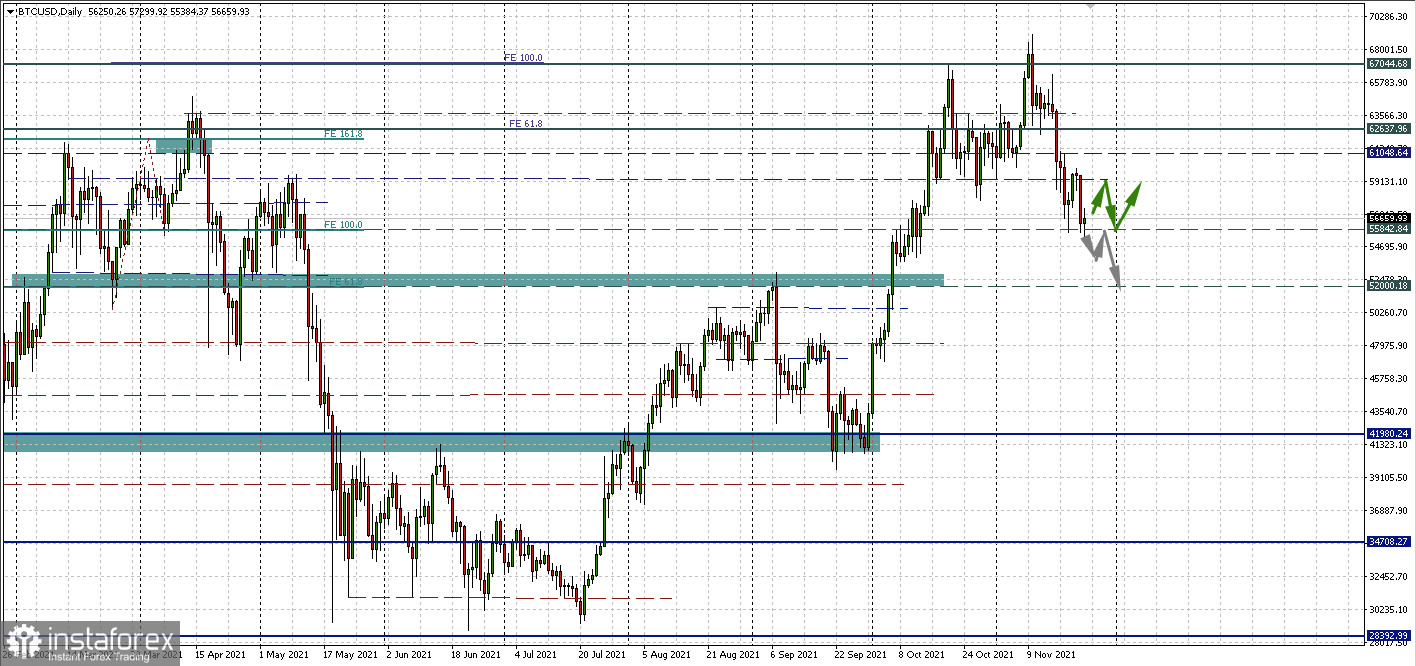

The situation on the Bitcoin chart looks very good so far. The support level of 55,842.84 has held out so far, and today a rebound is expected from it. It is possible that BTCUSD may move to consolidation in the range 55,842.84 - 59,283.67 before the next impulse.

Meanwhile, fundamentally, the situation also looks encouraging.

Signs of accumulation in the market

Despite the fall in the price of the main cryptocurrency, the fundamentals on the network point to signs of serious strength and accumulation, according to Glassnode.

Thus, the number of Bitcoin addresses with a non-zero balance reached a new record level - 38.76 million addresses. The previous high of 38.7 million was set seven months ago, on April 23. It took the market 213 days to recover to these values.

In parallel, the network data provider Santiment reports that, despite the decline in the main cryptocurrency, the supply of Bitcoins is leaving crypto exchanges, which reduces the risks of a sell-off. In addition, the supply of USDT on the exchanges is increasing, which indicates a high purchasing power.

Is profit taking completed?

As noted earlier, the current decline in the cryptocurrency market was mainly driven by profit-taking, especially after Bitcoin hit a new all-time high.

During the recent correction, Bitcoin short-term holders were selling, taking profits at highs, and capitulating at lows, according to Glassnode. Supply fell by 15%, and now the main cryptocurrency is in the transition zone from bulls to bears.

In addition, Glassnode adds that short-term holders are the most responsive to price changes. Their sensitivity stems from a combination of high relative value, higher time preference, and potentially lower confidence in the asset. Price action this week was no exception as short-term players played a role in setting both highs and lows.

All network indicators suggest that the BTC price is ready for the next rally. So this could be a good buying opportunity for now.

Long-term target of $250,000 per Bitcoin: why is it justified?

Thus, we have the prerequisites for the future growth of Bitcoin and technically three short-term scenarios. The first is a sideways consolidation at 55,842.84 - 59,283.67 before the breakout, the second is a recovery above $60,000 per coin and continued growth. Finally, the least optimistic is the deepening of the correction towards $52,000 per coin before the price returns to the increase.

While we are waiting for things to calm down, let's look at the situation globally from the point of view of targets. There is not much left to the popular expected value of $100,000 per coin. For the next target, some analysts, including Mark Yusko of Morgan Creek, see $250,000.

Where did this figure come from? The expert said that this is not just a target out of thin air, but the monetary value of the gold equivalent of Bitcoin.

Yusko stated that the total market capitalization of gold is about $10 trillion. While jewelry and other industrial uses account for about half of that amount, the other half is the monetary value of the shiny metal.

According to the analyst, Bitcoin will "easily" reach the gold equivalence point within four years, which would translate into about a quarter of a million dollars per coin.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română