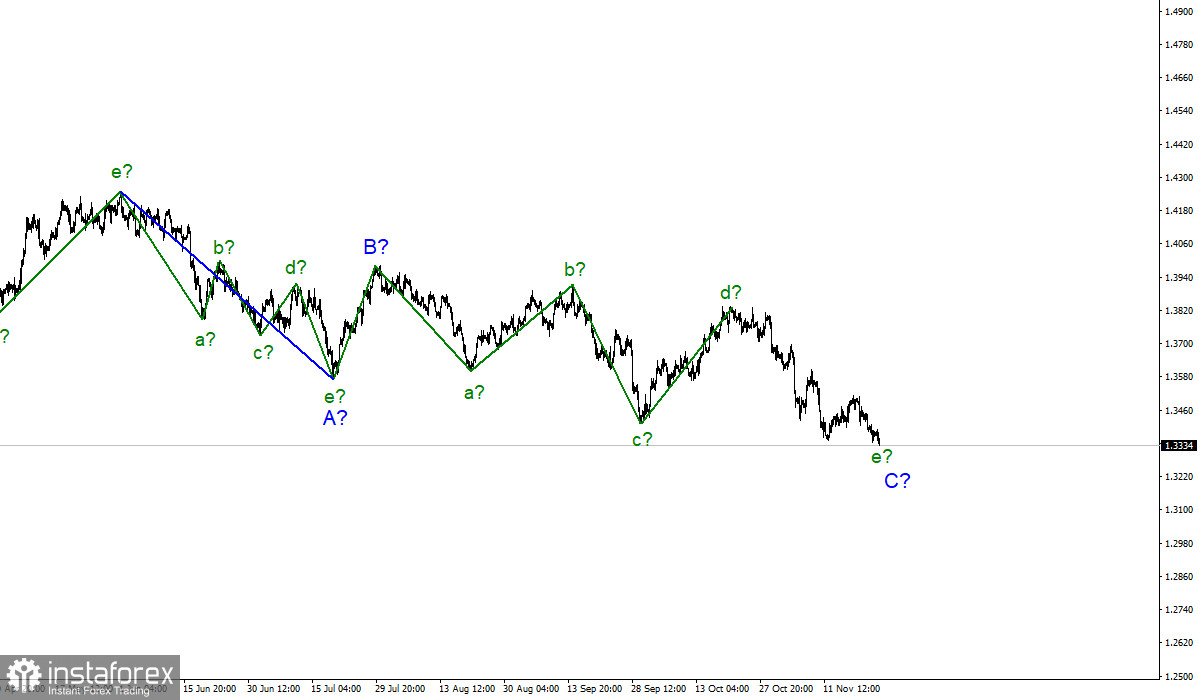

The wave counting for the Pound/Dollar instrument continues to look quite complicated, but at the same time quite convincing. Five internal waves are visible inside the last wave C, and each subsequent one is approximately equal in size to the previous one. However, since all the waves in the composition of C or A are almost equal in size, the last wave of e may already be nearing its completion. I thought it was already completed, but the decline in the quotes of the instrument in recent days has led to a complication of its internal wave structure.

Thus, now the decline can continue with targets located near the estimated mark of 1.3271, which is equivalent to 61.8% Fibonacci level. A downward wave is also nearing its completion for the Euro/Dollar instrument, which may be the last in the entire downward structure. Thus, both instruments can complete the construction of the downtrend sections at the same time. The news background or the unwillingness of the markets to stop buying the dollar can prevent this.

The situation for the pound is not changing, and its decline cannot be stopped even by the weak U.S. GDP

The exchange rate of the Pound/Dollar instrument decreased by 40 basis points on Wednesday. Thus, the markets continue to reduce the demand for U.S. currency.

Several important reports have been released in the USA today. First, the report on GDP in the third quarter. Despite the fact that the report for this quarter was already published a month earlier, the figures are adjusted over time, so changes are possible. By the end of October, U.S. GDP increased by 2.1% in Q3 2021, which was still below the market's expectation of 2.2% QoQ.

Second, the report on the volume of orders for durable goods in October. This indicator decreased by 0.5% MoM, which markets expected to increase by 0.2% compared to September. We were pleased only with applications for unemployment benefits. The number of both primary and secondary turned out to be lower during the reporting week than the markets expected.

The following reports were rather weak, which could lead to a slight decrease in demand for the U.S. currency. But this did not happen, which perfectly shows the mood of the markets at this time. Thus, the pound can only hope for the Fed's evening protocol or for an improvement in the situation with the coronavirus, or for a resolution of the conflict situation with the European Union. Next month, we can hope for the Bank of England to tighten monetary policy.

General conclusions

The wave pattern of the Pound/Dollar instrument looks quite convincing now. The proposed wave e may be nearing its completion, but it is not yet complete. Thus, now I am waiting for the completion of this wave near the 61.8% Fibonacci level, an unsuccessful attempt to break through which may lead to the construction of a new upward wave. Or even a new upward section of the trend. Until this happens, I advise you to continue selling the tool. A successful attempt to break through the 1.3271 mark will indicate the readiness of the markets for further sales.

Starting from January 6, the construction of a new downward trend section began, which can turn out to be almost any size and any length. At this time, the proposed wave C may be nearing its completion, but there is no confirmation of this yet. The entire downward section of the trend may lengthen, but there are no signals about this yet either.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română