To open long positions on GBP/USD, you need:

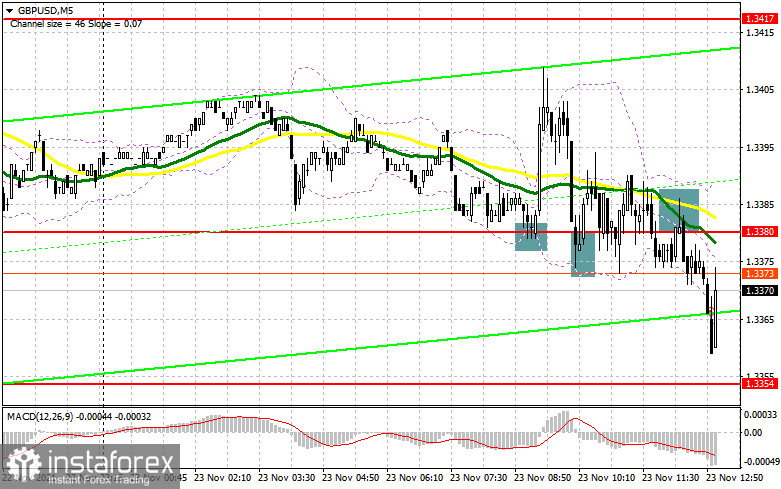

Despite the good data on the UK manufacturing sector and the service sector, the pressure on the pound remained, and all attempts by bulls to rebalance the market failed. However, in the first half of the day, several interesting signals were formed to enter the market, which I propose to deal with. Let's look at the 5-minute chart: an unsuccessful attempt to break below 1.3380 led to a false breakdown and a signal to buy the pound, after which there was an increase of 30 points. A little later, the bulls tried to defend this range again, which also led to the formation of a buy signal, but then without much upward movement – this suggested that the bears continue to strengthen their presence and it is better to wait for the PMI data, which did not help the pound in any way. The breakout and reverse test of 1.3380 from the bottom up formed an excellent entry point into short positions, which continues to work out at the time of writing. The technical picture has changed.

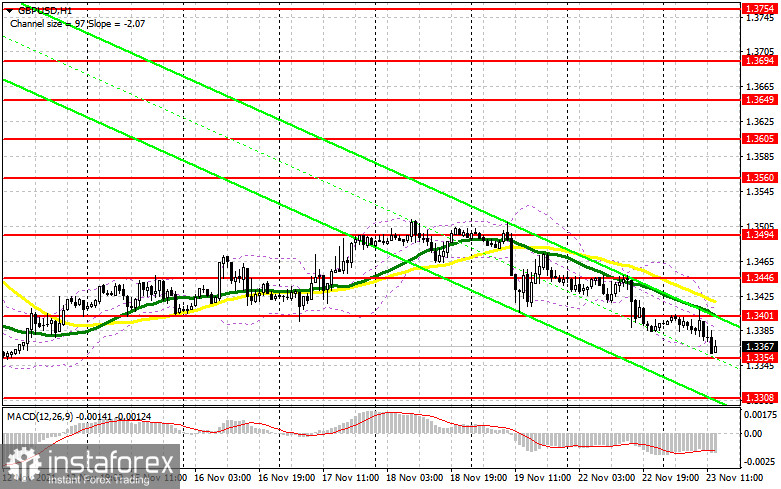

In the afternoon, similar data on activity in the manufacturing sector and the service sector of the United States of America are expected. Economists expect the indicators to improve. If the data turns out to be worse than the forecasts, the pound will fall to the next monthly lows. To prevent this, the bulls need to make every effort and protect the support of 1.3354. Only the formation of a false breakdown there, by analogy with what I discussed above, will lead to the formation of the first entry point into long positions to recover to the resistance of 1.3401. At the moment, moving averages are located there, which seriously limits the upward potential of the pair. If the bulls manage to break above this range, only its reverse test from top to bottom will give a new convenient entry point into long positions to return to 1.3446, where I recommend fixing the profits. A more distant target will be a maximum of 1.3494, but there are no objective reasons for such a large growth yet. Under the scenario of a decline in the pair in the afternoon and the absence of bull activity at the level of 1.3354, the pressure on the pound may seriously increase. In this case, I advise you to open new long positions only after a false breakdown in the area of 1.3308. You can watch GBP/USD purchases immediately on the rebound from last week's low in the area of 1.3254, counting on a correction of 25-30 points within a day.

To open short positions on GBP/USD, you need:

Bears continue to bend their line and put pressure on the British pound. Now their next goal is to support 1.3354, which will surely be broken in the case of good macroeconomic indicators for the United States of America. A breakout and a reverse test of 1.3354 will lead to the formation of an additional sell signal, similar to what I discussed above. All this will quickly collapse GBP/USD to the lows: 1.3308 and 1.3254, where I recommend fixing the profits. A more distant target will be the support of 1.3193. In the case of an upward correction of the pound in the afternoon, the bears will certainly try to protect the resistance of 1.3401, where the moving averages are playing on their side. Only the formation of a false breakout there will lead to the formation of a good entry point into short positions. If the pair grows during the US trading and there are no sellers at the level of 1.3401, it is best to postpone sales to a larger resistance of 1.3446. I advise you to open short positions immediately for a rebound from 1.3494, counting on the pair's rebound down by 20-25 points inside the day.

A slowdown in activity in the eurozone countries will further damage the euro. COT reports (Commitment of Traders) for November 16 recorded a sharp increase in short positions and a reduction in long ones, which led to an increase in the negative delta. Good data on the recovery of the UK labor market increased inflationary pressure, and growth in retail sales - all this saved the British pound last week and gave the bulls a chance to continue the pair's growth. However, the aggravation of the situation with coronavirus in the European part of the continent and statements by representatives of the Bank of England that no one will rush to change the course of monetary policy in the current conditions - all this very quickly returned pressure on the pair by the end of the week. An important point remains the unresolved issue around the Server Ireland protocol, which the UK authorities plan to suspend in the near future. To this, the European Union is preparing to introduce certain retaliatory measures – which do not add confidence to buyers of the British pound. At the same time, in the United States of America, we are witnessing an increase in inflation and increased talk about the need for an earlier increase in interest rates next year, which provides significant support to the US dollar. However, I recommend sticking to the strategy of buying the pair in case of very large falls, which will occur against the background of uncertainty in the policy of the central bank. The COT report indicates that long non-commercial positions decreased from the level of 54,004 to the level of 50,443, while short non-commercial positions increased from the level of 66,097 to the level of 82,042. This led to an increase in the negative non-commercial net position: the delta was -31,599 versus -12,093 a week earlier. The weekly closing price collapsed as a result of the Bank of England's policy from 1.3563 to 1.3410.

Signals of indicators:

Moving averages

Trading is conducted below 30 and 50 daily moving averages, which indicates the return of the market bears under their control.

Note: The period and prices of moving averages are considered by the author on the hourly chart H1 and differ from the general definition of the classic daily moving averages on the daily chart D1.

Bollinger Bands

A break of the lower limit of the indicator in the area of 1.3354 will increase the pressure on the pair. A break of the upper limit of the indicator in the area of 1.3401 will lead to the growth of the pair.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence/divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-profit speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română