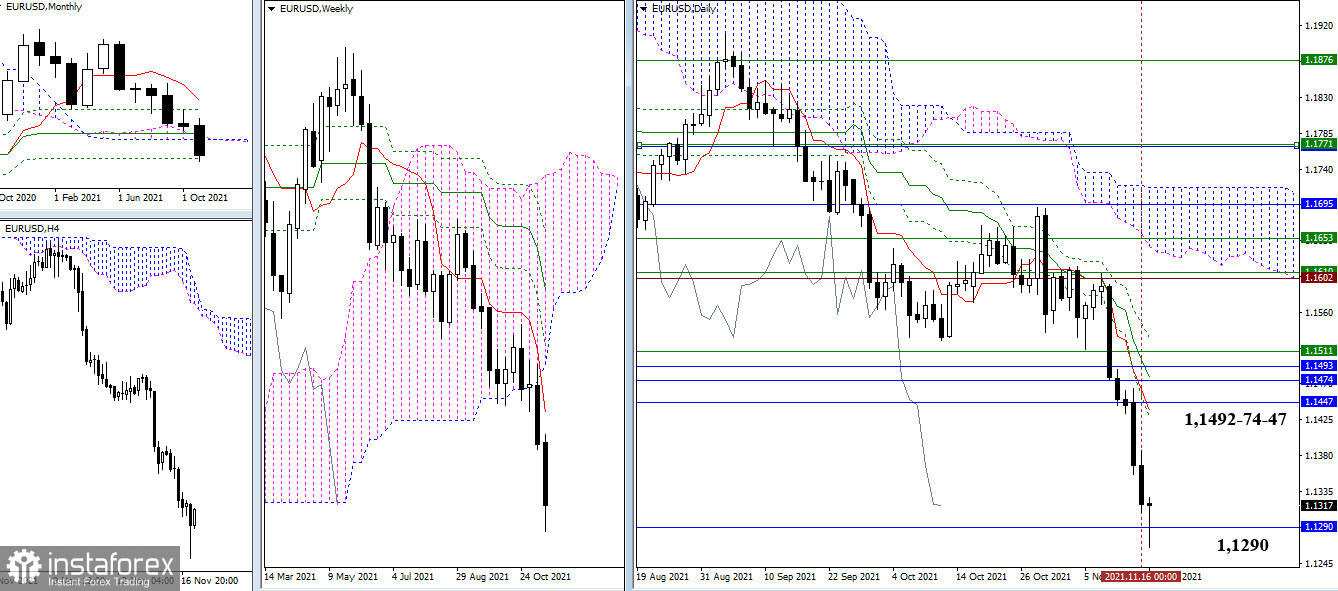

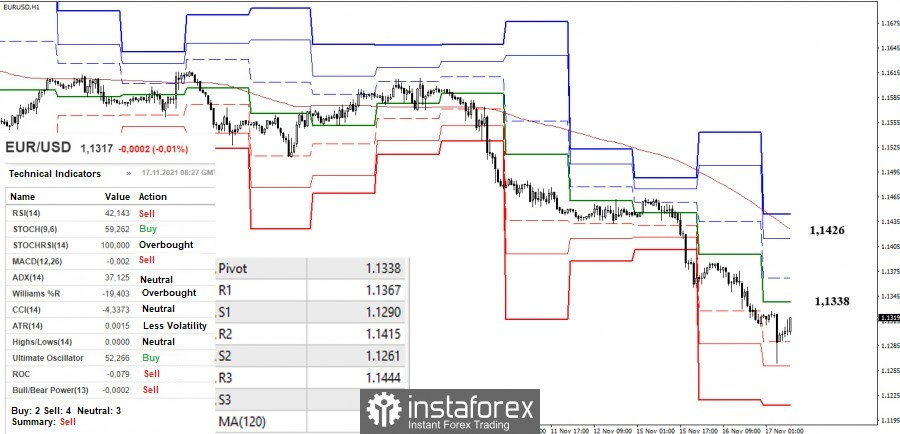

EUR/USD

The bears declined to the final level of the Ichimoku's monthly gold cross (1.1290). It should be noted that the result of the interaction is important for future prospects to appear. The breakdown of the level and elimination of the monthly cross will allow us to consider the formed bearish targets for the breakout of the weekly and monthly Ichimoku clouds as pivot points.

On the contrary, the implementation of the rebound from the met support will allow us to consider the development of an upward correction. Its closest and significant pivot point in the higher timeframes is currently the resistance zone, which consists of the monthly levels of 1.1492 - 1.1474 - 1.1447 broken the day before (Ichimoku cloud + medium-term trend).

The advantage in the smaller timeframes currently belongs to the bears. They tested the second support of the classic pivot levels (1.1261), after which the third support (1.1213) remains as a guide for the intraday decline. After testing the second support, a slowdown was outlined. But if the upward correction develops, then the interests of the bulls will be directed primarily at returning themselves to the central pivot level (1.1338), and then on rising to the key resistance in the same timeframes, which determines the current advantage (1.1426). Towards the weekly long-term trend (1.1426), the nearest resistances of the classic pivot levels (1.1367 -1.1415) can be noted.

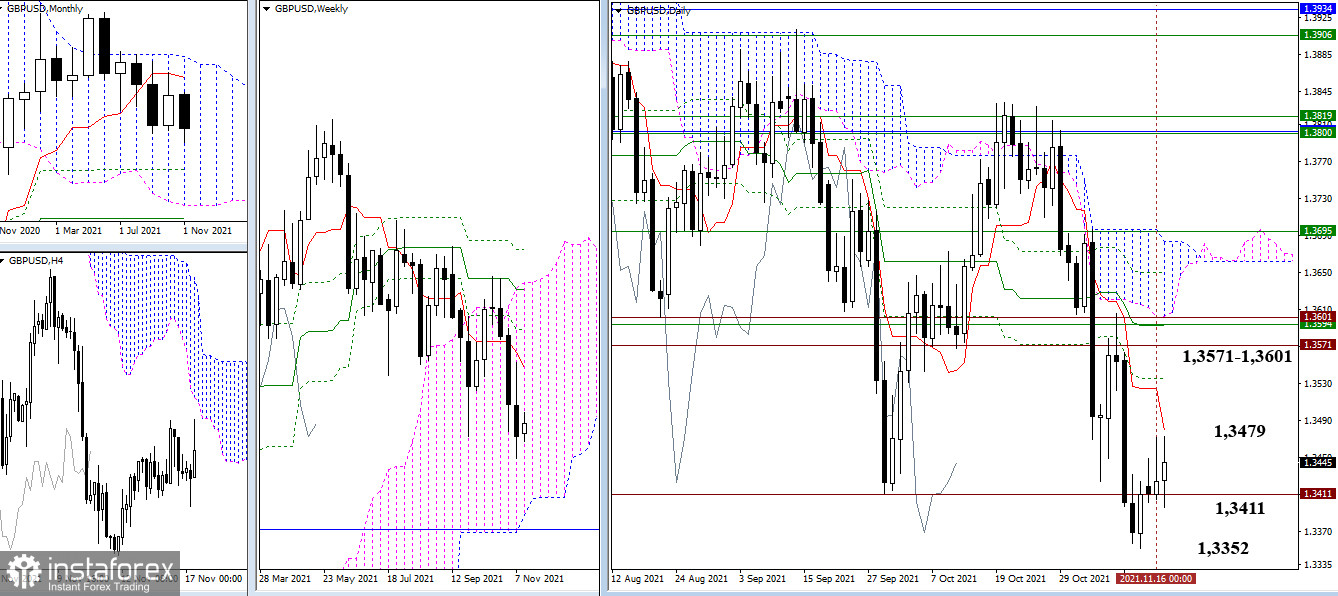

GBP/USD

The attraction and influence zone, formed by the border of the past minimum extreme (1.3411), continues to keep the situation from developing. For the bears, it is important to break through the support level of 1.3411, update the current low (1.3352) and continue the decline. As for the bulls, it is important to identify not only deceleration but also to implement a full-fledged corrective rally, which may further strengthen the bullish mood. The nearest resistance can now be noted at 1.3479 (daily short-term trend), and the main interest is concentrated in the area of 1.3571 - 1.3601 (historical levels + weekly short-term trend + daily medium-term trend).

Bullish traders strive to achieve more than a corrective recovery of positions in the smaller periods, so they are trying to conquer the key levels, which combine their efforts in the area of 1.3419-34 (central pivot level + weekly long-term trend) today. A consolidation above will be defined as a bullish advantage. Their next pivot points can be noted at 1.3501 and 1.3530 (classic pivot levels). But if bearish activity returns below 1.3419-34 area, then the main significance will be to restore the downward trend (1.3352).

***

Ichimoku Kinko Hyo (9.26.52) and Kijun-sen levels in the higher time frames, as well as classic Pivot Points and Moving Average (120) on the H1 chart, are used in the technical analysis of the trading instruments.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română