The past week ended on world markets with a new attempt by stock indexes to grow in the wake of corporate reporting, the strengthening of the US dollar, and declining crude oil prices.

Markets continue to reflect on the important topic of the expected change in monetary policy amid high inflation, and not only in America but also in other economically developed countries of the world. The understanding that stimulus measures cannot be eternal and have actually stopped working, which is very clearly seen in the example of the United States, pushes investors to reconsider their long-term views on the levels of interest rates, the growth of the world economy, and the economies of individual countries. But another thing is also obvious, which is holding back stock markets from falling in the first place – the uncertainty of how and when the process of raising interest rates in America will start, which will serve as a guideline for other countries as well.

It was already pointed out the importance of the "uncertainty" factor, which so far only stimulates the growth of volatility. The situation with the coronavirus pandemic in the world and high inflation only fuels it. In this wave, the dynamics of government bonds of economically developed countries are important. For example, the yield of the benchmark 10-year treasuries in the US began to consolidate above the yield level of 1.50% after a sharp decline and then growth, which indicates the lack of clear ideas among investors in the US government debt market about the prospects of the Fed rate hike process.

Here, the personality of J. Powell's possible successor as chairman of the Central Bank also plays an important role. There is a possibility that he will remain in this position, while it is believed that the rates could rise vigorously possibly by the spring of 2022. But if L. Brainard replaces him, and the market believes that she will tighten monetary policy less aggressively, then her election can give a broad impetus to the growth of demand for shares and other assets traded in dollars. In this case, the rate of the US currency may significantly decline. Against this background, other world central banks also may not rush to raise rates.

In general, the current condition in the market will clearly stimulate high volatility and the nervous reaction of investors both to important news and to the publication of economic statistics.

This week the RBNZ meeting will be held. Important data of intermediate GDP for the 3rd quarter in Germany, the USA, PMI numbers in manufacturing and service sectors in the USA, the Eurozone of Great Britain, and Germany will be published. But, in our opinion, the values of the basic index of personal consumption expenditures in America will attract full attention. This indicator plays a significant role in assessing the Fed's interest rate prospects.

Forecast of the day:

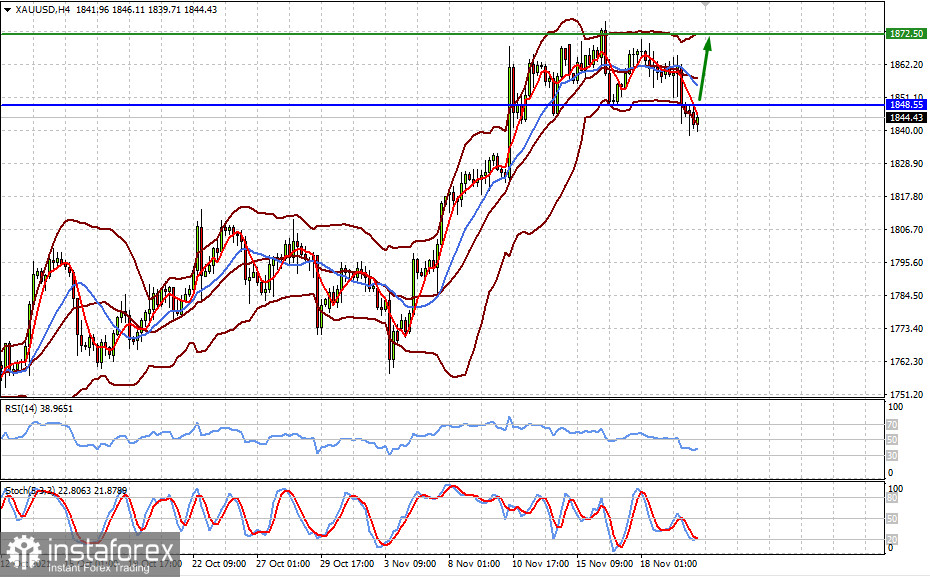

The US dollar's likely weakening in this short week for the United States may lead to a recovery in the price of gold amid the weakening US currency. A price increase above the 1848.55 mark may lead to further growth to 1872.50.

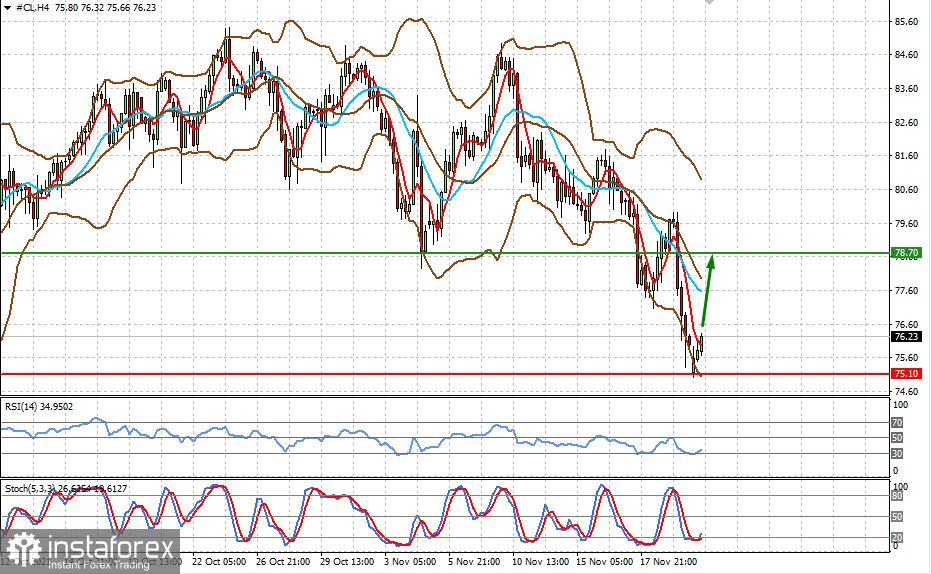

A consolidation of the price of American grade WTI oil above the level of 75.10 may lead to an increase in the price to 78.70. This movement may be supported by a local weakening of the US dollar before Thanksgiving in America.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română