Wave pattern

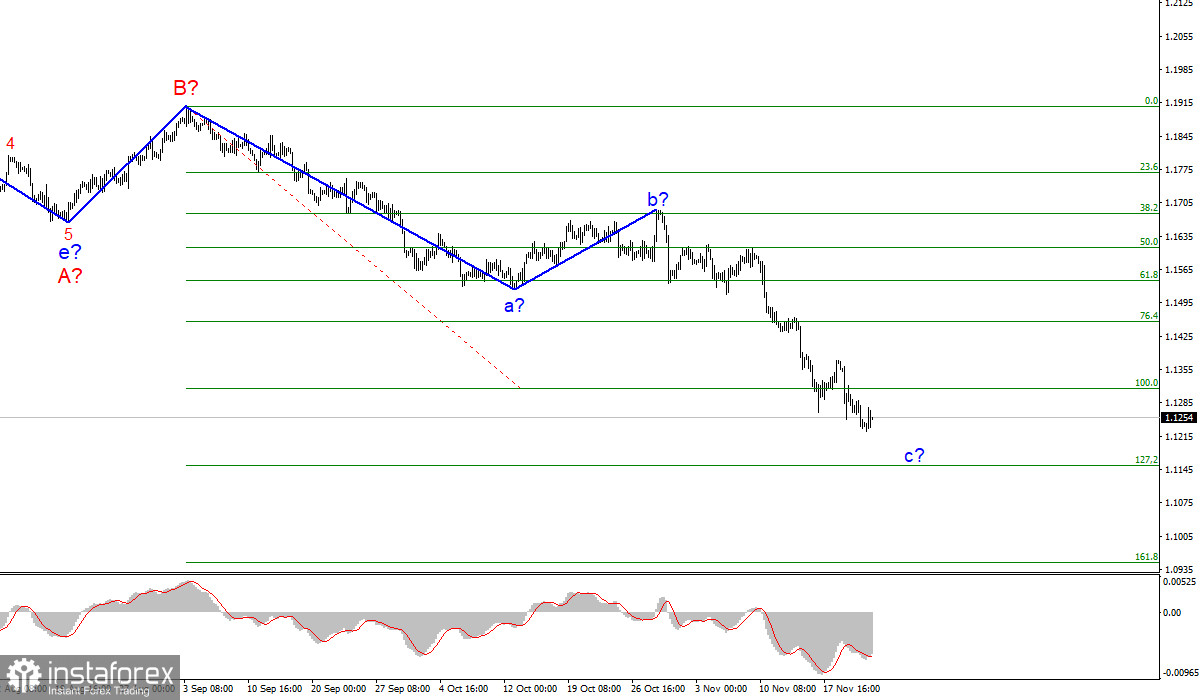

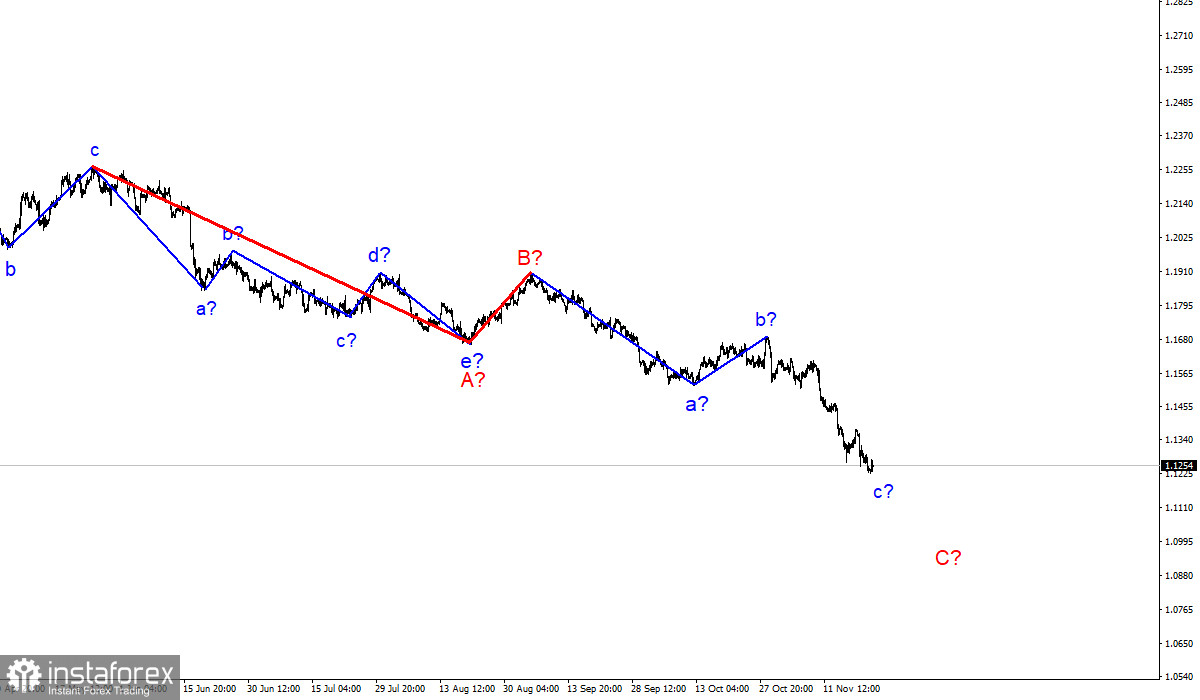

The wave counting of the 4-hour chart for the Euro/Dollar instrument continues to remain integral. The plot a-b-c-d-e, which has been forming since the beginning of the year, is interpreted as wave A, and the subsequent increase of the instrument is interpreted as wave B. Thus, the construction of the proposed wave C is now continuing, which can also take a very extended form.

If the current wave counting is correct, then the construction of the proposed wave c in C. And the entire wave C can also turn out to be a five-wave one. Its targets are located near the estimated mark of 1.1153, which corresponds to 127.2% Fibonacci level. This wave, however, may take on a more extended form with a target near the 1.0949 mark, which equates to 161.8% Fibonacci level.

A successful attempt to break through the 1.1314 mark indicates the readiness of the markets for further sales of the instrument. An unsuccessful attempt to break through the 1.1153 mark may herald the end of wave c in C.

The dollar has good opportunities to rise to the level of 1.1150

The news background for the EUR/USD instrument on Monday and Tuesday was quite weak. There are several important topics in the European Union and the U.S. that may interest and worry the markets. However, in the same recent weeks, demand has been growing only for the U.S. dollar, so it is easy to conclude which topics are of concern to the markets at this time.

It seems that the markets are now interested in the data that helps the U.S. currency. Topics such as the tightening of the Fed's rhetoric and policy appear more interesting to the markets at the moment. In addition, there are also topics with raising the debt ceiling in the United States, the topic with the nomination of Fed President Jerome Powell for a second term, the topic with inflation in the EU and the United States, as well as several others.

Reports on business activity in November in the service and manufacturing sectors have been released in the EU today. However, these data turned out to be ambiguous and did not lead to an increase in demand for the euro currency. Thus, the Euro/Dollar instrument remains very close to its annual lows and retains the prospect of updating them today or tomorrow. Wave c in C continues to get more complicated, but given the strong desire of the markets to sell, it may continue to get more complicated in the future.

General conclusions

Based on the analysis, I conclude that the construction of the downward wave C will continue. Therefore, now I advise you to continue selling the instrument for each downward signal from the MACD, with targets located near the estimated mark of 1.1153, which corresponds to 127.2% Fibonacci level, and below. An unsuccessful attempt to break through the 1.1153 mark may indicate readiness to build a corrective wave.

The wave counting of the higher scale looks quite convincing. The decline in quotes continues and now the downward section of the trend, which originates on May 25, takes the form of a three-wave corrective structure A-B-C. Thus, the decline may continue for another month or two until Wave C is fully staffed. And it can be both three and five-wave.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română