To open long positions on EURUSD, you need:

The data on the eurozone consumer price index released in the first half of the day coincided with economists' forecasts, which practically did not affect the European currency, which, having played back the entire morning drop, stopped near the daily highs. Since the nearest support and resistance levels were not updated, I did not wait for signals to enter the market. From a technical point of view, nothing has changed either.

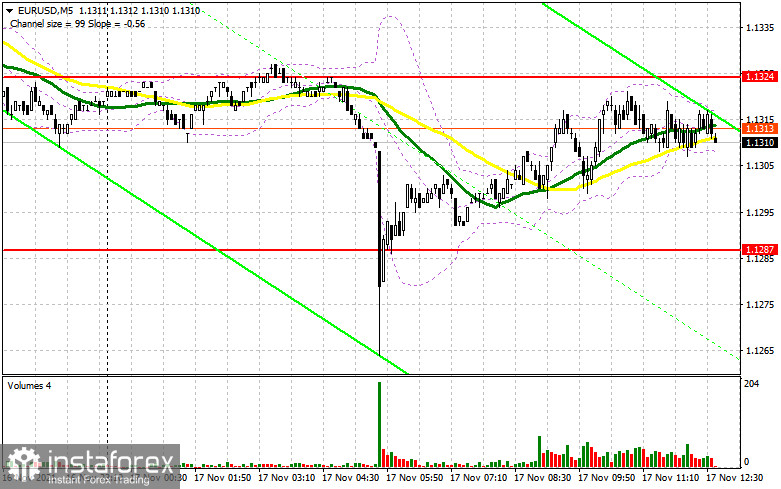

In the afternoon, we are expecting data on the volume of construction permits issued in the United States, as well as a large number of interviews with representatives of the Federal Reserve System. I advise you to pay special attention to the statements of John Williams, a lover of a tougher policy of the Central Bank, as well as the speech of FOMC member Mary Daly. Most likely, during the American session, the bulls will continue to focus on protecting the 1.1287 support. Yes, this will stop the bearish trend, but it is unlikely that it will not lead to an upward correction. The formation of a false breakdown there will be the first signal to open long positions. However, for a real return to the bull market, it is necessary to get beyond the resistance of 1.1324, which will be very difficult to do during the speech of representatives of the Federal Reserve System. The reverse test of 1.1324 from top to bottom, together with weak data on the US real estate market, will give an entry point to long positions based on the growth of EUR/ USD in the area of 1.1353, where moving averages are similar, limiting the upward potential of the pair. A breakthrough of 1.1353 and a similar top-down test will lead to an additional buy signal and growth in the area of 1.1386, where I recommend fixing profits. A more distant target will be the 1.1421 area. If the pressure on EUR/USD persists in the first half of the day and there is no bull activity at 1.1287, it is best not to rush into buying against the trend. I advise you to wait for the formation of a false breakdown in the area of 1.1257. It is possible to open long positions on EUR/USD immediately for a rebound from the minimum of 1.1222, or even lower - from 1.1193, counting on a correction of 15-20 points within a day.

To open short positions on EURUSD, you need:

Nothing has changed for euro sellers. They continue to control the market and will certainly count on hawkish statements from representatives of the Federal Reserve System, as has been happening throughout this week. Euro sellers also need the protection of the 1.1324 level. Only the formation of a false breakdown there will form the first signal to open short positions in the continuation of the downtrend, which will give an excellent point to reduce to the intermediate support of 1.1287. A breakdown and a test of this area from the bottom up will increase pressure on EUR/USD and lead to the demolition of several buyers' stop orders. This will open the way to new lows: 1.1257 and 1.1222. There I recommend fixing profits on short positions. Under the scenario of euro growth during the American session and the absence of bear activity in the area of 1.1324, I advise you to postpone sales until the test of the next resistance - 1.1353. But even there, it is best to open short positions after the formation of a false breakdown. The best option for selling EUR/USD immediately on a rebound will be a maximum in the area of 1.1386. You can count on a downward correction of 15-20 points.

The COT report (Commitment of Traders) for November 9 recorded a reduction in short positions and a slight increase in long ones, which led to the return of a positive delta. The fact of high inflationary pressure in the US continues to support the US dollar, as many investors are counting on an earlier increase in interest rates by the Federal Reserve next year and are already winning back the market in this direction by buying the US dollar. The statements of representatives of the Central Bank, which have been heard recently, only confirm the expectations of market participants. At the same time, the president of the European Central Bank, Christine Lagarde, confidently insists that the ultra-soft monetary policy will not change even next year. This puts some pressure on buyers of risky assets, who are counting on a more active recovery of the euro. In the near future, we will get acquainted with important data on retail sales in the United States and the unemployment rate in the eurozone, which will shed light on further actions by regulators to stimulate the economies of their countries. The latest November COT report indicated that long non-profit positions increased from the level of 191,496 to the level of 192,544, while short non-profit positions decreased from the level of 197,634 to the level of 188,771. At the end of the week, the total non-commercial net position became positive and amounted to 3,773 against -6,138. The weekly closing price decreased quite slightly, to the level of 1.1587 against 1.1599.

Signals of indicators:

Moving averages

Trading is conducted below 30 and 50 daily moving averages, which indicates continued pressure on the market.

Note. The period and prices of moving averages are considered by the author on the hourly chart H1 and differ from the general definition of the classic daily moving averages on the daily chart D1.

Bollinger Bands

A breakthrough of the upper limit of the indicator in the area of 1.1330 will lead to a new wave of euro growth. A breakthrough of the lower limit of the indicator in the area of 1.1285 will increase the pressure on the pair.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence/divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-profit speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română