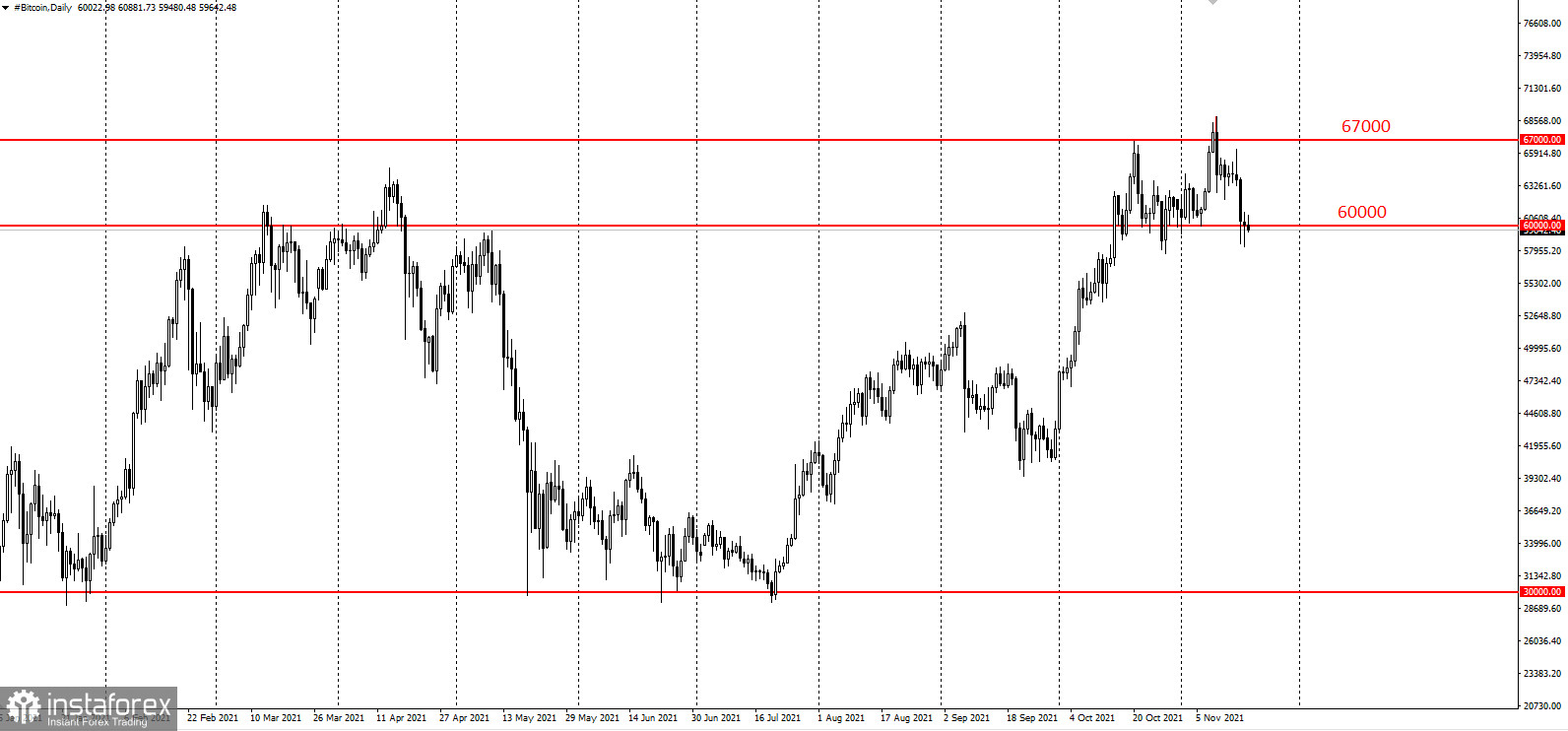

Bitcoin hovered around $ 60,000 as traders held back the excessive speculation that led to the surge to record highs last week.

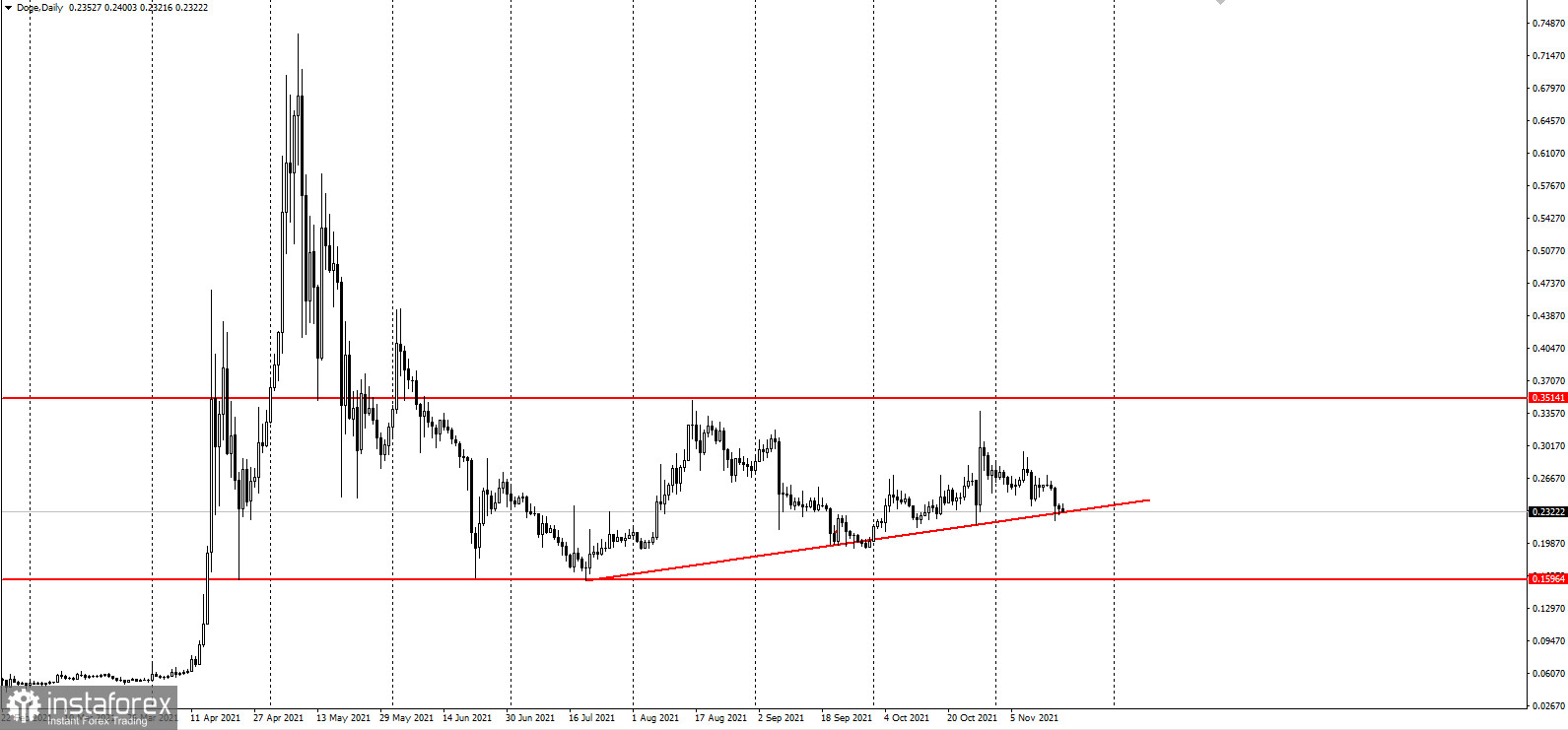

It initially declined by 3.4%, but recovered and stayed unchanged. Some said the drop was caused by traders closing positions before the end of the year, but the decline in coins such as Dogecoin and Shiba Inu suggests that speculation has decreased.

"Some cleansing of meme coins might pressure the stalwarts as a necessary part of the evolving, strengthening ecosystem," said Bloomberg Intelligence commodity strategist Mike McGlone. "We say the sooner the better for the speculation machine coins to experience some purging, so as to move on with the adoption process of crypto assets in investment portfolios."

Meanwhile, the market capitalization of Dogecoin declined from $ 80 billion to around $ 31.5 billion.

Shiba Inu also fell from $ 41 billion to $ 26.6 billion.

Carter Henderson, portfolio manager at Fort Pitt Capital Group, said: "For the most part, people are going into the end of the year and taking gains - taking some off the table - as we head into a quiet period in the market. People are just locking in gains."

Bitcoin prices, which are up 108% this year, have been bolstered by key advances such as the launch of three Bitcoin futures ETFs in the United States, despite a string of regulatory measures in China and concerns over new tax reporting requirements in the United States.

McGlone said it could stabilize around $ 60,000, while Ethereum may hit $ 4,000. As such, the next level to watch in BTC is $ 60,000, as it could provoke a large jump to $ 100,000.

"This is a good battle between long-term buyers and leveraged speculators," Henderson said.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română