Treasury yields rose after US President Joe Biden appointed Jerome Powell for a second term as Fed chief. The yields on two- and five-year bonds even closed at session highs.

Now, markets are preparing for a full 25 basis point rate hike at the Fed meeting in June, with a second hike expected in November next year.

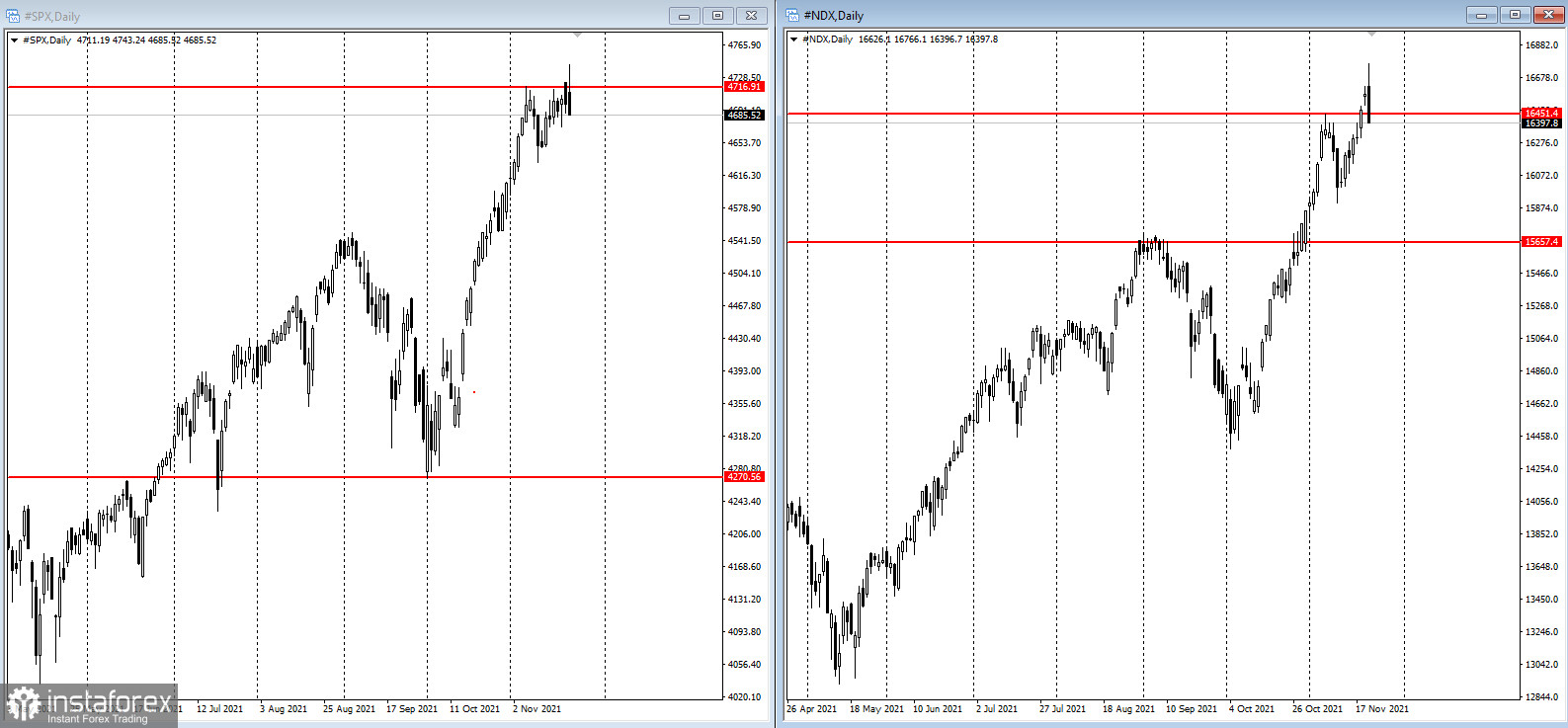

Meanwhile, the S&P 500 and Nasdaq 100 decreased sharply.

Biden was torn between Jerome Powell and Lael Brainard, who he appointed as Vice Chairman. He chose Powell most likely because there is a risk that the US central bank will lag behind the curve in tackling sticky inflation. After all, consumer prices continue to increase at the fastest pace in decades, and expectations have risen to the highest since 2013.

"The whole point is it doesn't change anything," said CIBC Private Wealth Management CIO David Donabedian. "The same issues are on his plate now: are they going to be right that the pop in inflation is going to be transitory and if not, what do they do about it? The choice about Powell's renomination is all about continuity."

Meanwhile, as mentioned earlier, tech stocks tumbled amid speculation that an earlier push is unwarranted, since higher yields weaken the outlook for stocks.

E*Trade Financial Managing Director Chris Larkin said: "We're kicking off a busier-than-you-may-think Thanksgiving week in rebound mode. And while the short trading week historically is considered sleepier than others, keep in mind that over the past 15 years the U.S. stock market has tended to gain more ground the month after Thanksgiving than the month before it. So coupled with a busy economic calendar and more retail earnings, traders may have good reason to stay tuned in to the market this week."

US stocks are trading near record levels, outpacing the rest of the world as investors see no alternatives amid rising inflation and a persistent pandemic that is undermining the global economic recovery. Fears of high valuations and potential overheating of the economy amid loose monetary and fiscal policies interrupted, but did not halt their growth.

Other key events this week are:

- Eurozone and US PMI data (Tuesday);

- policy decision of the Reserve Bank of New Zealand (Wednesday)

- Fed minutes and reports on US consumer income, wholesale inventories, new home sales, GDP, jobless claims, orders for durable goods and consumer sentiment (Wednesday);

- policy decision of the Bank of Korea (Thursday);

- closure of US stock and bond markets amid Thanksgiving (Thursday);

- statements of Bank of England Governor Andrew Bailey (Thursday).

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română