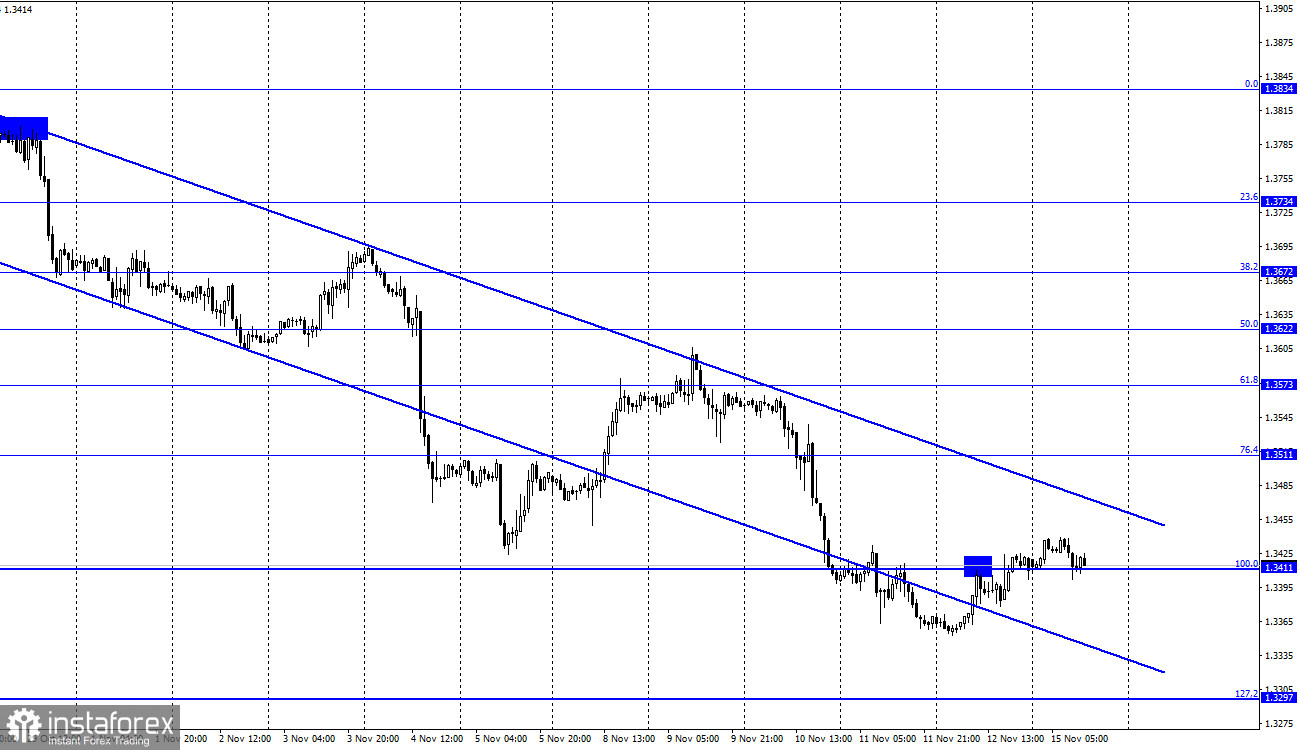

GBP/USD – 1H.

According to the hourly chart, the GBP/USD pair on Friday performed a consolidation above the corrective level of 100.0% (1.3411). Thus, the growth process can be continued towards the next Fibo level of 76.4% (1.3511). However, the British dollar quotes are still inside the downward trend corridor, which keeps the current mood of traders "bearish". Thus, the rebound from the upper limit of this corridor will allow us to count on the resumption of the fall in the direction of the corrective level of 127.2% (1.3297). Closing the pair's rate above the corridor will increase the likelihood of further growth of quotes. Meanwhile, the information background for the pound is getting worse and worse. I have already said that London and Brussels cannot find a compromise on the issue of the Northern Irish border. Negotiations are continuing, but there is no progress. And they can last in this mode for at least several months, and no one knows how it will end.

In addition, Scotland does not abandon its idea of holding a referendum on independence next year, and the current government expects that Scots will choose to live outside the UK. However, Boris Johnson does not permit to hold a new referendum. And from a legal point of view, Edinburgh has no right to hold a referendum without London's consent. However, Scotland's First Minister Nicola Sturgeon believes that Boris Johnson, "who has not been consistent on many issues," may change his mind. Sturgeon believes that the world has changed a lot over the past 7 years, so the results of the 2014 referendum no longer matter now. She also recalled that the majority of Scots did not support leaving the European Union in the 2016 referendum, hinting that an entire nation is being held in chains against its will. Most likely, this issue will not subside by itself.

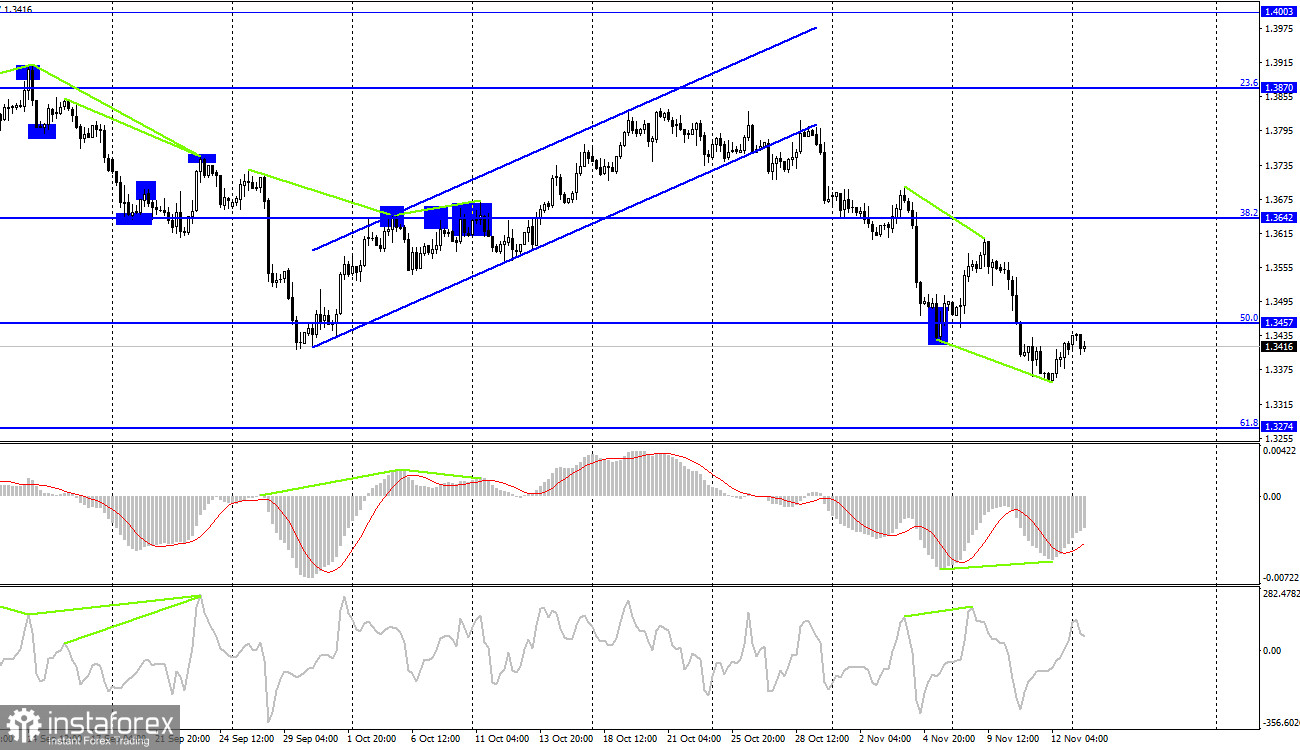

GBP/USD - 4H.

On the 4-hour chart, the British quotes performed a close under the corrective level of 50.0% (1.3457). However, the bullish divergence of the MACD indicator allowed some growth in the direction of 1.3457. The rebound of quotes from this level will work again in favor of the US currency and the resumption of the fall in the direction of the corrective level of 61.8% (1.3274). Fixing the pair's rate above the level of 1.3457 will increase the probability of continued growth in the direction of the Fibo level of 38.2% (1.3642). There are no emerging divergences at this time.

News calendar for the USA and the UK:

UK - Bank of England Governor Andrew Bailey will deliver a speech (14:30 UTC).

On Monday, the Governor of the Bank of England will give a speech in the UK. However, there are suspicions that his speech will cause the same effect as Christine Lagarde's speech. Thus, I think that the information background today will be very weak or absent.

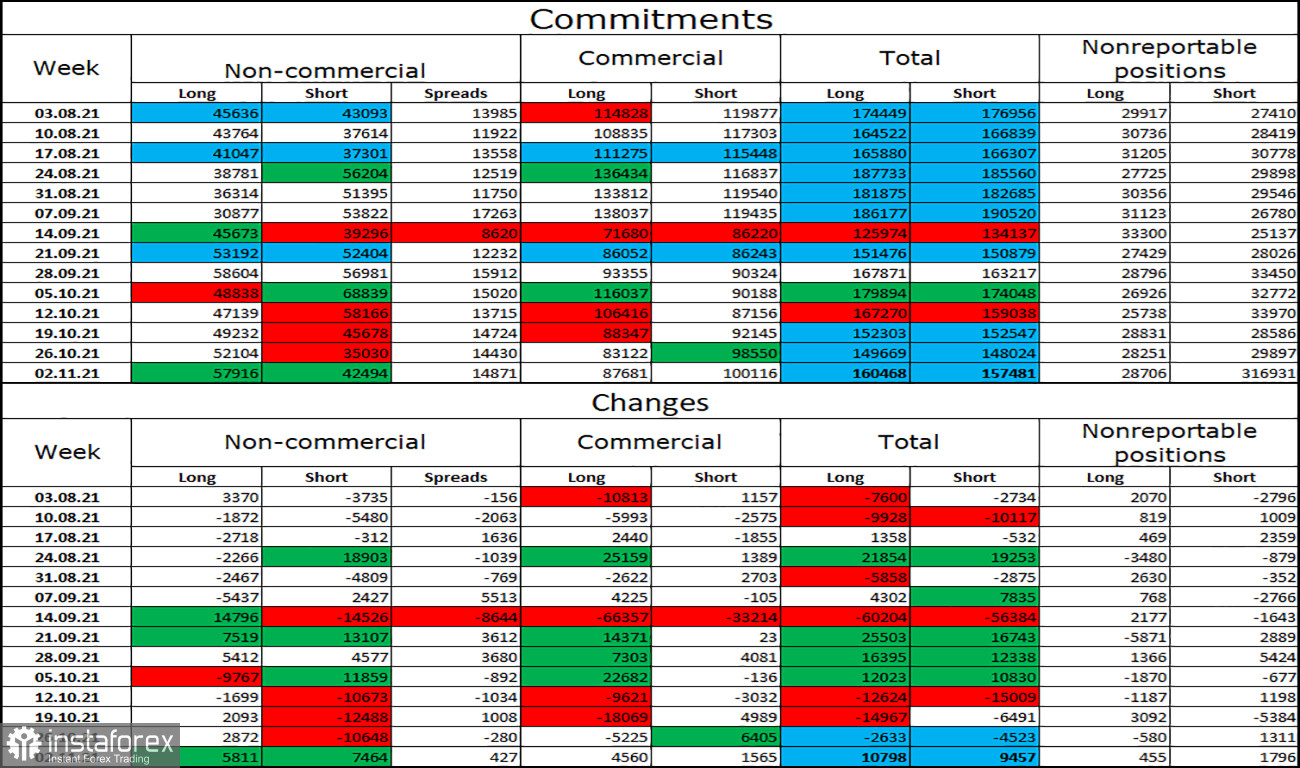

COT (Commitments of Traders) report:

The latest COT report from November 2 on the pound showed that the mood of major players has become a little less "bullish". In the reporting week, speculators opened 5,811 long contracts and 7,464 short contracts. Thus, the number of long contracts in the hands of major players still exceeds the number of short contracts by 17 thousand, but the gap is narrowing. In recent weeks, major players do not have any clear mood and then increase purchases, then increase sales, and the total number of long and short contracts for all categories of traders is the same (160K - 157K). Thus, after several weeks of an active build-up of longs, it may be the turn of shorts

Forecast for GBP/USD and recommendations to traders:

I recommend new sales if there is a rebound from the upper limit of the corridor on the hourly chart with targets of 1.3411 and 1.3297. Or when closing below the 1.3411 level. I recommend buying the pound when closing above the downward corridor on the hourly chart with targets of 1.3511 and 1.3573.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy foreign currency not to make speculative profits, but to ensure current activities or export-import operations.

"Non-reportable positions" are small traders who do not have a significant impact on the price.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română