The pound is demonstrating a typical dynamic.

Hello, dear traders!

I will start today's review of the GBP/USD currency pair with the macroeconomic reports on the price dynamics in the UK. The data on the consumer and retail prices index, as well as the purchasing and producer prices data, released at 10:00 MSK, almost all turned out to be in the green zone, i.e. better than the values predicted by analysts. I recommend observing the economic calendar for traders who want to discover precise figures. Quite a lot of data was released, therefore I do not see the point of mentioning them all in this article to save time. Notably, the consumer price index is considered to be a so-called inflation indicator. In this regard, it is logical to assume that further rise in prices amid the recovery of the British economy from the COVID-19 pandemic will force the Bank of England to implement a stricter monetary policy. It is quite possible that considering this scenario the UK Central Bank may raise the main interest rate as early as next year, following the Fed. So, let's discover how the British pound reacted to today's statistics, especially the GBP/USD currency pair.

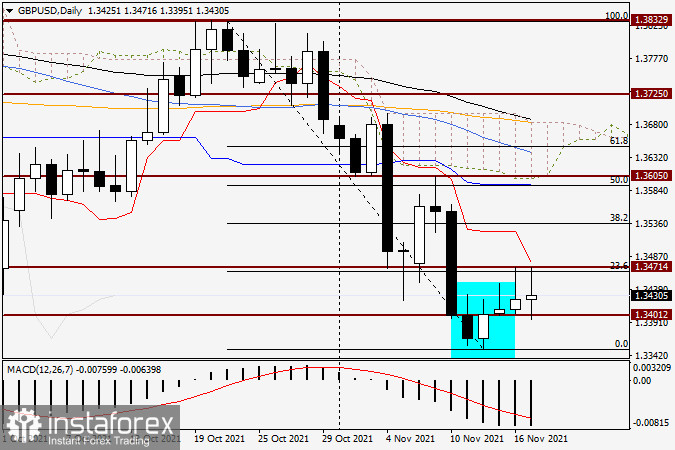

Daily

Evidently, at the moment the reaction is rather mixed. Now, the pair is trading slightly higher, having rather long shadows at the bottom and at the top. The pound is demonstrating a typical dynamic. An increased speculation and volatility has been its characteristic feature. The current highs are still at 1.3471, while the lows are at 1.3395. As expected, this level was aimed to provide strong support for the pair after it rose and consolidated above 1.3400, and that is exactly the case. As for the resistance, it is necessary to highlight that yesterday the pair was blocked by the same level to the north direction. At the moment of the article writing, this level pushed the quote down, particularly to 1.3471. If GBP bulls have enough power to close today's session above the strong resistance of the sellers at 1.3471, there is a real chance for further growth, the nearest benchmark is the strong and extremely significant price zone at 1.3500-1.3530. The bearish scenario is possible after a true breakdown of a strong and significant technical level 1.3400.

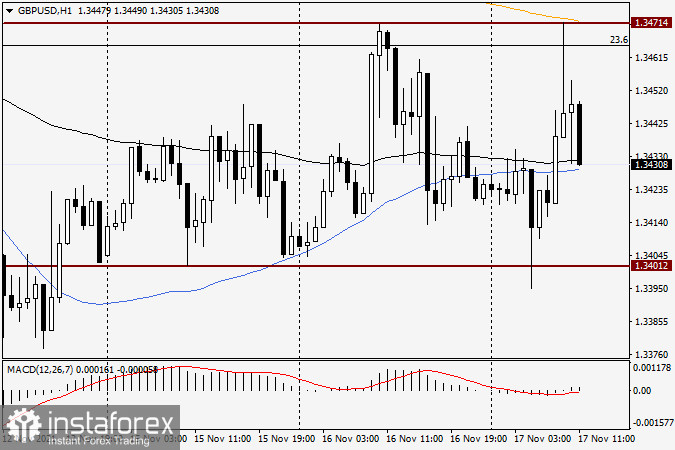

H1

A very unusual pattern is observed on the hour chart of GBP/USD. As suggested yesterday, it is unlikely to expect further strengthening of the exchange rate without a breakdown of the orange 200 exponential moving average. Evidently, despite the quite positive British statistics the 200 EMA pushed the price down. On the other hand, at this stage the black 89 exponent provides a strong support to the pair. Besides, there is also the 50 simple moving average below. Taking into account the current indefinite nature of the GBP/USD trades, I suggest to start buying until the breakdown of the orange 200 EMA and resistance level 1.3471 occurs, and then buy the pair on the rebound with the targets around 1.3500-1.3530. If bearish candlestick patterns are formed on this or the 4-hour chart, it will be a signal to open short positions. I would not try to sell on the breakdown of 89 EMA, 50 MA and the level of 1.3400. There is an extremely high probability of strong support and reversal.

All the best!

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română